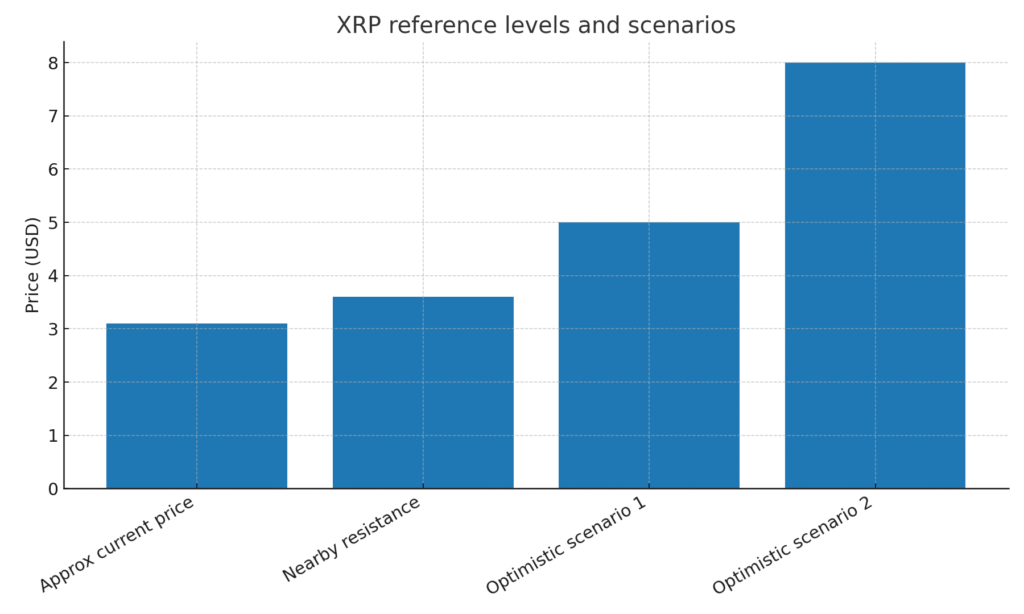

Core idea: A friendlier rate path together with regulatory clarity after the Ripple case revived flows into XRP. Price approached 3 while some desks discussed stepwise routes to 5 and even 8 under strict conditions. This article lays out the validation ladder, the risks, and an execution plan that avoids euphoria.

What changed and why it matters

Macro: A less restrictive message supported risk assets and reduced dollar strength. That eased pressure on crypto and lifted demand for mid beta names like XRP.

Market structure: Open interest cleaned up during the recent drawdowns. With less froth, an advance that builds on spot volume is more sustainable.

Regulatory narrative: With more clarity on the token status after litigation, several institutions reopened tactical exposure.

Validation map by steps

| Step | Validation conditions | Red flags | Base probability |

|---|---|---|---|

| 3 to 3.60 | Daily closes above 3 with rising spot volume and contained funding | Repeated rejections at 3.10 with funding rising | Medium |

| 3.60 to 5 | Weekly close above 3.60 followed by 2 to 3 sessions of continuation | Bearish divergence on 4h and OI rising without spot progress | Medium low |

| 5 to 8 | Strong adoption catalysts and persistent net inflows beyond macro effect | Thin order book at highs and fast givebacks after breakout | Low |

Figure 1. Ladder of XRP levels with scenarios from 3 to 8

Pre‑breakout checklist

Spot volume leads derivatives.

Funding stays contained while price advances.

Wide range candles do not get fully reversed on the same day.

Net exchange outflows improve after up days.

Key risks and mitigators

| Risk | Impact | Practical mitigator |

| Crowded longs | High | Lower leverage, scale entries, monitor funding |

| Adverse headlines on listings or enforcement | High | Conservative size, disciplined stops |

| Violent rotation into other large caps | Medium | Diversify inside the liquid top bucket |

Levels to watch

Nearby support: 3 and 2.80 as control zones.

Resistances: 3.60 is the first test. 5 is a regime change confirmation. 8 is a stretched scenario that needs new catalysts.

Staged execution plan

Controlled accumulation while 3 holds with real volume. Avoid adding size if funding spikes without spot progress.

Confirmed breakout above 3.60 with close and continuation over 48 to 72 hours. Prefer scaling with time based stops in addition to price based stops.

Managing the 5 zone with partial hedges in options or systematic profit taking if the advance extends.

Invalidation signals

Daily closes below 2.80 with volume.

Rising funding and OI without spot progress.

Persistent bearish divergences on 4h and daily.