Executive brief

October is now the key month for XRP. The SEC pushed several XRP ETF decisions into mid and late October. The Fed also meets at the end of October. These dates can move liquidity and narrative. This guide explains the new timeline and gives clear base, bull, and bear paths. It also shows, in plain language, why Ripple’s stack still matters to institutions.

What just changed

Spot XRP ETFs: The SEC set longer review periods. Final windows land in October.

Market plumbing: Gemini’s S‑1 shows a $75M credit line from Ripple, expandable to $150M, with an option to draw in RLUSD. This links exchange funding and Ripple’s enterprise tools.

Enterprise adoption: Wellgistics switched on an XRPL payment program for thousands of U.S. pharmacies. It is a rare, real‑world scale case.

Policy backdrop: The next FOMC windows are Sep 16–17 and Oct 28–29. Forward guidance around these dates can lift or drain risk appetite.

October regulatory calendar

Publicly posted outside dates by venue:

Oct 18: NYSE Arca — Grayscale XRP Trust decision window.

Oct 19: Cboe BZX — 21Shares Core XRP Trust decision window.

Oct 23: Nasdaq — CoinShares XRP ETF decision window.

These are statutory dates. The SEC may approve, deny, or extend. Because the windows are close, announcements may cluster.

Why Ripple matters in 2025

First, payments and liquidity. Ripple Payments sources liquidity with XRP as a bridge. It cuts pre‑funding and settles fast. For thin corridors, this is capital‑efficient.

Second, RLUSD. Ripple’s dollar stablecoin gives a bank‑friendly unit for accounting and settlement. Firms can use RLUSD for balance sheet comfort and XRP for the bridge.

Third, custody and controls. Ripple and partners offer institutional custody with policy rules and audits. That matters for ETFs, brokers, and corporates.

Fourth, live deployments. Wellgistics shows XRPL running inside a regulated healthcare flow with many parties.

Finally, the ledger. XRPL finalizes in seconds and burns a tiny fee per transaction. The native AMM improves price sync without heavy smart‑contract code. Monthly escrow releases remain predictable and mostly re‑locked.

Scenarios into and after October

Base case

Regulation: At least one XRP ETF is approved in late October. Others follow soon after.

Flows: Early AUM is moderate. Crypto‑native funds lead.

Market: Liquidity depth improves. Volatility stays high at first, then cools.

Watch: AP creations vs. redemptions, implied spread, funding, options skew, XRPL AMM volumes, RLUSD supply.

Bull case

Regulation: Multiple approvals land within the same cycle.

Macro: The Sep FOMC tone is neutral to dovish. Later guidance does not bite.

Flows: RIAs whitelist fast. Net creations beat inventory. Basis turns positive.

Network: More pilots cite RLUSD + XRP together. EMEA and APAC corridors light up.

Result: Better depth and tighter slippage.

Bear case

Regulation: Decisions slip again or turn negative. The SEC flags manipulation or custody gaps.

Macro: Growth runs hot. The Fed leans hawkish into October. The dollar firms.

Flows: Discounts show up in other ETPs. Appetite fades.

Network: Deployments continue, but price chops.

Controls: Prefer cash‑and‑carry when spreads pay. Keep leverage low. Use options for tails.

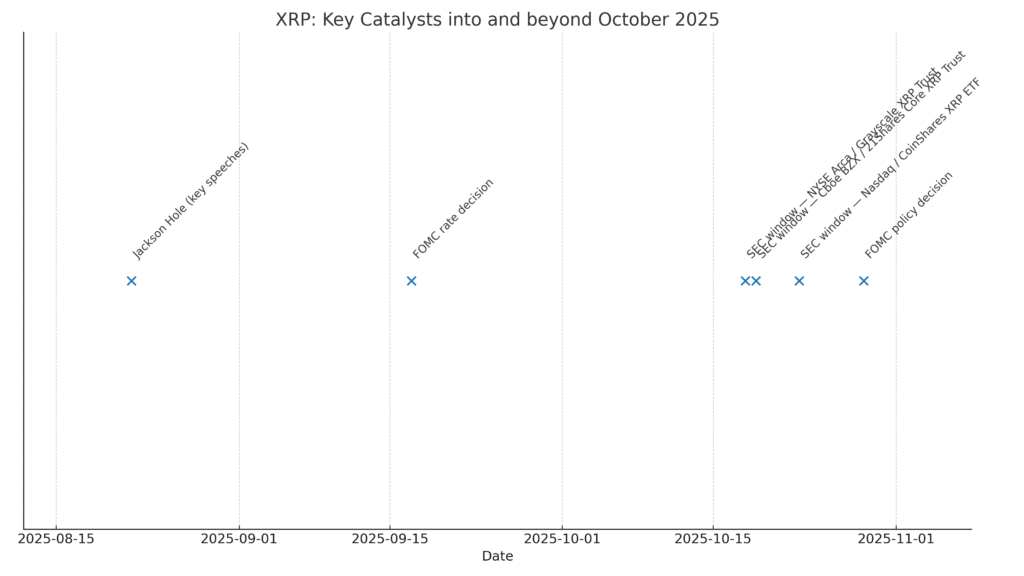

Timeline and catalysts

Aug 21–23: Jackson Hole signals and late‑August positioning.

Sep 16–17: FOMC rate decision and press conference.

Oct 18–23: XRP ETF decision windows by venue.

Oct 28–29: FOMC meeting. Policy tone can sway ETF flows.

Figure 1. Caption: “Dates in CEST. Sources: SEC dockets and FOMC calendar”

Figure 2. Dates in CEST. Sources: SEC dockets & FOMC calendar.

Governance and custody blueprint

Legal clarity: Final judgment on Aug 7, 2024 set a $125,035,150 penalty and a permanent injunction on certain institutional sales. Exchange trading of XRP was not judged a securities offering. In Jun 2025 the court refused to cut the penalty. In Aug 2025 both sides closed appeals.

Escrow: Releases follow a monthly schedule. Most tranches are re‑locked. That smooths supply.

Fee burn: Every transaction burns a small amount of XRP. This limits spam and makes net supply slightly deflationary at scale.

Custody: Use policy rules, key sharding, and SOC‑audited processes whether on Ripple custody or third parties.

Operator’s checklist

Monitor Federal Register dockets for each venue.

Track ETF creations, implied spreads and premium or discount.

Watch XRPL AMM volumes and pool depth in key pairs.

Check RLUSD circulation, integrations and fiat on‑ramp coverage.

Review XRP funding, perp basis, and options skew around each regulatory date.

FAQ

Does ETF approval guarantee sustained price appreciation

No. It improves access and brand legitimacy. Performance depends on breadth of distribution, AP activity, macro liquidity and network adoption.

Will RLUSD cannibalize XRP

No. RLUSD is a settlement unit. XRP is a bridge asset and fee unit on XRPL. They are complementary across different compliance profiles.

What is the risk from escrow

Monthly releases are predictable and mostly re‑locked. Watch on‑chain movements around month‑start, exchange inflows and any unusual OTC prints.

If ETFs are denied, what next

The institutional story does not end. Payments and RLUSD integrations continue. Price discovery would compress until the next policy or infra catalyst.

Related Posts

External Sources

Federal Register: NYSE Arca Grayscale XRP Trust longer‑period notice

Federal Register: Cboe BZX 21Shares Core XRP Trust longer‑period notice

Federal Register: Nasdaq CoinShares XRP ETF longer‑period notice designating Oct 23, 2025

Federal Reserve: FOMC calendar 2025

XRPL: XLS 30 AMM overview

Reuters: Judge rebuffs bid to cut penalty

Reuters: SEC ends lawsuit; $125M fine stands