XRP and Solana led this week’s intraday rotations. Momentum improved as price tested well defined resistance clusters. This piece clarifies the exact confirmations that would turn the current bounce into a sustained move, and the objective invalidations that would tell you the trade idea is wrong. It includes a technician’s checklist, a mini dataset of levels, and a scenario map for the next 72 hours. No investment advice.

Market context

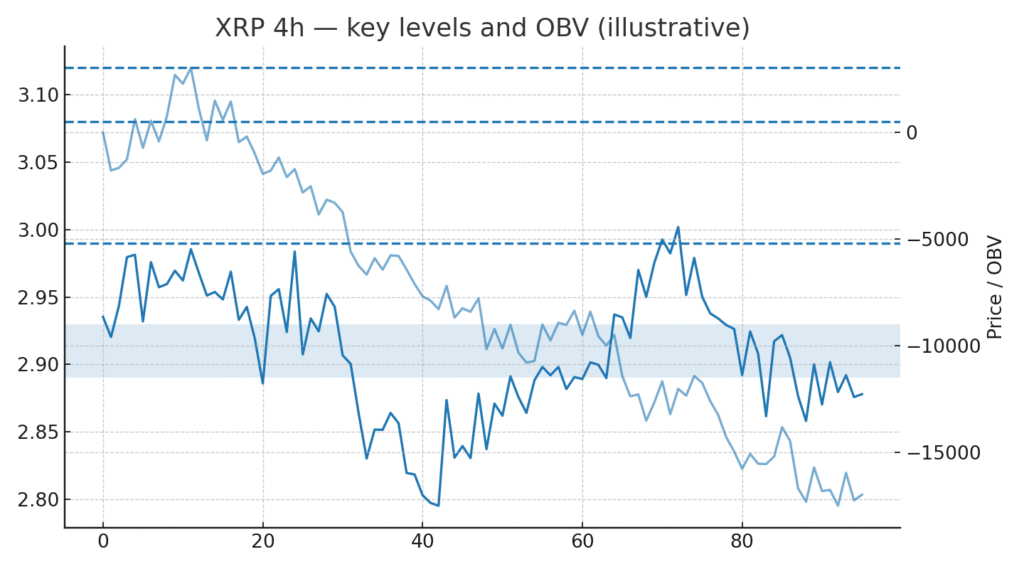

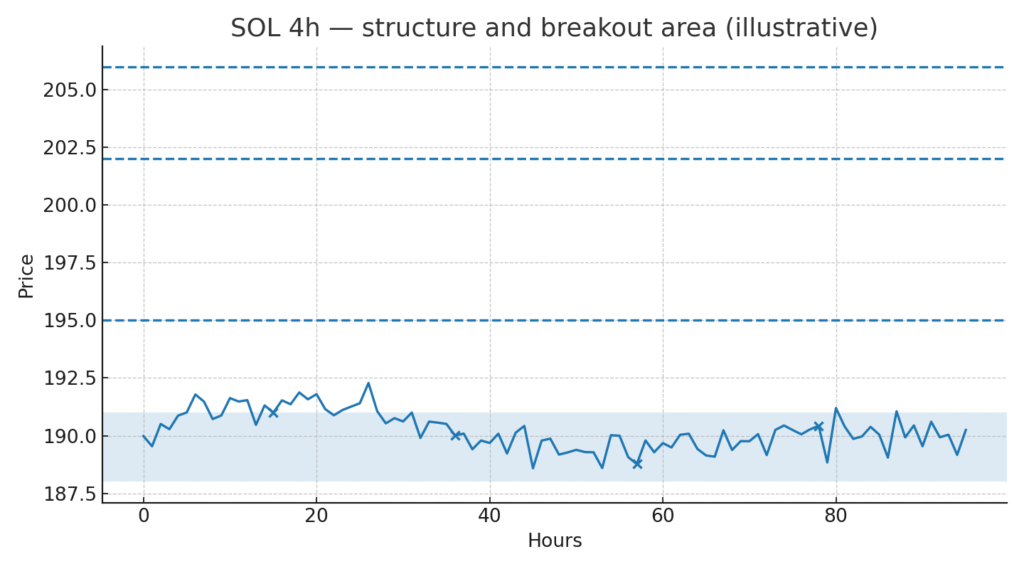

The past five sessions featured a mix of profit taking and fresh inflows. XRP whipsawed in a narrow two dollar eighty to two dollar ninety nine range before attempting a push through the psychological three dollar handle. SOL printed higher lows on the four hour chart while testing supply between one eighty eight and one ninety five. Depth improved on the bid during New York hours, while Asia opened with lighter volumes.

Technical snapshot

Below is a compact view of the levels that matter in the very short term. These are derived from recent sessions and publicly available quotes at the time of writing.

| Asset | Immediate support | Pivot to watch | First resistance | Breakout area | Invalidates thesis if… |

|---|---|---|---|---|---|

| XRP | 2.89 to 2.93 | 2.99 | 3.08 | Close above 3.12 with expanding volume | A four hour close below 2.84 followed by lower high on retest |

| SOL | 188 to 191 | 195 | 202 | Close above 206 with higher high and OBV uptick | Loss of 186 on volume with RSI failing to reclaim 50 |

Figure 1. Four hour XRP with the levels tabled above and a simple OBV pane

How to read this table

The pivot to watch is the intraday hinge. It is the level where failed moves often become fast moves in the opposite direction. The breakout area requires both price and participation. We look for a close through the area and a measurable expansion in traded volume or an uptick in on balance volume.

The technician’s checklist

Structure series of higher lows on the four hour chart. If structure breaks, stop respecting bullish setups.

Participation rising volume on up closes, flat to lower volume on pullbacks.

Liquidity shallow wicks into support zones on selloffs. Deep wicks that close weak suggest trapped buyers.

Momentum RSI holding above the midline after pullbacks. Failure to do so twice in a row weakens the case.

Invalidation if XRP closes below 2.84 and rejects the level on retest, or if SOL loses 186 on volume and fails to reclaim it, step aside.

Scenario map for the next 72 hours

Base case: price coils under resistance, volatility compresses, then breaks with a directional move. Confirmation comes from a close through the breakout area and a higher high on the next session.

Upside extension: upside accelerates if resistance flips to support and dips are bought quickly. Look for stacked higher lows and intraday acceptance above prior day value.

Downside risk: a fakeout through resistance followed by a swift rejection will often travel back to the last area of balance. That is where failed breakouts go to die. Protect against this outcome by pre defining invalidations.

Figure 2. Four hour SOL with marked higher low sequence and breakout area

Microstructure tells to watch live

• Delta versus price positive delta with little price progress can reveal passive sellers absorbing the move.

• Order book behavior does supply reload at round numbers or does it get pulled as price approaches

• Time of day New York close and Asia open tend to reset the tone. Track how each session treats the same level.

Risk notebook

• XRP remains sensitive to headlines about the post litigation path and potential ETF filing progress.

• SOL’s path depends on sustained network stability and high quality throughput during peak activity. Any degradation will be punished quickly by the market.

• Correlation regime can flip if the macro tape changes. A sudden shift in rates or dollar liquidity often overrides technicals.

Related Posts

• Wall Street closes higher as Powell hints at a September rate cut the crypto angle

• Issuers ramp up crypto ETF filings ahead of an expected launch window

• Ethereum sets a new all time high as markets price a September rate cut

External Sources

• CoinDesk market note on XRP and SOL short term signals

• CoinDesk XRP intraday whipsaw range analysis