Summary

A prominent traditional finance voice called Ethereum the Wall Street token and argued that banks will need a blockchain standard for stablecoin flows. This article evaluates that claim through a market structure lens adds a Daily Market Pulse snapshot and outlines scenarios for exchange traded funds futures and real world asset adoption.

The claim in plain terms

As stablecoins become mainstream settlement media for funds broker dealers and corporates banks and payment processors must pick a blockchain standard. The case for Ethereum rests on entrenched developer depth EVM compatibility across layer two networks and maturing institutional wrappers such as spot exchange traded funds futures and qualified custody. If banks need to ingest and route stablecoins within the next year the least friction option is EVM and Ethereum.

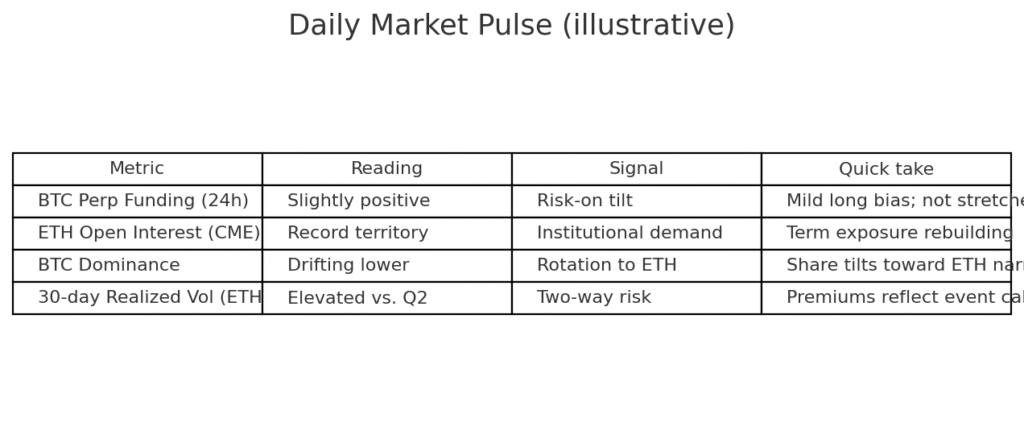

Daily Market Pulse illustrative

| Metric | Reading | Signal | Quick take |

|---|---|---|---|

| BTC perpetual funding 24 hours | Slightly positive | Risk on tilt | Mild long bias not stretched |

| ETH open interest on CME | Record territory | Institutional demand | Term exposure is rebuilding |

| BTC dominance | Drifting lower | Rotation to ETH | Share tilts toward ETH narratives |

| Thirty day realized volatility ETH | Elevated versus Q2 | Two way risk | Premiums reflect an event calendar |

The table is illustrative and uses synthetic descriptors.

Figure 1. Ethereum wall street daily pulse

Microstructure ETFs CME and layer two liquidity

ETFs. Spot ETH funds continue to deepen secondary market liquidity and authorized participants arbitrage net asset value gaps more efficiently than in the first month of trading. The investor base is broadening from hedge funds to registered investment advisers and multi asset strategies.

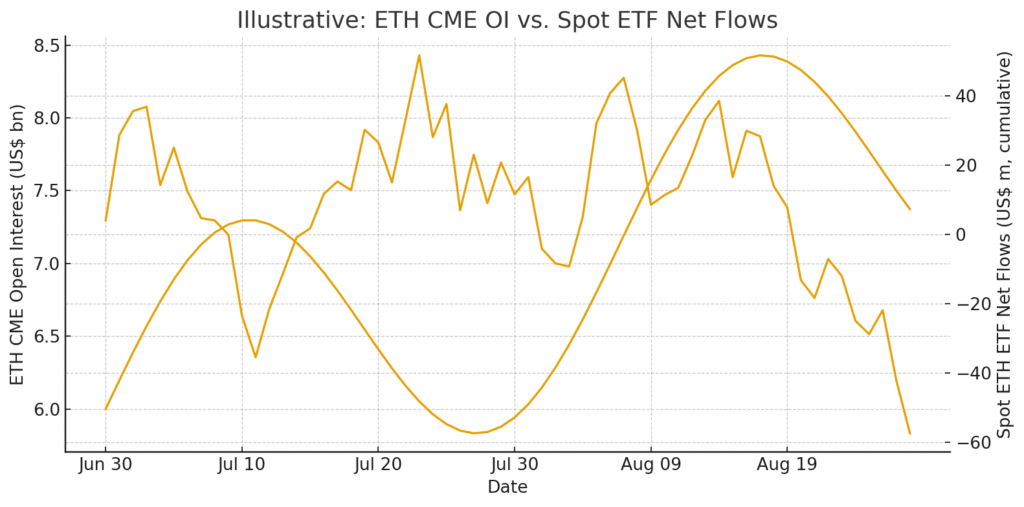

Futures and options. Open interest in ETH futures on CME has reached fresh highs which indicates institutional risk appetite. Options skews around macro events have normalized from panic levels and this supports more predictable roll dynamics.

Layer two settlement. Growth of EVM compatible layer two networks allows banks to pilot low cost high throughput flows while anchoring settlement finality on layer one Ethereum. For compliance and reporting the data availability model is increasingly understood by auditors.

Figure 2. Ethereum oi vs ETF inflows

Where the Wall Street token thesis holds

Stablecoin gravity remains strongest on EVM rails and corporate treasurers prefer composability with existing money markets for short term yield management.

Custody services with audit reports segregated accounts and staking policy disclosures are now common in institutional menus which shrinks the operational gap versus traditional assets.

Developer tools auditors libraries and incident playbooks are richer on EVM than any other stack which reduces time to pilot for banks.

Where it can break

Regulatory chokepoints could emerge if authorities restrict staking or layer two settlement pathways. Banks may prefer centralized tokenized deposits that minimize public chain exposure.

Throughput and privacy can clash with bank reporting. Permissioned forks or walled garden layer twos could fragment liquidity.

If spot ETH funds suffer persistent outflows futures basis compresses and the narrative loses its macro tailwind.

Value add scenario map for bank adoption illustrative

| Scenario | Six to twelve month markers | Implications |

|---|---|---|

| Base case gradual EVM adoption | More registered adviser inflows to ETH funds and bank pilots on EVM layer two networks | Liquidity improves, custody revenues rise, and fee compression remains modest |

| Upside EVM standardizes | Treasury vendors integrate EVM rails natively and cross-border settlement volumes jump | ETH earns a plumbing premium and futures and options depth expand |

| Downside fragmentation | Banks default to tokenized deposits on private ledgers | Public chain liquidity bifurcates, fund assets stagnate, and builder activity shifts to permissioned stacks |

Bottom line

Calling Ethereum the Wall Street token is a directional claim about settlement gravity not a promise of price. What matters is the plumbing including fund wrappers CME depth and layer two rails that auditors and risk teams can sign off on. On those fronts the trend is constructive provided regulation and bank governance keep pace.