Street reality is colliding with policy. This guide pulls together what changed this week, what has been quietly in motion for months, and how merchants, families, and treasuries can adapt without adding new risk.

Field report

Caracas and other large cities now show a clear pattern. With cash dollars scarce, many exchanges and merchants rely on USDT. Reuters reports that authorities are allowing more use of stablecoins at currency desks and that approved wallets can source crypto through banks for domestic and cross border payments. PDVSA has shifted part of its transactions to USDT. Families and small shops already used these rails for remittances and fast settlement. Now policy is catching up with the market.

The stablecoin street matrix

Mini dataset to anchor the story

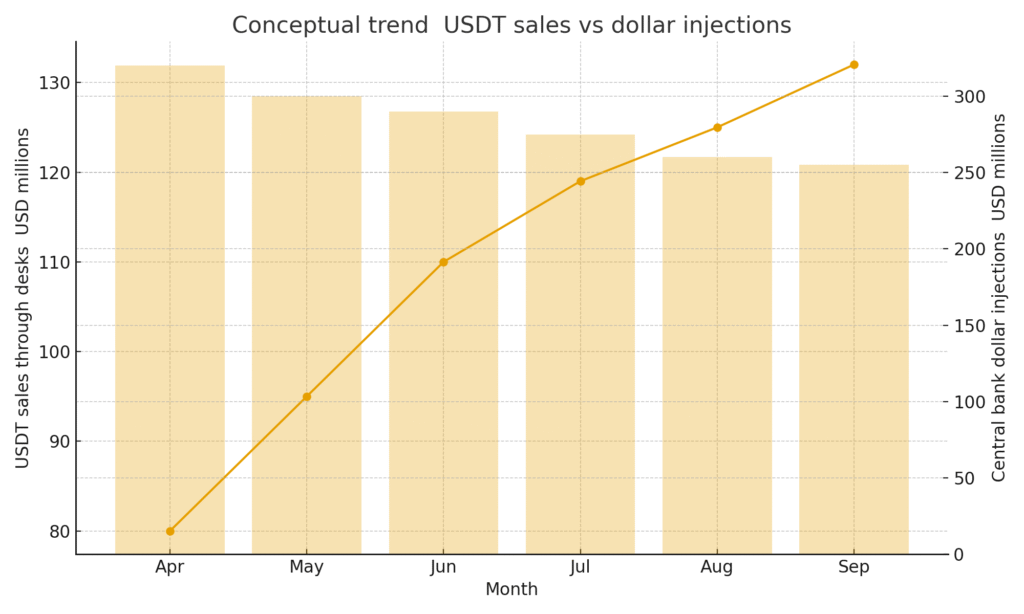

Analysts quoted by Reuters estimate one hundred nineteen million dollars in crypto sales in July.

The central bank cut dollar injections by fourteen percent in the first seven months of the year.

Banks can supply crypto to approved wallets for payments under new rules.

Figure 1. Line and bar chart comparing rising USDT sales with declining central bank dollar injections across recent months.

How prices are set on a typical day

Morning prices reference global markets and local spreads. Midday, liqudity splits between retail peaks and exchange posts. Late day, spreads widen and small shops prefer a quick round number. This rhythm means consumers should plan larger purchases earlier in the day and merchants should publish a clear conversion rule to avoid disputes.

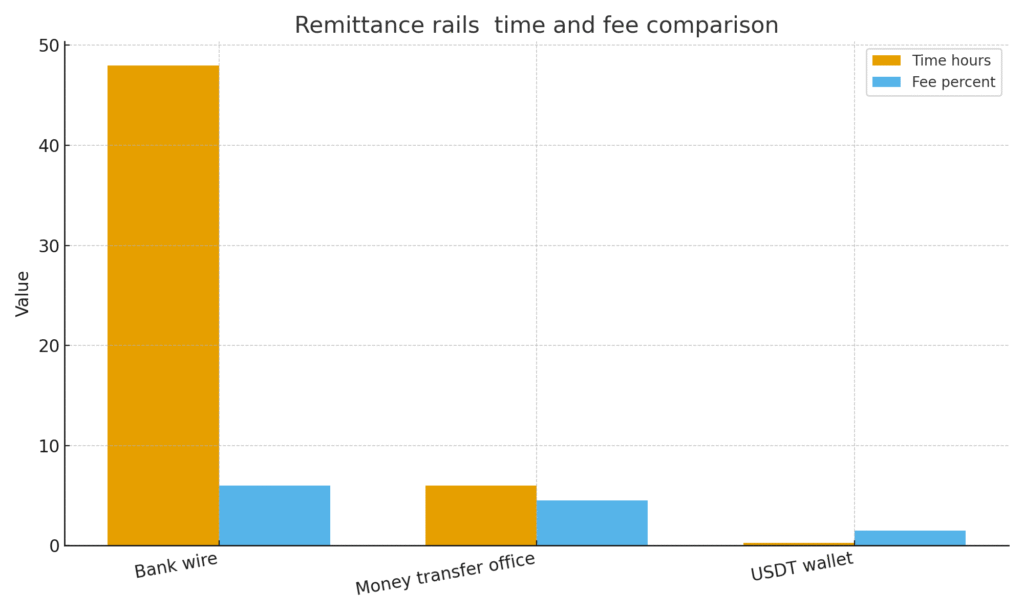

Figure 2. Grouped bars showing remittance rails where USDT wallet is fastest and cheapest versus bank wire and transfer office.

Timeline so far

Families and traders adopt USDT for remittances and inventory protection.

PDVSA experiments with stablecoin settlement for exports.

Currency desks get the green light to use USDT with bank support.

Public messaging hints at non traditional payment methods while details remain selective.

Shops in large cities normalize sticker prices in USDT for fast settlement.

Policy blueprint for a safer rollout

Licenses for currency desks that include basic custody and reporting standards.

Public guidance on acceptable wallets and the audit trail they must keep.

A fair on ramp with posted fees so small merchants are not priced out.

Consumer education about seed safety and how to avoid fake apps.

Open dashboards with aggregate flows and conversion bands for transparency.

Risks and how to live with them

What this means for families and small firms

Families can reduce the churn of price changes by keeping a small USDT buffer for essential purchases. Shops can speed checkout by using QR and a posted rate rule with a time stamp. Importers can split invoices so that part settles in USDT and part in local currency, reducing the shock if rules change.

Where this is going next

Expect more formal rails at banks and clearer tax rules on stablecoin settlements. If remittance platforms publish open integration guides, local wallets can add one click payout options. The result is a mixed economy where cash dollars, bolivars, and USDT coexist, with USDT covering the gaps when legacy rails slow down.

Related Posts

Venus Protocol incident Phishing loss pause and a defense playbook for DeFi teams

Solv and Chainlink enable real time collateral verification for SolvBTC Dossier and blueprint

September market setup Eric Trump in Tokyo Metaplanet capital plan and BTC seasonality risk map

- Gemini IPO Valuation math and what a 17 to 19 range implies for proceeds