South Korea’s Dunamu, the operator of leading crypto exchange Upbit, has unveiled GIWA, a new Ethereum layer-2 network designed with the OP Stack framework. The launch places Dunamu among a growing list of global players racing to build scalable infrastructure on Ethereum.

Issuer Dossier

Dunamu, the Seoul-based parent company of Upbit, has formally introduced GIWA, a layer-2 blockchain aimed at solving Ethereum’s scalability challenges. Built on Optimism’s OP Stack, the network leverages rollup technology to deliver lower fees and faster confirmation times while maintaining Ethereum’s security guarantees.

Key facts at launch:

| Feature | GIWA (Dunamu) |

|---|---|

| Parent Company | Dunamu (operator of Upbit) |

| Blockchain Type | Ethereum Layer-2 (OP Stack rollup) |

| Launch Status | Testnet live, mainnet scheduled in 2026 |

| Target Market | South Korea + global institutional partners |

| Key Focus | Trading scalability, Web3 apps, compliance |

| Governance | Initially centralized, roadmap to community |

| Competitors | Base (Coinbase), Blast, Linea, zkSync |

Dunamu is positioning GIWA as a strategic backbone for South Korea’s fast growing digital asset industry. By controlling both an exchange (Upbit) and a layer-2, the company gains vertical integration bridging liquidity, custody, and applications within its ecosystem.

Governance & Custody Blueprint

GIWA’s governance model begins under Dunamu’s direct oversight, ensuring early stability while the network is in testnet phase. According to company statements, a progressive decentralization roadmap is planned once the mainnet is stable and adoption grows.

Custody and compliance are central to GIWA’s positioning. By aligning with South Korea’s tightening digital asset rules, Dunamu aims to create a blockchain environment where institutional clients can interact safely while benefiting from Ethereum’s scalability.

Key governance pillars:

Initial oversight: Dunamu retains operational control during testnet.

Progressive decentralization: A phased plan to introduce validator diversity and community input.

Regulatory compliance: Full alignment with Korean and global digital asset regulations.

Custody integration: Designed for interoperability with Upbit’s custody services and external institutional providers.

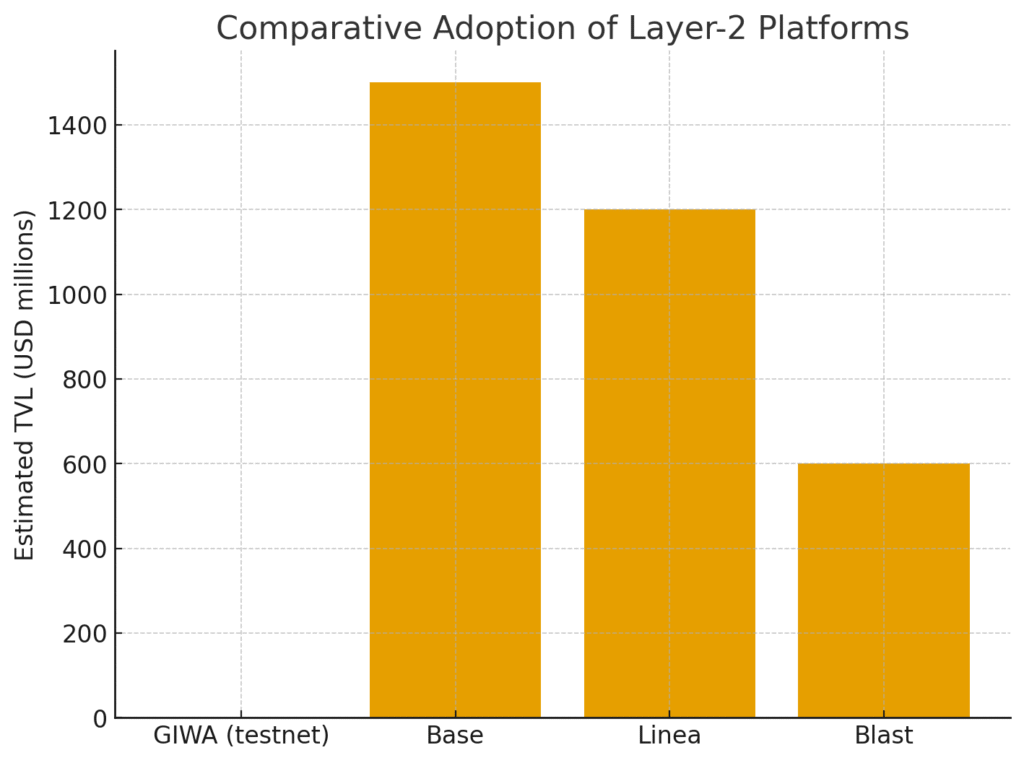

Comparative Snapshot of Layer-2 Platforms

| Platform | Parent / Backer | Tech Stack | Launch Status | Focus Area | Regulatory Angle |

|---|---|---|---|---|---|

| GIWA | Dunamu (Upbit) | OP Stack rollup | Testnet 2025 | Exchange integration, institutions | Korean digital asset compliance |

| Base | Coinbase | OP Stack rollup | Mainnet 2023 | Retail on-ramp, DeFi ecosystem | US SEC scrutiny, transparency |

| Linea | Consensys | zkEVM | Mainnet 2023 | Developer-first, zk scalability | Neutral, global developer focus |

| Blast | Blur ecosystem | Optimistic rollup | Mainnet 2024 | NFT liquidity, yield strategies | Less emphasis on compliance |

Figure 1. Bar chart comparing estimated adoption/TVL of GIWA (0 testnet), Base ($1.5B), Linea ($1.2B), Blast ($600M)

Conclusion

GIWA positions Dunamu as more than just the operator of South Korea’s largest crypto exchange. By building a dedicated layer-2, the company is betting on scalability and regulatory alignment as the cornerstones of Web3 adoption in Asia. The integration of trading, custody, and blockchain infrastructure gives Dunamu a strategic edge in shaping how digital assets are issued and settled in the region.

What’s Next

With GIWA still in testnet, the key milestones ahead include the mainnet launch in 2026, onboarding of institutional partners, and integration with Upbit’s liquidity pools. The project’s success will depend on whether Dunamu can differentiate GIWA from global competitors like Coinbase’s Base and Consensys’ Linea. If adoption scales, GIWA could emerge as South Korea’s flagship contribution to the Ethereum layer-2 landscape.

Related Posts

Nasdaq’s bid to trade tokenized securities signals a turning point in US market structure

Venus Protocol returns eleven million to a phishing victim after coordinated recovery

4 Comments

Pingback: Kraken opens xStocks to European investors as tokenized equities gain traction - The Crypto Tides

Pingback: Grayscale files with the SEC to convert Bitcoin Cash Hedera and Litecoin trusts into exchange traded funds - The Crypto Tides

Pingback: Polygon PoS mainnet hard fork resolves finality delays and restores checkpointing and state sync - The Crypto Tides

Pingback: BBVA and Ripple push bank grade crypto custody in Spain as MiCA era begins - The Crypto Tides