Unicoin and several executives were charged by the U.S. SEC for alleged fraud tied to fundraising claims and asset backed representations. The company’s CEO says Unicoin will move to dismiss. This brief gathers what is public, lays out the procedural posture, and maps risk for token holders and prospective investors.

Allegations in brief

Misleading statements to investors. The complaint alleges exaggerated claims about asset backing and partnerships.

Unregistered offers and sales. The SEC argues sales involved instruments within the securities definition without proper registration or exemption.

Use of proceeds and governance. Questions on how funds were represented and deployed.

Company’s response

Motion to dismiss planned. Unicoin indicates it will move to dismiss, arguing factual distortions and legal insufficiency.

Political motivation argument. Public statements frame the case as overreach rather than fraud.

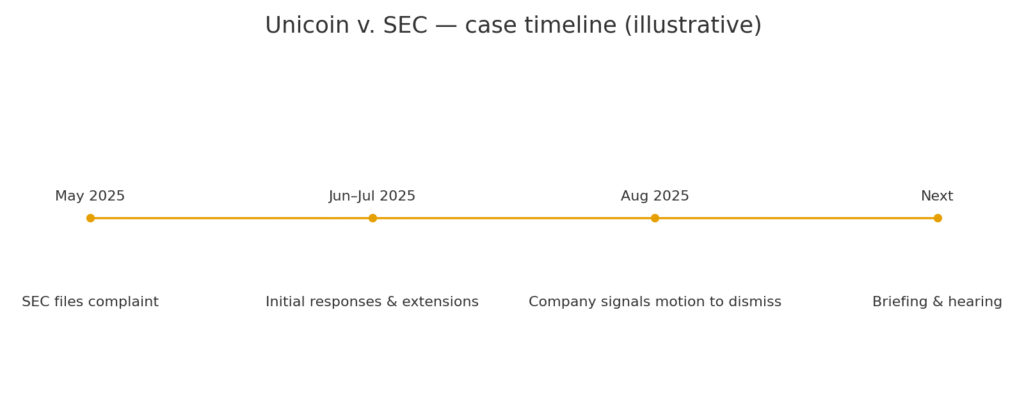

Litigation timeline

| Date | Milestone | Notes |

|---|---|---|

| May 2025 | SEC files civil complaint | Fraud and registration claims detailed. |

| June–July 2025 | Initial responses and extensions | Scheduling and service issues resolved. |

| August 2025 | Company signals motion to dismiss | CEO states intent to contest complaint in court. |

| Next | Motion briefing and hearing | Court rules on sufficiency of the SEC’s claims. If dismissed, may allow amendment. |

Figure 1. Case timeline

What the motion to dismiss tests

Pleading sufficiency. Whether the complaint states a claim with particularity where required.

Jurisdiction and venue. Whether the court is proper and the SEC’s theory reaches the facts pled.

Instruments at issue. Whether what was sold qualifies as a security under relevant tests.

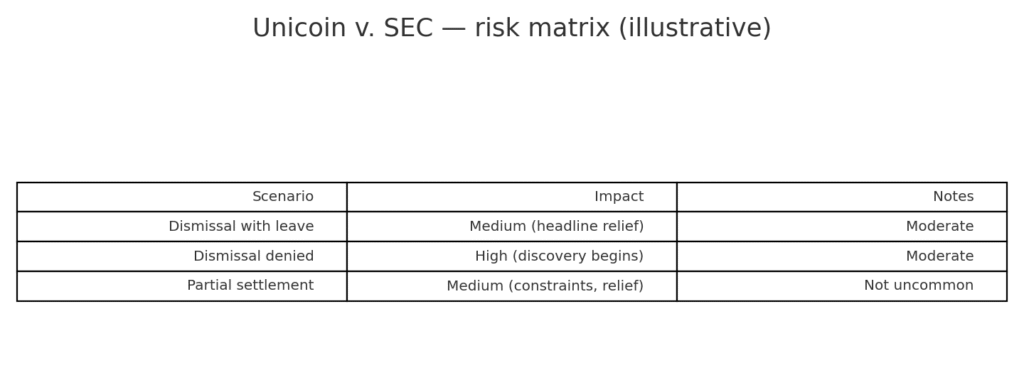

Risk and scenario map

Dismissal granted with leave to amend. Case continues with a narrower theory; headlines ease in the interim.

Dismissal denied. Discovery begins; risk rises for adverse facts.

Partial settlement before or after ruling. Common in SEC matters that seek investor relief and undertakings.

Figure 2. Risk matrix

Conclusion

The path from complaint to resolution is usually long. Motions to dismiss filter legal theories but do not adjudicate facts. Investors should track filings, prepare for volatility around rulings, and anchor decisions on primary documents, not headlines.

Related Posts

- Stellar’s XLM tests 0.40 market pathways and actionable levels

- HBAR steadies near 0.24 microstructure, levels and risk playbook

- Google’s finance‑grade Layer 1 how GCUL stacks up against Stripe and Circle