Tokenised stocks investor safeguards must match the speed and access promised by tokenisation. Regulators around the world are sharpening their warnings on tokenised stocks and synthetic equity exposure. This article sets a practical blueprint for investor safeguards that cover custody clarity, redemption, corporate actions and disclosures, and explains where the biggest gaps remain today.

What tokenised stocks are in practice

Tokenised stocks seek to give investors equity like exposure using a token that represents economic rights to a share or to a synthetic instrument that tracks its value. Designs vary a lot, from exchange issued synthetics to claims fully backed by underlying shares held with a licensed custodian.

Governance and custody blueprint

- Asset representation. Prefer a structure where each token maps to a specific claim against an identified pool of real shares under a clear trust or custody agreement.

- Chain of title. Document how legal ownership flows from issuer to custodian to token holder. Publish the reconciliation workflow and audit cadence.

- Segregation and insolvency. Underwrite segregation of client assets and explain how token holders rank in insolvency. State the law and the court that governs disputes.

- Oracles and pricing. Use primary market references with observable inputs and clear fallbacks. Ban self referenced feeds.

- Redemption and corporate actions. Spell out cash and in kind redemption rules, voting instructions, dividends, splits and rights issues.

- Disclosure and attestations. Provide short form monthly attestations on backing and a quarterly controls report by an independent auditor.

Threat model snapshot

Actors. Issuer, custodian, market maker, oracle provider, exchange venue, on chain bridge.

Risks. Misrepresentation of backing, failure to settle redemptions, oracle manipulation, custody rehypothecation, regulatory breach across borders, bridge compromise.

Controls. Daily position reconciliation, oracle diversity with circuit breakers, fully segregated custody, public proof of reserves with independent attestation, strict KYC for primary issuance, audit trails for corporate actions.

Design spectrum without a table

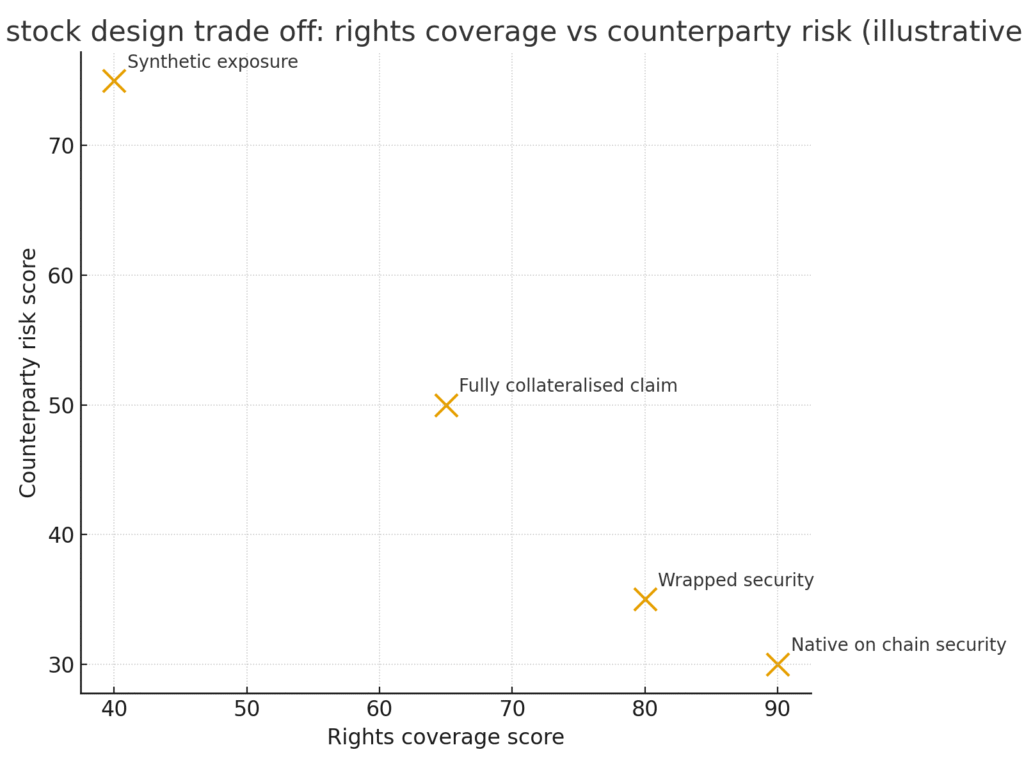

Synthetic exposure

Exposure through derivatives or internal market making with no right to a specific share. High counterparty risk and limited rights.

Fully collateralised claim

Token maps to a claim on shares held by a licensed custodian. Redemption and corporate actions flow by contract. Medium counterparty risk.

Wrapped security

A security exists off chain and is wrapped into a token through a registrar or a central securities depository partner. Stronger corporate rights and clearer disclosures.

Native on chain security under a sandbox regime

Issued directly on chain within a pilot regime. Corporate registry links, cap table, and corporate actions live on chain. Highest clarity on rights when law recognises the ledger.

Figure 1. Illustrative scatter plot that compares rights coverage against counterparty risk across synthetic fully collateralised wrapped and native models

Compliance checklist for safer tokenised stocks

Map every investor right to a legal mechanism. Include redemption, dividends, voting and information rights.

Publish a one page solvency and segregation statement and link to the custody agreement.

Commit to monthly backing attestations and a quarterly controls report.

Provide a failover price source and publish the trigger rules for manual intervention.

Disclose how corporate actions propagate from issuer to token holders and test the flow twice a year.

Offer a clear complaints process with the competent authority indicated by name.

What is a tokenized stock

A tokenized stock is a digital token that gives exposure to the economic value of an equity. Depending on the design it may or may not grant corporate rights or redemption against real shares.

Are tokenized stocks legal

Legality depends on the jurisdiction and the product structure. Many forms are treated as regulated securities and require prospectus rules, custody oversight and disclosures. Sandbox regimes can authorise pilots with strict limits.

Will the stock market become tokenized

Parts of it can. The most likely path is tokenised depositary receipts and wrapped securities first, followed by native on chain issuance in controlled regimes as legal recognition expands.

What companies offer tokenized stocks

Offerings exist at centralised exchanges, compliant broker dealer platforms and specialised fintechs. The strongest options disclose custody partners and corporate action handling and avoid synthetic exposure without collateral.

Is tokenization a good investment

It is a distribution and market structure innovation rather than an asset class. Returns come from the underlying equity and from improved market access and settlement efficiency, not from tokenisation alone.

What is Tesla tokenized stock

It is a token that tracks the value or rights of Tesla equity depending on the structure. The safest versions link to real shares with documented custody and redemption.

Conclusion

Tokenised stocks can widen access and speed settlement only if investor safeguards match the promise. By focusing on custody clarity, attested backing, oracle diversity and plain language disclosures, platforms can reduce risk for retail and institutional users while giving regulators the comfort they demand.

Related Posts

Hedera v066 mainnet upgrade explained and what it changes for builders today

Ethereum Fusaka BPO explained: how blob‑only forks safely boost L2 throughput (October 2025)

MEXC Cecilia Hsueh at TOKEN2049! new Chief Strategy Officer sets strategy for 2025

External Sources

Reuters Crypto race to tokenize stocks raises investor protection flags

Reuters Stock exchanges urge regulators to crack down on tokenised stocks

ESMA DLT Pilot Regime (framework for trading and settlement of tokenised financial instruments)

ESMA — Keynote (Natasha Cazenave): testing tokenisation through the DLT Pilot Regime

IOSCO Policy Recommendations for Crypto and Digital Asset Markets (Nov 2023)

4 Comments

Pingback: Ethereum Fusaka Sepolia upgrade readiness for OP Stack and Erigon 3.2.0 - The Crypto Tides

Pingback: Visa rebrands DeFi as onchain finance and builds lending rails for banks - The Crypto Tides

Pingback: WazirX restart and Recovery Tokens after the Singapore court approval - The Crypto Tides

Pingback: Hong Kong regulator approves first Solana spot ETF listing set for October 27 - The Crypto Tides