Payroll does not need to land twice a month. With stablecoins and programmable contracts, value can flow second by second. This essay argues that streaming money already competes with legacy rails on cost, latency and programmability, and that adoption will stack in layers: corporate pilots first, B2B flows next, then consumer use.

What streaming money is

It is continuous settlement of a planned payment through a smart contract. Instead of discrete transfers, the sender opens a flow that delivers small units of value over a defined interval. The receiver can pause, withdraw or reroute funds as needed.

Key advantages

Fast finality and simpler reconciliation.

Programmability for business conditions, escrow and automatic revenue splits.

Global access to digital dollars in markets with banking friction.

Use cases that win first

Payroll and variable compensation. Pay by hour or task, released continuously. Works well for shift workers, gig economy and metric‑linked bonuses.

Remittances and aid. Progressive disbursement that reduces misuse risk and smooths income.

Creator economy. Subscriptions, tips and revenue share split among collaborators without manual ops.

B2B and treasury. Suppliers receive a stream against measurable milestones. Fewer disputes and less working capital.

Mini dataset

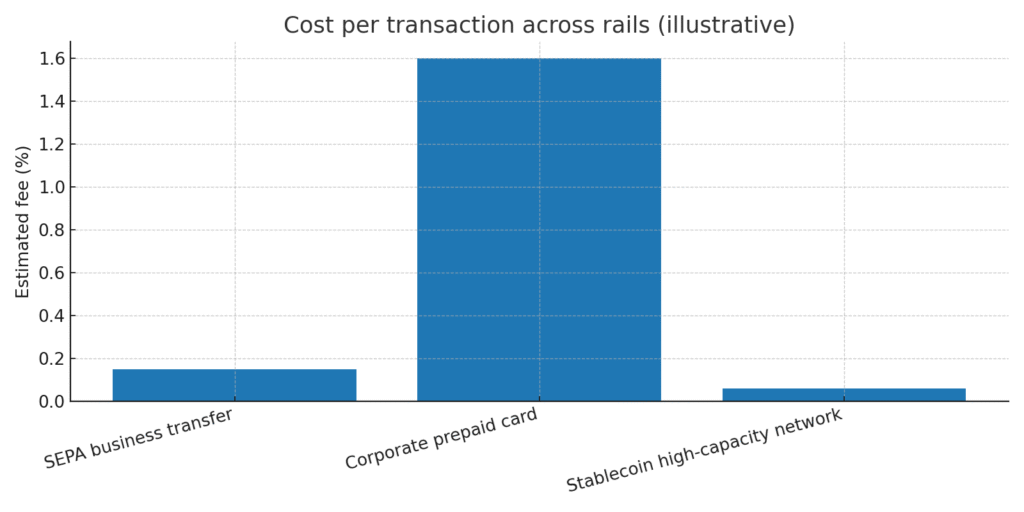

Relative cost for a firm with 100 employees and a gross monthly salary of 2,200 USD. Total gross payroll 220,000 USD.

| Rail | Frequency | Estimated fee | Settlement latency | Notes |

|---|---|---|---|---|

| SEPA business transfer | monthly | 0.10% to 0.20% | hours to 1 day | No programmability. Banking hours. |

| Corporate prepaid card | biweekly | 1.25% to 2.00% | immediate | High fee and chargebacks. |

| Stablecoin on high‑capacity network | daily streaming | 0.01% to 0.10% | seconds to minutes | Fast finality and rules in contract. |

Figure 1. Cost per transaction across rails

Reference architecture

Custodial or self‑custody wallet with company and employee permissions.

Stream contract that defines amount per unit of time, period, pauses, withdrawal rights.

Oracles and logs for accounting and compliance.

Payments blueprint

Contract design. Set parameters and termination conditions.

Identity. KYC and beneficiary verification. Prevent duplicates and wrong addresses.

Compliance. Transaction logs, sanctions screening and jurisdiction checks.

Multi‑network treasury. Choose networks by throughput and fee structure. Define conversion to fiat.

User experience. Real time balance view and partial withdrawals without friction.

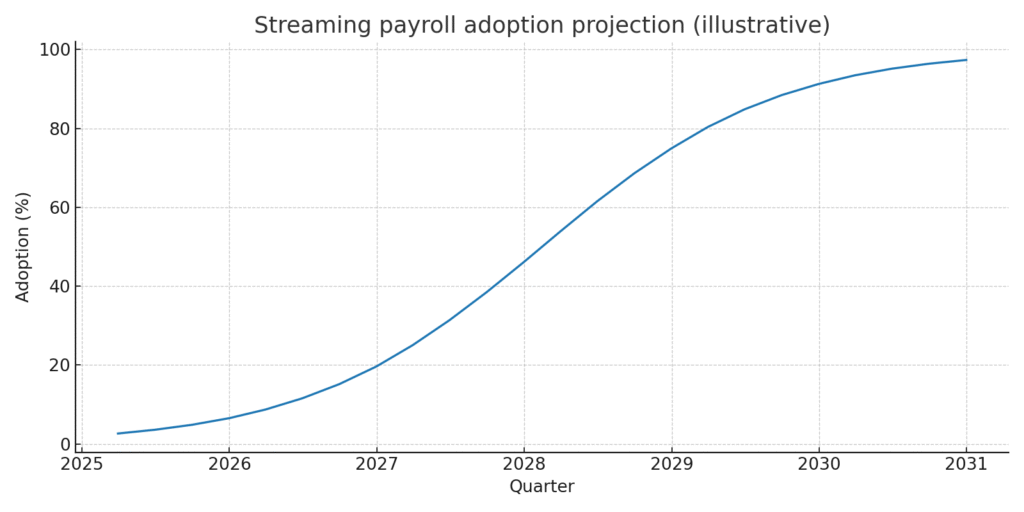

Figure 2. Adoption curve for streaming payroll

Risks and mitigations

Issuer risk. Segregated reserves with independent audits.

Network risk. Diversify across high‑capacity networks. Plan contingencies.

Operational risk. Misconfigured contracts. Use reviewed templates.

Regulatory risk. Clear reporting and AML policies with auditable records.

Recent signals that push adoption

A stablecoin summer with faster growth and clearer national frameworks.

Integrations by card networks and processors that add stablecoin settlement.

Corporate pilots for fractional payroll and lower‑cost cross‑border flows.

Conclusion

Streaming money will not replace everything overnight. It wins where friction hurts most, it creates real time reconciliation habits and shifts batch processes into programmable flows.