Market overview

Solana takes center stage as traders price a policy cut from the Federal Reserve. Liquidity rotates into high throughput ecosystems while large caps consolidate. As funding tilts positive and open interest builds, directional bets cluster around clear technical levels. At the same time, spot flows remain active on United States hours, which supports sustained momentum rather than a single spike. Solana benefits from a clean execution story. Finality remains stable during volatile periods and fee pressure stays contained. As a result, on chain activity converts into visible volumes across decentralized venues and app front ends. This mix keeps market depth resilient while market makers lean into tighter spreads.Daily Market Pulse

The snapshot below captures conditions at press time.| Metric | Value | Read |

|---|---|---|

| SOL perpetual funding rate | Slightly positive | Longs pay, reflects soft bullish bias |

| SOL open interest change 24 hours | Rising | Leverage builds ahead of the policy decision |

| SOL spot volume 24 hours | Elevated versus weekly average | Participation broadens beyond futures |

| BTC dominance | Stable to lower | Rotation toward high beta assets |

| Thirty day realized volatility SOL | High and climbing | Range expansion likely |

| ETF flow backdrop United States | Net inflows this week | Risk appetite improves into the event |

Levels that matter

Price holds above a rising intraday trend. First support sits near the prior breakout area and prior day value. A deeper pullback would test a cluster formed by recent higher lows. On the upside, momentum traders watch the round number above and the zone where sellers capped the last two rallies. A clean push above that zone could trigger stops and fast continuation.What is driving flows

Macro dominates near the policy meeting. A smaller cut would favor a slow grind rather than a sharp move. Meanwhile, market structure helps. Robust throughput reduces slippage during busy hours, which invites larger tickets. In addition, app level catalysts keep users active across consumer front ends and trading tools. As builders ship, active wallets persist and volumes stay resilient.Intraday snapshot

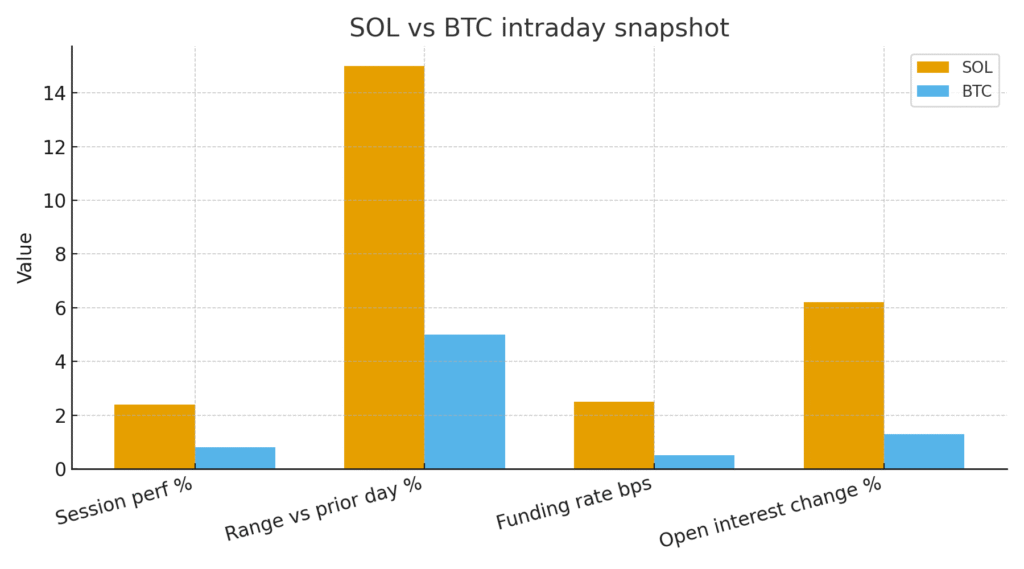

The table compares intraday behavior for Solana and Bitcoin at press time. It serves as a quick read for relative strength and positioning.

| Metric | SOL | BTC |

| Session performance | Outperforms on the day | Mixed tone during United States hours |

| Range versus prior day | Expands with higher highs | Holds inside prior value area |

| Perpetual funding tilt | Positive and steady | Neutral to slightly positive |

| Open interest drift | Builds into event | Flat to modest builds |

| Liquidity depth top of book | Tighter spreads on major pairs | Stable with wider spreads during bursts |

Figure 1. Intraday comparison metrics for SOL and BTC including session performance range versus prior day funding rate in basis points and open interest change with SOL showing stronger readings

Intraday timeline

Early session Europe shows steady bids in SOL while BTC trades mixed. Then momentum improves as funding tilts positive and open interest climbs. During United States hours spot volume stays active and depth holds. Into the close traders fade small spikes yet the trend remains intact.

Event window scenarios

Small rate cut Flows favor a grind higher with pullbacks bought near intraday supports. Funding stays modest and risk builds gradually.

Larger cut A sharp squeeze lifts high beta names first. Use clear levels to manage slippage. Expect wider spreads for a short window.

No cut A fast test of nearby supports follows. Rotation pauses and liquidity seeks safer pairs. Wait for stabilization before adding risk.

Risk notes

Use position sizing that survives a wide print. Place stops beyond obvious clusters. Avoid chasing green candles during the first minutes after the decision.

Conclusion

Solana leads into the policy event as liquidity rotates toward throughput and app activity. If conditions remain orderly and the decision aligns with expectations the trend can extend. If the tape turns messy use the same levels to manage exits and keep powder dry for the next setup.