Executive summary

The Securities and Exchange Commission released a new rule making agenda that targets crypto market clarity and basic investor protections. The docket concentrates on disclosures, custody, market structure and the way trading venues connect with broker dealers. The message is simple. The agency wants consistent rule books that work with existing securities law while also leaving room for innovation. As a result the plan favors clear definitions, phased implementation and measurable outcomes.

What changed

The agenda elevates three priorities. First, standardized disclosures for token issuers and for intermediaries that hold client assets. Second, tighter custody rules that spell out segregation, attestations and incident reporting. Third, market structure items that touch matching engines, best execution, conflicts and surveillance. In addition the staff proposes a path that allows qualified broker dealers to interact with crypto trading venues under robust safeguards. Therefore the overall set points to integration rather than isolation.

Why it matters

With clearer rules investors can compare products and venues more easily. Platforms can also design controls that match the same expectations across the industry. As rules converge, liquidity concentrates and spreads tend to narrow. Moreover institutions gain a better way to evaluate counterparty risk and to allocate capital. This can support deeper markets during both calm and stress.

Key proposals at a glance

| Area | Aim | Practical effect for venues |

|---|---|---|

| Disclosures | Comparable facts about tokens and intermediaries | Standard templates and periodic updates |

| Custody | Segregation and attestation of client assets | Clear control testing and incident playbooks |

| Market structure | Fair access and clean execution | Transparent routing and surveillance reporting |

| Broker dealer access | Safer connections with venues | Defined capital rules and onboarding pathways |

Timeline and scope

The agenda outlines proposals that move through a comment period, revisions and final adoption. The staff expects different clocks for each item. Disclosures can move faster because templates reuse existing frameworks. Custody and market structure require deeper consultation with industry and with other agencies. Even so the direction is firm. The agency wants predictable steps so that firms can plan upgrades without sudden shocks.

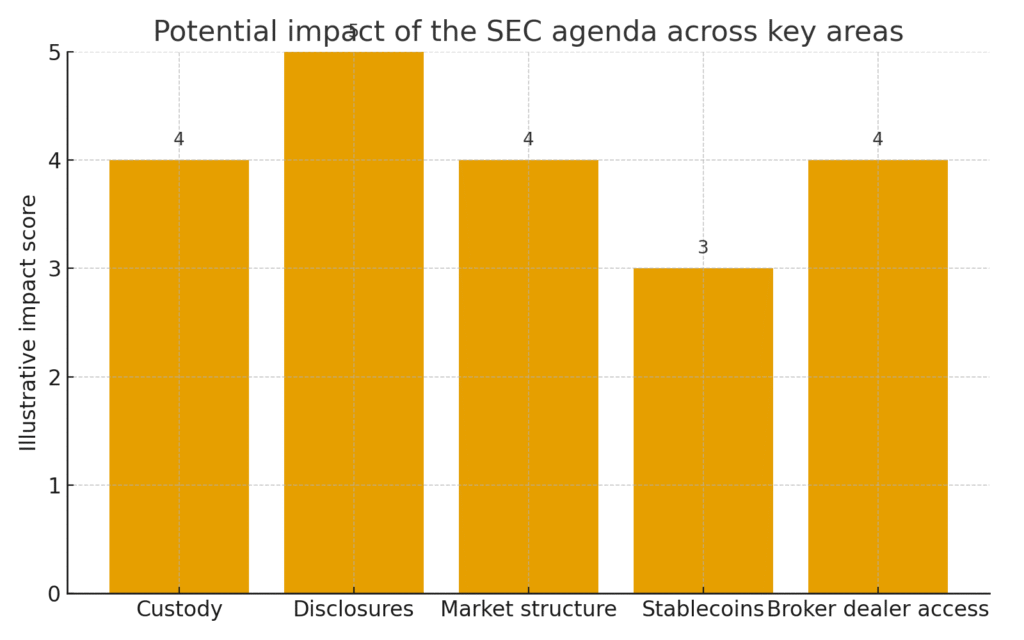

Figure 1. Bar chart with five categories that shows an illustrative impact score for custody, disclosures, market structure, stablecoins and broker dealer access

Practical effects for venues

First, disclosures become comparable. Platforms can present standardized facts about assets and operations. As a result, investors read fewer surprises and more consistent data.

Second, custody controls move into the spotlight. Clear segregation, attestations and incident playbooks reduce ambiguity during stress.

Third, market structure work ties it together. Matching, routing and surveillance receive measurable requirements. Consequently, venues can design systems that pass audits and scale.

What broker dealers need to know

Initially, access will rely on capital rules and onboarding tests. Then, connectivity with trading systems will be assessed against best execution and conflict policies. Finally, firms must show clean books for client assets. Because of that sequence, early movers should map controls now and close any gaps before pilot connections start.

Implications for token issuers

Issuers should prepare baseline files that cover purpose, token economics and governance. In addition, they should plan periodic updates and an event driven notice path. Short, clear documents beat long vague ones. Therefore, teams should adopt plain language and traceable metrics that regulators and investors can verify.

Compliance checklist

Map custody flows from deposit to withdrawal. Include exception handling and incident timelines.

Document surveillance triggers and escalation paths. Add dry runs and audit evidence.

Publish a best execution policy that traders can test. Measure it and report it.

Maintain a single inventory of disclosures. Update it on a predictable schedule.

Train staff. Then, retrain after each rule change.

Scenarios to watch

If disclosures arrive first, smaller venues can compete on clarity while they build custody depth. Conversely, if custody rules lead, institutions may wait for attestations before adding risk. Meanwhile, broker dealer access can unlock liquidity when market structure rules settle. In any case, firms that publish real metrics will stand out.

What comes next

A comment period opens the door for feedback. Soon after, revised drafts should narrow open questions. Finally, adoption dates and phase in windows will set the tempo for upgrades. Until then, the safest strategy is simple. Start building documentation and test controls with internal audits.