Executive summary

Ripple is extending RLUSD to institutional users across Africa. The rollout comes through regulated payment and exchange partners. In parallel, climate programs in Kenya test parametric insurance that escrows RLUSD and releases funds when satellite triggers fire. As a result, compliant dollar liquidity meets a real economy need. Moreover, treasury teams gain a faster way to settle cross border flows.

Issuer dossier

Issuer profile

Ripple operates enterprise rails for payments and digital assets. RLUSD is issued by a regulated trust entity with a mandate to hold high quality dollar reserves. The token targets institutions that need predictable settlement and transparent controls.

Asset design

RLUSD seeks one to one convertibility with United States dollars. Reserves sit in cash and short duration treasuries under third party attestation. Issuance and redemption run through onboarded institutions that complete know your customer and anti money laundering checks. Integration with Ripple Payments reduces reconciliation friction.

Why Africa now

Dollar demand remains high in many markets due to inflation risk and correspondent banking frictions. Consequently, institutions look for programmatic settlement and safer liquidity. With RLUSD, partners can distribute dollars at internet speed while staying within governance bounds.

Governance and custody blueprint

Reserves and reporting

Reserves are segregated and reported on a routine cadence. Monthly statements match tokens outstanding with backing instruments. Furthermore, attestations enhance confidence for corporate treasuries.

Mint and burn controls

Whitelisted channels handle mints and redemptions. Smart contracts enforce supply rules and allow court ordered actions when required by law. As a result, operational risk is reduced.

Counterparty management

Payment companies, exchanges, and large corporates undergo enhanced due diligence. Contracts define service levels for uptime, reconciliation, and dispute handling. In addition, incident playbooks set clear roles.

Custody patterns

Institutions blend qualified custodians for cold storage with hot wallets for working capital. For climate pilots, funds remain in program escrow with multi sign policies.

Value added analysis

Institutional motivations

Banks and fintechs want dollars that move quickly and predictably. RLUSD aligns with that need. It can reduce pre funding and daylight exposure for remittances, payroll, and merchant settlement.

Competitive map

Market share in Africa is concentrated in a few dollar tokens that grew through retail channels. RLUSD differentiates on compliance posture and enterprise integration. Therefore it can capture institutional corridors even if retail share grows slowly.

Climate finance angle

Parametric insurance depends on fast, rule based payouts. By holding RLUSD in escrow until triggers fire, programs avoid manual adjudication. Households recover sooner. Local merchants stabilize demand. Meanwhile, auditors can track every disbursement on chain.

Policy and risk matrix

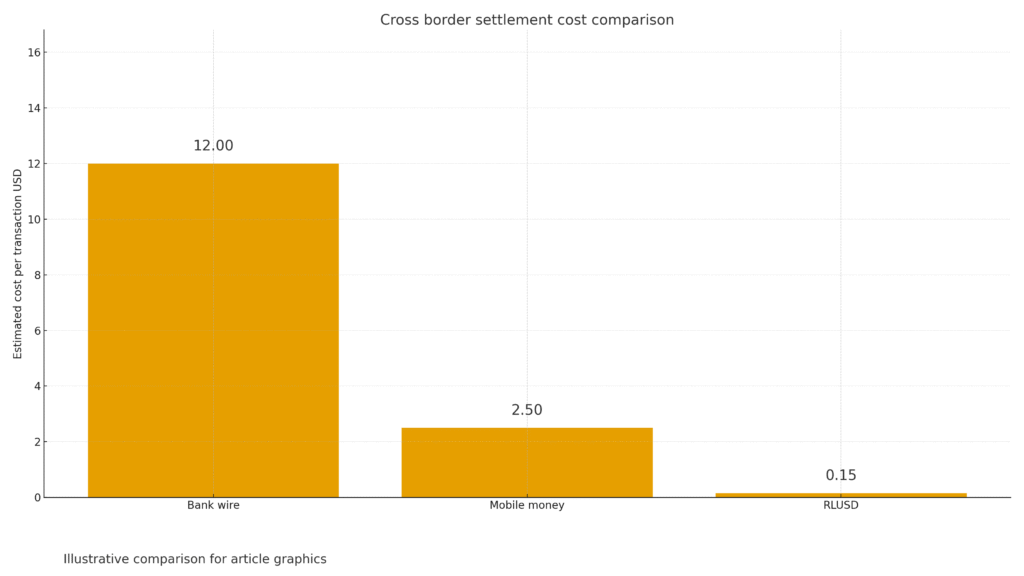

Figure 1. Comparison of estimated cost per transaction for bank wire, mobile money, and RLUSD based settlement in a cross border corridor

Deployment scenarios in the next two quarters

Scenario one. Momentum with institutions.

Large payment companies adopt RLUSD for high volume corridors. Fees fall for corporate clients. In turn, exchanges list RLUSD pairs against regional currencies and deepen liquidity.

Scenario two. Measured rollout with extra controls.

Supervisors request more reporting on reserves and custody. Adoption continues within set caps while audits run. Meanwhile, partners expand documentation and training.

Scenario three. Stress test in a volatile month.

Dollar tokens face redemptions during market stress. RLUSD governance and redemption windows hold. Consequently, institutions that prioritize transparency migrate flows.

What to watch next

Reserve attestations and monthly reports. Listing announcements from partners. Measured data on payout times in Kenya. Any public sector pilots for treasury or aid distribution. Finally, disclosures on how routing rules handle fragmented liquidity.

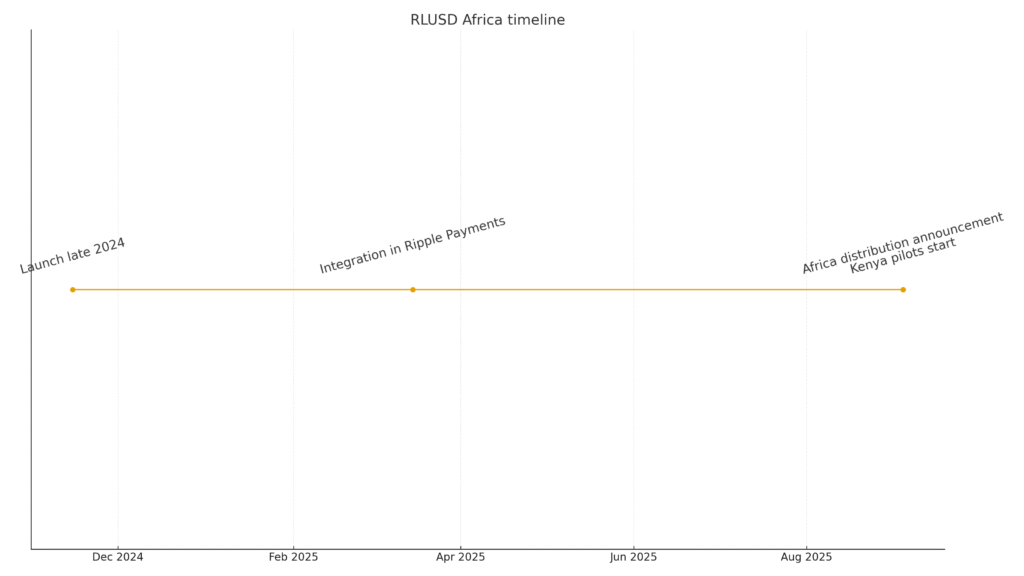

Figure 2. Timeline with four points launch late 2024, integration in Ripple Payments, Africa distribution announcement, start of Kenya pilots

Related posts

- A bitcoin treasury heads to Amsterdam through a reverse listing and why it matters for Europe

- Venus Protocol incident Phishing loss pause and a defense playbook for DeFi teams

- SEC and CFTC joint crypto initiative decoded for venues and users

External sources

- Ripple press release

- Press coverage Yahoo Finance

- Press coverage CoinDesk

- Context CryptoSlate