Issuer dossier for Morgan Stanley crypto trading

Who Morgan Stanley is a leading global bank with multi trillion client assets across wealth and investment management. E*Trade is its retail brokerage arm with millions of accounts. Zerohash is a digital asset infrastructure provider that handles crypto rails behind the scenes for brokers and fintechs. What A plan to let E*Trade clients trade bitcoin, ether and solana. The initial scope targets spot trading with integrated settlement. The platform route relies on Zerohash for crypto market access and operational plumbing. Why now Client demand has grown across wealth and self directed retail. Competitive pressure from brokers that already offer crypto is also a driver. Regulatory clarity is improving in the United States which lowers the execution risk for large banks. When Launch is guided for the first half of 2026. Pilot work and vendor integration will run during 2025. Where The service will appear inside the E*Trade experience for eligible clients. Access will respect regional restrictions and client suitability rules.Governance and custody for Morgan Stanley crypto trading

Operating model Zerohash provides crypto order routing, liquidity access, wallet management, and settlement. Morgan Stanley controls the client relationship and the broker layer. E*Trade presents the user interface, portfolio view, tax reports, and account statements. Custody and security Client assets are held in segregated wallets with institutional controls. Keys are managed with hardware security modules and multi party controls. Withdrawal permissions follow bank grade entitlements. Incident response and audit trails are part of the service design. Compliance stack Onboarding uses KYC and AML screening aligned with bank policy. Transaction monitoring flags suspicious patterns. Market surveillance looks for wash trades and spoofing. Reporting follows United States regulatory obligations and applicable state rules. Risk controls Eligible assets will start small and liquid. Listing review checks market depth, chain stability, regulatory posture, and custody support. Leverage is out of scope for the first phase. Hard forks and airdrops will follow written policies.How Morgan Stanley crypto trading via E*Trade will work

- The client opens the E*Trade app and navigates to crypto.

- The client places a market or limit order on a supported asset.

- E*Trade sends the order to Zerohash for execution across approved venues.

- Zerohash fills the order and settles to the client wallet within the program.

- E*Trade shows the position, cost basis, and tax lot details in the portfolio.

What Morgan Stanley crypto trading means for Bitcoin Ethereum and Solana

Bitcoin A new flow of retail and wealth clients can add spot exposure through a familiar broker. That can improve liquidity and tighten spreads during United States hours. It also strengthens the narrative that bitcoin sits alongside equities and ETFs in traditional portfolios. Ethereum Access through E*Trade simplifies entry for developers and investors who already hold ETH in ETFs. A direct spot rail can create incremental demand for on chain activity through awareness and education. Staking is separate from this launch and would require additional governance. Solana A listing for SOL places a high throughput chain in front of a large retail base. It broadens the asset mix beyond the two leaders and may increase trading volume during earnings seasons and macro events when E*Trade activity peaks.Competitive signals around Morgan Stanley crypto trading

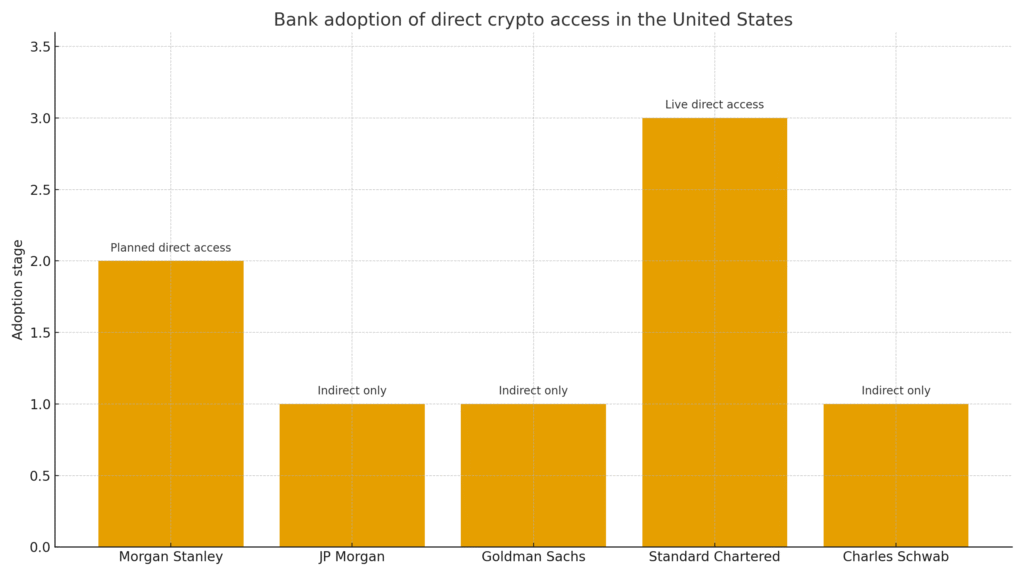

Large brokers in the United States already provide some form of crypto access. The Morgan Stanley plan adds a household brand with deep wealth relationships. That can trigger responses from rivals in areas like asset coverage, fees, education, and research.

Figure 1. Chart showing Morgan Stanley crypto trading adoption compared with other banks

Bank exposure to crypto compared with Morgan Stanley crypto trading

Below is an at a glance comparison that focuses on public programs and direction of travel. It highlights scope, client type, and route to market without using third party links inside the body.

Benefits and risks of Morgan Stanley crypto trading

Benefits Convenience inside an existing brokerage account. Single portfolio view with taxes and statements. Bank grade controls and compliance. Education and research reach a broad audience.

Risks Asset volatility remains high. Service scope is limited at launch which can create expectations gaps. Custody is program based which means withdrawals and deposits may be restricted at first. Fees and spreads can vary with market conditions.

PAA for Morgan Stanley crypto trading

How is Morgan Stanley performing The bank reports strong client assets and steady profitability in wealth management during 2025. The firm signals continued investment in digital and client experience. The crypto plan aligns with that trajectory.

What does Morgan Stanley invest in The firm serves wealth and institutional clients across equities, fixed income, funds, private markets, and alternatives. The new program adds direct access to bitcoin, ether, and solana for eligible retail clients through E*Trade.

Are JP Morgan and Morgan Stanley the same No. They are separate banks with different leadership and product mixes. JP Morgan focuses on payments and tokenization for institutions through Onyx while Morgan Stanley emphasizes wealth and brokerage access for retail through E*Trade.

What is the total assets of Morgan Stanley Total client assets across wealth and investment management are in the multi trillion range during 2025 based on firm reports. The scale indicates significant reach when the crypto channel opens.

What to watch next for Morgan Stanley crypto trading

Vendor certification milestones for Zerohash within the E*Trade environment. Regulatory notices and updated disclosures on eligible assets and custody. Education content and fee schedules inside the broker app. Signals from competitors as they adjust coverage or pricing.

Sources and methodology for Morgan Stanley crypto trading

This article is based on primary reports, bank filings, and reputable industry media published on September twenty three of twenty twenty five. Figures are presented in plain text to avoid link use inside the body of the post.

Conclusion

Morgan Stanley crypto trading is preparing a practical on ramp for crypto inside a familiar brokerage. The plan is simple. Keep the client experience in E*Trade and outsource crypto rails to a specialist. If integration and governance land on time, the first half of twenty twenty six could mark a visible step in the mainstreaming of bitcoin, ether, and solana for retail investors.

Related Posts

Ethereum Fusaka upgrade slated for December with higher blob capacity

IG Group acquires Independent Reserve to expand digital assets in Asia Pacific

3 Comments

Pingback: Euro stablecoin by European banks what it means for payments and DeFi 2025 - The Crypto Tides

Pingback: What is SharpLink tokenization on Ethereum and why it matters for public equity in 2025 - The Crypto Tides

Pingback: MEXC Cecilia Hsueh at TOKEN2049! new Chief Strategy Officer sets strategy for 2025 - The Crypto Tides