Why MEXC Cecilia Hsueh at TOKEN2049 matters now

MEXC appointed Cecilia Hsueh as Chief Strategy Officer in late September. Days later she took the stage at TOKEN2049 and framed how exchanges must evolve beyond pure trading into full stack infrastructure. The timing is important. Liquidity rotates fast. Regulation shifts across regions. Builders need routes from idea to market that include capital, listings, and compliant distribution. This piece explains who Hsueh is, her track record, the playbook she is bringing to MEXC, and how it answers user questions about trust, safety, and geography.

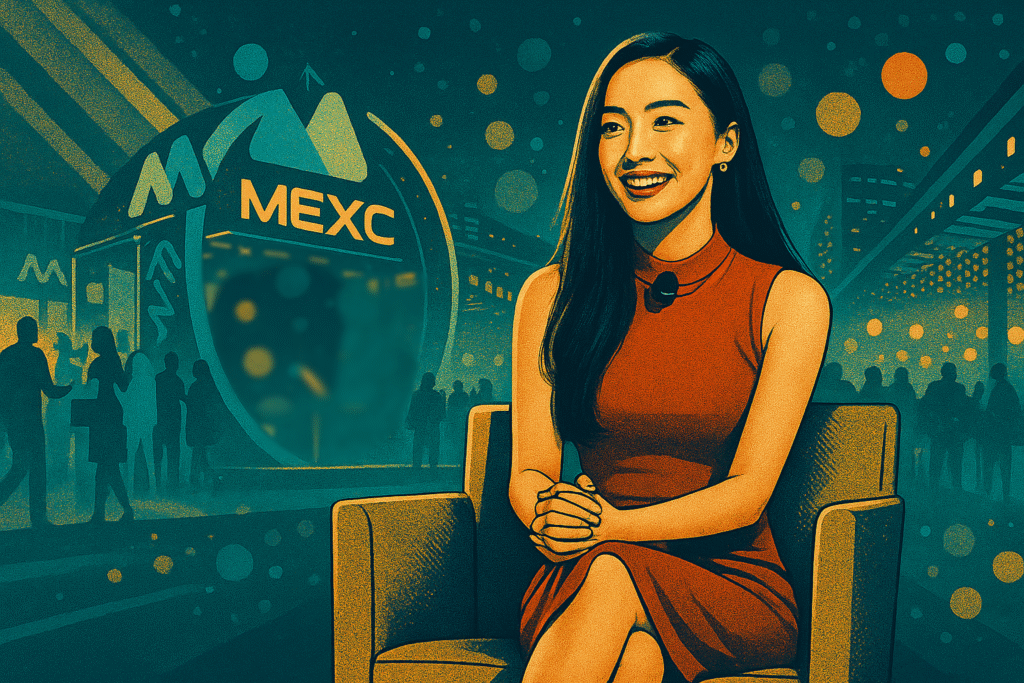

TOKEN2049 highlights MEXC Cecilia Hsueh

On stage at TOKEN2049 Singapore, MEXC Cecilia Hsueh outlined how exchanges must evolve from pure matching engines into infrastructure orchestrators. She emphasized modular services over a single super app, with liquidity, compliance middleware and builder tooling at the core. Her remarks framed a pragmatic roadmap: safer liquidity, faster listings with post‑listing market‑maker support, and region‑specific product tracks.

Who is Cecilia Hsueh?

Cecilia Hsueh is a crypto industry operator and strategist with more than a decade driving product growth, ecosystem design, and cross border launches. Her work sits at the intersection of trading infrastructure, market making relationships, and developer programs. Teams that worked with her describe a builder first mindset and clear communication between engineering, legal and go to market.

Career highlights and operating style

Led international expansion programs and liquidity partnerships across multiple regions.

Built pipelines that connect early stage projects with listings, market makers and community growth.

Advocated for security by design and proactive transparency including proof of reserves and incident response.

Public speaker and mentor on growth frameworks and risk controls for exchanges and protocols.

Governance and execution blueprint MEXC Cecilia Hsueh

Capital and listings connect promising projects to capital and liquidity with transparent criteria and post listing support.

Infrastructure shift push beyond a trading venue into a platform that exposes APIs, services and compliance middleware for Web3 teams.

User safety invest in risk controls, withdrawal allow lists, proof of reserves, and clear incident communication.

Regional strategy tailor products to local rules and promote clarity about where the exchange operates and where it does not.

Partnerships align with networks and L2s for tokenization and cross chain routes.

Hsueh playbook at a glance

| Objective | What users see | What builders get | What MEXC measures |

|---|---|---|---|

| Safer liquidity | Faster withdrawals, better order book depth | Market makers and post listing support | Slippage, uptime, incident MTTR |

| Product velocity | Fresh listings and new earn tools | Review pipeline, SDKs, white glove integration | Time to list, activation, retention |

| Regional clarity | Clear availability and restrictions by country | Local compliance advice and fiat partners | Legal coverage, user growth by region |

| Transparency | Proof of reserves and status dashboards | Auditable flows and sandbox processes | API consumption, developer NPS |

Timeline snapshot

-

Sep 22–23 2025 appointment announced.

-

Late Sep to early Oct media and exchange channels highlight her stage appearances and strategy points at TOKEN2049.

-

Following week product and ecosystem updates including new Earn formats and event recaps.

Conclusion

Cecilia Hsueh enters with an operator mindset and a builder friendly lens. Her TOKEN2049 remarks point to a practical path. Exchanges evolve into platforms that combine capital, liquidity, and access. Users get safer and clearer products. Builders get pipelines that shorten the distance from idea to adoption. If execution follows, MEXC can strengthen trust while expanding its footprint.

Editorial image alt and credit

Alt MEXC Chief Strategy Officer Cecilia Hsueh on stage at a conference speaking about exchange strategy and builder support.

Credit Courtesy of MEXC press image from MEXC Blog.

3 Comments

Pingback: Ethereum Fusaka BPO explained: how blob‑only forks safely boost L2 throughput (October 2025) - The Crypto Tides

Pingback: Hedera v066 mainnet upgrade explained and what it changes for builders today - The Crypto Tides

Pingback: The Crypto Tides - Tokenised stocks need real investor safeguards models gaps and the path forward (October 2025)