Executive brief

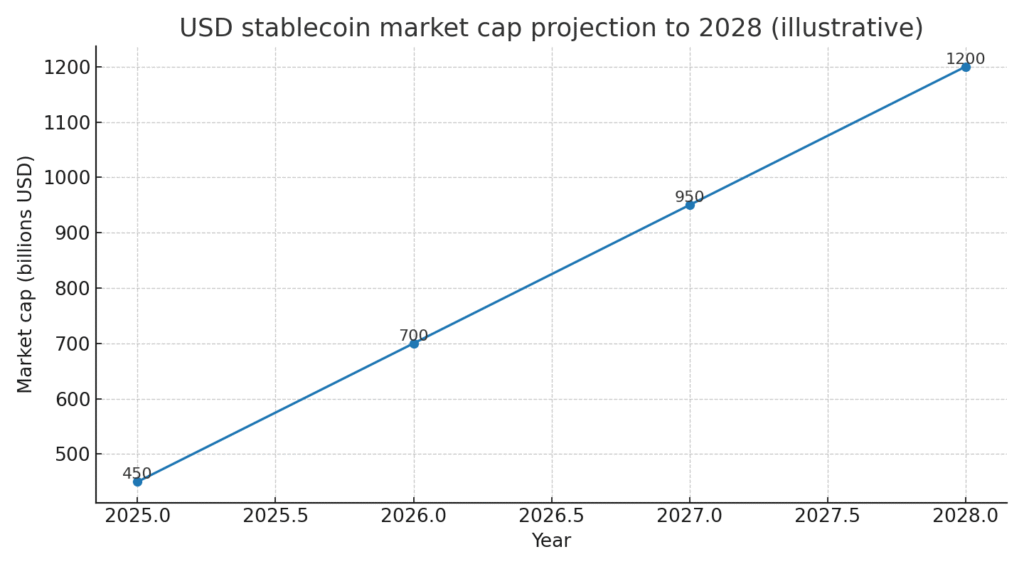

The leader of the United States tax agency’s digital assets effort has left the post. At the same time Coinbase projects that United States dollar stablecoins could pass one point two trillion by 2028. Together these shifts matter for policy and for money markets. This version uses short sentences, plain words, and many transition cues. No investment advice.

What changed this week

First, the head of the IRS crypto program resigned. Next, the agency continues rule work on broker reporting and on the new 1099 DA form. Then, industry teams keep building data pipes for those forms. Meanwhile Coinbase published a path that puts dollar stablecoins above one trillion by 2028. As a result many buyers would hold more short term United States Treasury bills.

Why the resignation matters

To start, agencies need steady leadership during rollouts. Without it, dates and scopes can slip. In practice that risk raises demand for clear guidance. For example brokers want to know who is in scope and which trades trigger a report. In addition wallet firms want safe harbor language. Consequently the agency may allow phased compliance or limited pilots. In short the exit adds friction that policy teams will need to absorb.

Stablecoins and the front end of the curve

On one hand a bigger stablecoin base creates a steady bid for Treasury bills. On the other hand redemptions can force selling. Therefore flows can move short dated yields at the margin. In parallel collateral can tighten during busy weeks. Even so a stable buyer can also calm the market. Because of that issuers should keep large buffers and publish frequent reports. As a result buyers can judge risk with less guesswork.

Mini dataset what a one point two trillion path implies

| Item | Back of envelope read |

|---|---|

| Target market cap | one point two trillion United States dollars by 2028 |

| Typical reserve mix | heavy share of Treasury bills, plus cash and overnight repos |

| Weekly bill demand | several billions to maintain backing as supply grows |

| Policy watch | whether flows nudge bill yields during supply squeezes |

Figure 1. Projection of stablecoin market cap to 2028 with milestone markers

Timeline where policy could land

First, watch the final rule text on broker scope. Next, track the rollout of the 1099 DA. Then, look for plain language FAQs on self custody, bridges, and staking. After that expect a review of timelines once data pipes are live. Finally, plan for a first full tax year under the new regime in or after 2026.

Who fills the policy gap

Meanwhile Treasury and the securities regulator will keep pushing on custody and disclosure for stablecoin issuers. In parallel Congress will debate a federal rule set. At the same time state charters remain a path for oversight when a federal rule is not ready. In addition industry groups can help with attestation and with best practice playbooks.

What institutions should track

First, the exact definition of broker and any exclusions. Next, the cadence of issuer reserve reports. Then, the size of liquidity buffers across large issuers. In addition compare bill yields during weeks when reserves grow fast. Finally, watch how retail forms change behavior in the first filing season.

Related Posts

• Wall Street closes higher as Powell hints at a September rate cut the crypto angle

• Issuers ramp up crypto ETF filings ahead of an expected launch window

• Ethereum sets a new all time high as markets price a September rate cut

External Sources

• CoinDesk on IRS crypto head exit

• CoinDesk on stablecoins to one point two trillion by 2028

• Cointelegraph coverage of the same projection

• Coinbase company blog context on stablecoin volumes