Summary

In 2018, Harvard economist Kenneth Rogoff said it was more likely for Bitcoin to fall to 100 than to reach 100,000. In a new interview he explains what he underestimated and how the landscape changed. This is a practical audit of that shift.

Claim audit

| 2018 claim | 2024 to 2025 outcome | Why it matters |

|---|---|---|

| Regulators would suppress adoption | A regulatory perimeter formed instead and allowed controlled access | Custody, disclosures and product rules made participation possible |

| Institutions would not adopt | Demand did materialize through spot ETFs and expanding mandates | New vehicles solved many blockers to buy |

| Underground use would not persist | It persisted alongside regulated channels | Global heterogeneity kept crypto demand alive |

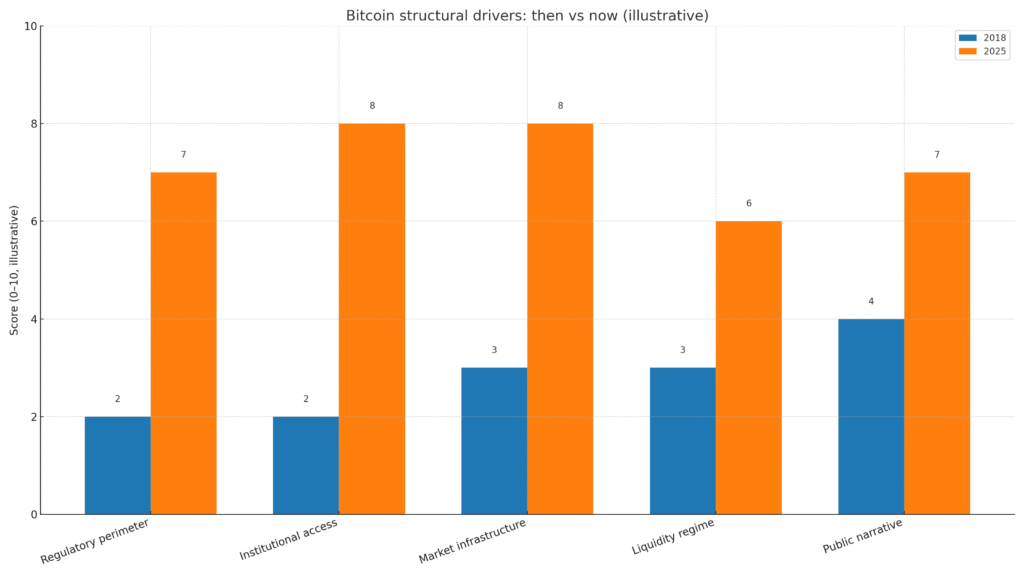

Structural drivers then and now

| Driver | 2018 level | 2025 level | What changed |

|---|---|---|---|

| Regulatory perimeter | Low | Higher | Rules without bans |

| Institutional access | Very low | High | ETFs, ETNs and custodians |

| Market infrastructure | Low to medium | High | Better venues and surveillance |

| Liquidity regime | Low | Medium to high | Deeper markets yet still cyclical |

| Public narrative | Low | Medium to high | From fringe to macro relevant |

Bitcoin structural drivers then versus now. See file in the assets section below.

Counterarguments and stress tests

A coordinated crackdown on custody and venue access could compress the perimeter.

A market integrity shock could reset trust and volumes.

Liquidity cycles still drive returns, which means risk timing and sizing are critical.

What decision makers should do next

Update priors when access vehicles change who can buy.

Separate adoption from price action. Participation is enabled, not guaranteed upside.

Monitor policy, market plumbing and positioning together when setting risk budgets.

Related Posts

Solana ‘Alpenglow’ Enters Governance: What 150ms Finality Could Mean for Validators and Apps

- Market Forensics: Cardano and Dogecoin led losses as breadth cracked

- Adviser Briefing: UK bitcoin ETNs are opening the gate for professional and retail investors