Hong Kong has released stricter custody expectations for licensed virtual asset trading platforms. The new circular focuses on senior management accountability, cold wallet design, third-party wallet oversight, and continuous security monitoring. Below, a simulated interview with a security lead at a licensed exchange unpacks what changes on day one and what it means for users and developers.

Interview with a licensed exchange security lead

Q. What is the headline change for custody in Hong Kong right now

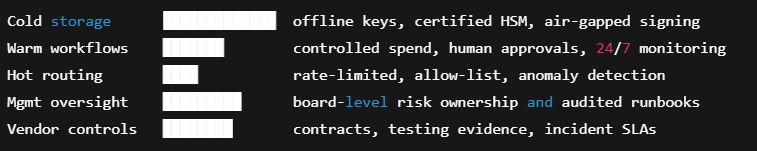

The regulator is moving from principles to very concrete expectations. Senior management must own custody risk. Cold wallet operations need clear, documented controls. If a platform uses external wallet tech, it must prove segregation, resilience, and vendor oversight. There is also a stronger requirement for continuous security operations and incident response.

Q. What does “cold wallet hardening” look like under the new guide

Air-gapped signing, certified hardware security modules, strict physical access control, and allow-list withdrawals only. Environments that touch private keys must be offline and physically protected. The guide pushes platforms to remove programmable surfaces that can extend the attack window in storage that is supposed to be offline.

Q. We are hearing about a ban on smart contracts inside cold wallets. Is that accurate

Yes for cold. The idea is to minimize attack surface where assets are supposed to be offline. Smart contracts remain useful in hot and warm contexts, but cold storage should be as minimal and auditable as possible.

Q. How does this affect partners that provide wallet infrastructure

Exchanges will still work with vendors, but the burden shifts to demonstrable controls. That means key ceremony evidence, access logs, change control, and real audits. If a vendor cannot provide that level of proof, exchanges will be expected to reduce reliance or switch.

Q. What is different for everyday users

Better segregation, more predictable withdrawal processing, and stronger incident playbooks. Users should expect clearer disclosures about how assets are kept, who controls keys, and how events are handled.

Q. What should developers and listed projects expect

Faster is not always better at the custody layer. Projects should design treasury and operations to tolerate stricter withdrawal windows from cold storage, while keeping user experience smooth through hot and warm routing. Network-level innovations that reduce signing pressure and improve settlement certainty still help developers, as we discussed in our Solana governance piece:

https://www.thecryptotides.com/solana-alpenglow-enters-governance-what-150ms-finality-could-mean-for-validators-and-apps/

Q. How does this compare with UK and EU directions

The UK leans on promotions, conduct, and authorization rules for user protection, while Europe’s MiCA framework harmonizes service categories and custody expectations. Hong Kong is signaling that platforms must hit a higher bar on operational security to compete for institutional flow. For a practical comparison of how European brands message trust and licensing, see our UK launch analysis of Bitpanda:

https://www.thecryptotides.com/bitpanda-enters-the-uk-600-assets-arsenal-partnership-and-a-two-year-push-for-scale/

Custody control layers

What to watch next

Implementation guidance from licensed platforms and their vendors

Independent attestations of key ceremonies and withdrawal controls

Updates to insurance, capital buffers, and disclosures to match the new baseline

Enforcement for platforms that are slow to adopt the minimum standards

Risks and open questions

Platform costs may rise as smaller operators upgrade hardware, monitoring, and audit processes. Vendor ecosystems will need to document controls more rigorously. The near-term effect could be market concentration among firms that already run institutional-grade custody, while user protection improves across the board.