Hong Kong’s Financial Services and the Treasury Secretary, Christopher Hui, reiterated that fiat‑referenced stablecoins are conceived as a payment instrument, not as a speculative asset. The message aligns with the ordinance approved in May and the entry into force of the licensing regime for fiat‑referenced stablecoin issuers. The aim is to give certainty to merchants and users while enforcing reserves, convertibility and risk controls.

Regulatory context

Stablecoin ordinance passed in May and effective from August.

Same activity, same risk, same rules principle.

Supervision by the Hong Kong Monetary Authority in coordination with the Treasury.

Issuer dossier

Reference requirements for an issuer operating in Hong Kong.

| Area | Requirement | Practical effect |

|---|---|---|

| License | Specific license for fiat‑referenced stablecoin issuer | Formal market access with supervised responsibility |

| Reserves | High quality liquid assets at par value | Coverage for redemptions under stress |

| Convertibility | Par redemptions under defined windows | End user and merchant confidence |

| Audit | Periodic reporting and independent verification | Transparency and market discipline |

| Governance | Board and risk controls | Prevention of conflicts and operational failure |

Governance and custody blueprint

Custody, compliance and distribution aspects that drive everyday payments.

| Module | What is required | Why it matters |

| AML and KYC | Identity, transaction monitoring, sanctions lists | Reduces abuse and keeps banking access |

| Wallets | Secure custody and self‑custody support with suitability rules | Minimises operator failure and fraud |

| Redemption | Clear windows and SLA | Predictability for merchants |

| Integration | APIs and standards for POS and gateways | Smooth merchant onboarding |

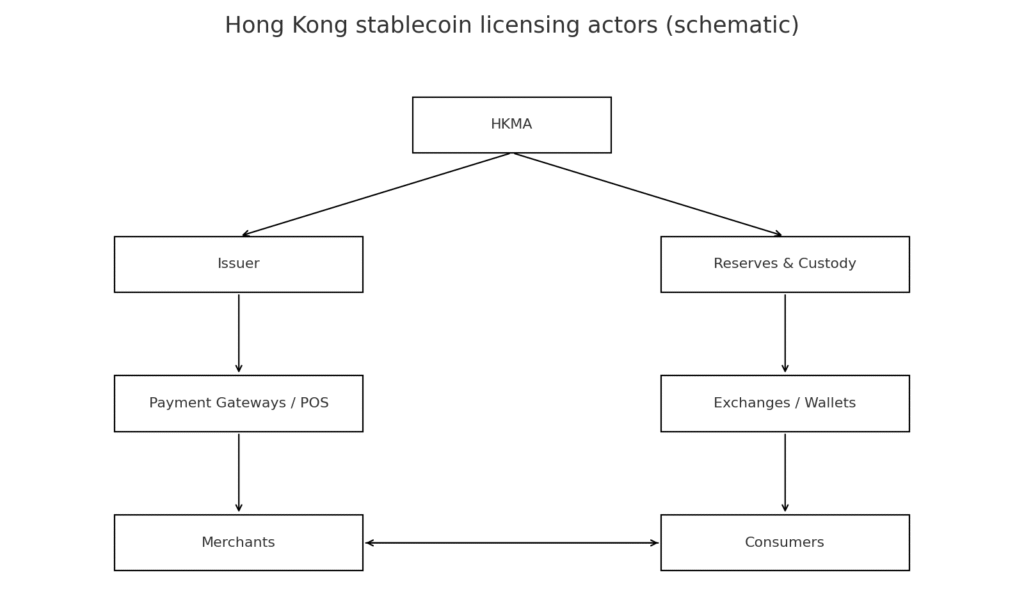

Figure 1. Map of actors in Hong Kong’s licensing regime

Essential timeline

Public consultation and technical conclusions in 2024.

Law approved in May 2025.

Licensing regime effective from August 2025.

Payment‑first positioning reiterated in August 2025.

Implications for merchants and fintechs

Point of sale acceptance. Clear rules let gateways add stablecoins with near‑instant settlement.

Cross‑border flows. Hong Kong acts as a bridge among e‑CNY, digital dollars and regional systems.

Cost and reconciliation. Lower fees than cards, near real time reconciliation and fewer chargebacks.

Risk under control. Reserves and audits protect end users.

Risks and limits

Regulatory arbitrage. Differences across jurisdictions can raise compliance costs.

Reserve management. Clarity on eligible assets and stress tests is required.

User education. Avoid “appreciation” expectations. Emphasise transactional use.

Conclusion

The message from Secretary Hui is clear and market friendly. Hong Kong wants payments with fiat‑referenced stablecoins under solvency and transparency rules. The model lowers merchant friction and can be exported to other hubs.