Filing dossier

Scope

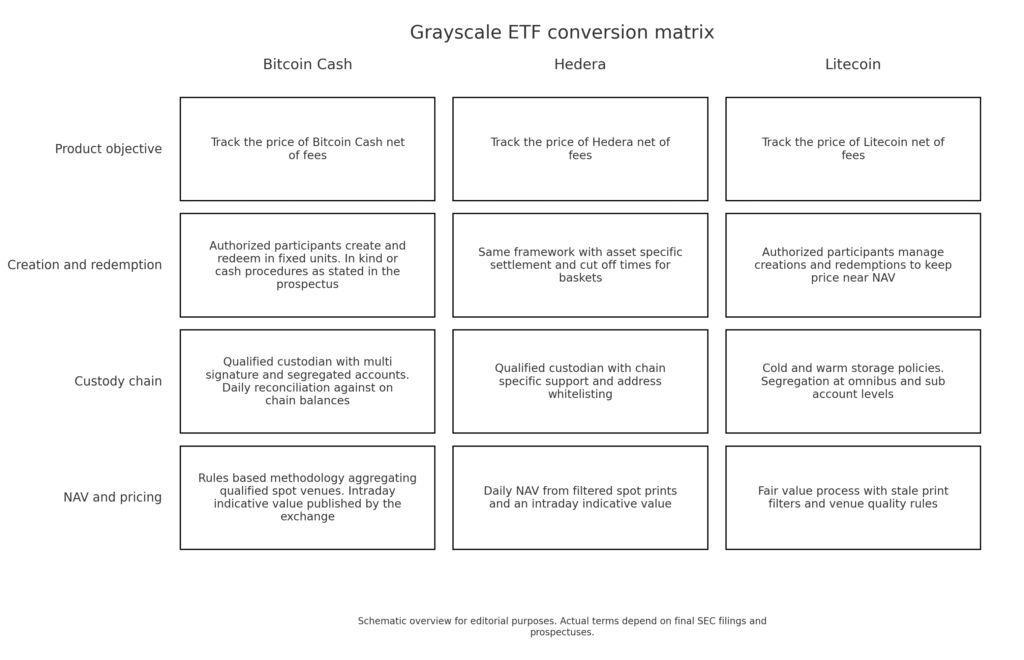

Grayscale submitted conversion plans for three single asset trusts. The target wrapper is an exchange traded fund that offers daily creations and redemptions and lives on a national securities exchange.

Objective

Each fund seeks to track the price of its underlying asset less fees and expenses. The conversion aims to replace secondary market shares of a closed end trust with an open ended vehicle.

Rationale

The new wrapper gives market makers a primary tool to align the share price with net asset value. It can reduce persistent discounts, standardize disclosures and simplify portfolio operations for both retail and professional investors.

Regulatory path

The process includes review of a registration statement and a listing rule filing by the exchange. After publication, the docket moves through comment periods and decision deadlines that can be extended.

Readiness signals to watch

-

Identification of the listing venue and the lead market maker

-

Publication of creation unit size and cash versus in kind rules

-

Disclosure cadence for inventory attestations and fee policy

ETF mechanics explainer

Creations and redemptions

Authorized participants deliver the underlying asset or cash to the custodian in exchange for creation units. Redemptions reverse the flow. These operations expand or contract supply in response to demand and keep the market price near net asset value.

Pricing and valuation

Net asset value is calculated from qualified spot venues using a rules based methodology with filters for stale prints and clear fallbacks. An intraday indicative value helps keep quotes aligned during trading hours.

Custody and controls

Assets sit with a qualified custodian under segregation. Controls include multi signature policies, address whitelisting and routine reconciliations between on chain balances and fund records.

Liquidity and spreads

Early trading often concentrates around a single venue with a designated market maker. As authorized participants gain confidence in the operational runbook, spreads narrow and depth improves across the book.

Corporate actions and tax lot handling

Stock split style events do not apply to these assets. The fund processes protocol events only when they are recognized by policy. Daily creations and redemptions improve tax lot management for active allocators.

Risk snapshot

-

Tracking error during volatile sessions

-

Venue concentration in the spot market

-

Settlement frictions for large creations or redemptions

-

Fee pressure from competing products

Figure 1. Comparative matrix showing Bitcoin Cash, Hedera and Litecoin proposed spot ETF

Impact analysis by asset

Bitcoin Cash

A conversion could pull liquidity from fragmented over the counter venues into a single exchange venue with creations and redemptions. That tends to compress the discount to net asset value and makes inventory management easier for market makers.

Hedera

A rules based valuation that blends qualified spot venues would clarify fair value for a network that trades across a smaller set of marketplaces. The wrapper gives institutions a standardized path to exposure subject to custody controls.

Litecoin

Deep history and mature custody support reduce operational frictions for creations and redemptions. If spreads tighten quickly, secondary market depth can scale faster than in newer assets.

Fee and liquidity dynamics

Management fees will anchor to the new equilibrium set by bitcoin and ether products. If pricing lands above peers, assets under management may lag. If pricing undercuts peers, growth can accelerate but scale becomes critical for sustainability.

Early depth often concentrates around one venue with a designated market maker. True health appears when several market makers quote tight markets across the book and when creations and redemptions run smoothly through volatile sessions.

What could delay approval

Requests from staff to modify pricing inputs or fallbacks

Concerns about venue concentration in the underlying spot markets

Additional comment cycles on custody segregation and key management

Insufficient disclosures on creation unit size or cash versus in kind rules

Due diligence checklist for allocators

Pricing methodology with multi venue inputs and stale print filters

Qualified custodian with segregation and reconciliations that are easy to audit

Several active authorized participants with tested settlement

Clear runbook for chain incidents and operational exceptions

Transparent fee stack and a timetable for inventory attestations

Bottom line

Grayscale is testing whether the trust to ETF pathway can scale beyond bitcoin and ether. The filings aim to deliver tighter tracking, standardized disclosures and a clearer operational runbook for allocators. Outcomes hinge on valuation rules, custody controls, the breadth of the authorized participant network and fee positioning once live. If approvals land, liquidity should migrate into a cleaner wrapper. If timelines slip, discounts in the legacy trusts remain the key trade.

1 Comment

Pingback: Polygon PoS mainnet hard fork resolves finality delays and restores checkpointing and state sync - The Crypto Tides