Google is moving its finance‑grade Layer 1, GCUL, from concept into private testing. The pitch is a neutral ledger with Python‑based smart contracts and institutional features from day one. This brief unpacks what GCUL is, how it fits alongside offerings from Stripe and Circle, and what would matter for adoption by exchanges, banks and merchants.

Executive snapshot

Neutrality by design. The stated goal is to serve multiple financial institutions rather than a single payments provider’s walled garden.

Programmable contracts. Support for Python‑based smart contracts lowers the barrier for traditional developers.

Integration targets. Pilots with market infrastructure firms aim at tokenization, settlement and compliance‑ready rails.

Sources listed at the end. We avoid links inside the body by editorial policy.

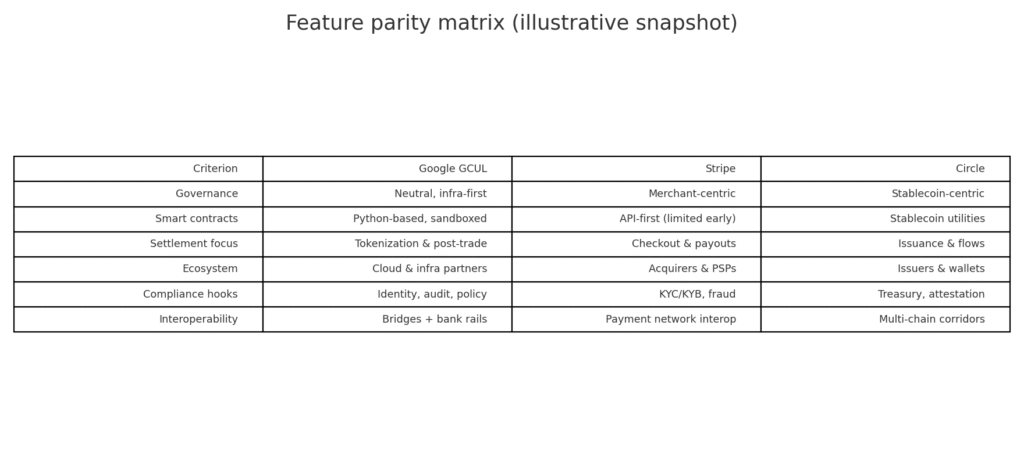

Comparative matrix

| Criterion | Google GCUL | Stripe’s L1 approach | Circle’s chain approach | Notes |

|---|---|---|---|---|

| Governance posture | Neutral, infra‑first | Merchants/payments centric | Stablecoin‑centric | Who controls the roadmap matters for banks. |

| Smart contracts | Python‑based, sandboxed | Limited programmability early, API‑first | Focused on stablecoin utilities | Developer on‑ramp is strategic. |

| Settlement focus | Finance operations, tokenized assets, post‑trade | Merchant checkout and payouts | Stablecoin issuance and flows | Defines first killer apps. |

| Ecosystem | Cloud and market‑infra partners | Merchant acquirers and PSPs | Issuers, wallets and CeDeFi | Partner mix shapes go‑to‑market. |

| Compliance hooks | Built‑in identity, audit logs, policy modules | Merchant KYC/KYB and fraud tooling | Treasury, attestation, policy controls | Must interoperate across regimes. |

| Interop | Bridges to existing chains and bank rails | Payment network integrations | Multi‑chain stablecoin corridors | Avoid lock‑in for institutions. |

Figure 1. Feature parity matrix snapshot

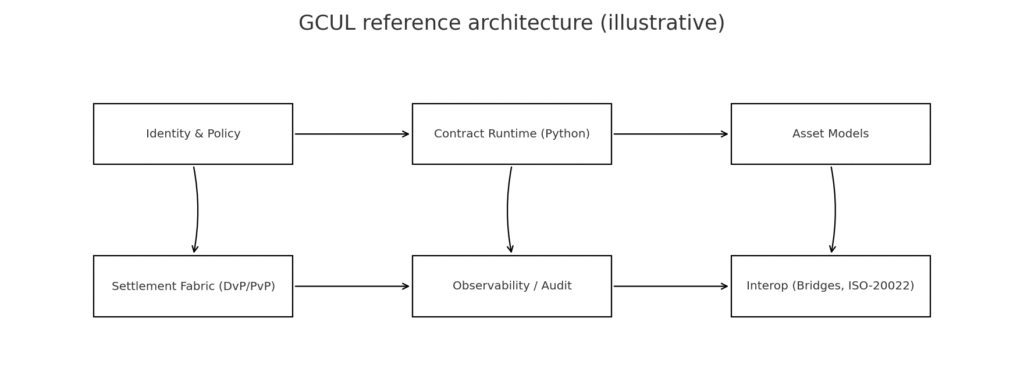

Architecture blueprint

Identity and policy layer. Native identity objects, permissioning and policy engines for KYC/KYB, sanction checks and travel rule.

Contract runtime. Python sandbox with deterministic execution, formal limits and auditability.

Asset models. Token classes for fiat‑referenced stablecoins, RWAs and settlement tokens with lifecycle events.

Settlement fabric. Atomic DvP/PvP primitives and time‑boxed finality suitable for post‑trade workflows.

Observability. Telemetry, audit logs and compliance reports for regulated entities.

Figure 2. Reference architecture diagram

What would make it win

Neutral governance and open standards. Banks will require a voice in upgrades and an exit path.

Interoperability that works. Bridges to public chains and ISO‑20022 messaging for banks reduce switching costs.

SDKs for existing teams. Python contracts and enterprise SDKs must be safe, testable and well‑tooled.

Regulatory alignment. Clear mapping to data residency, privacy and record‑keeping obligations.

Adoption risks

Perception of vendor lock‑in. Even a neutral posture can look like a cloud walled garden if self‑hosting or multi‑cloud are weak.

Throughput vs trust trade‑offs. Finance wants speed, but not at the cost of auditability or deterministic behavior.

Competing agendas. Stripe and Circle will court the same clients with checkout‑first or stablecoin‑first narratives.

Conclusion

If GCUL lands as a truly neutral, programmable, compliance‑ready ledger, it can anchor tokenization and post‑trade settlement projects that currently live in pilots. The work ahead is governance, interop and credible neutrality.

Related Posts

- Stellar’s XLM tests 0.40 market pathways and actionable levels

- HBAR steadies near 0.24 microstructure, levels and risk playbook

XRP jumps on softer Fed tone with a validation map from 3 to 5 and scenarios up to 8