A corporate read that combines the latest filing details with a clean model for sizing and governance. The goal is to help allocators and founders read beyond headlines.

Executive summary

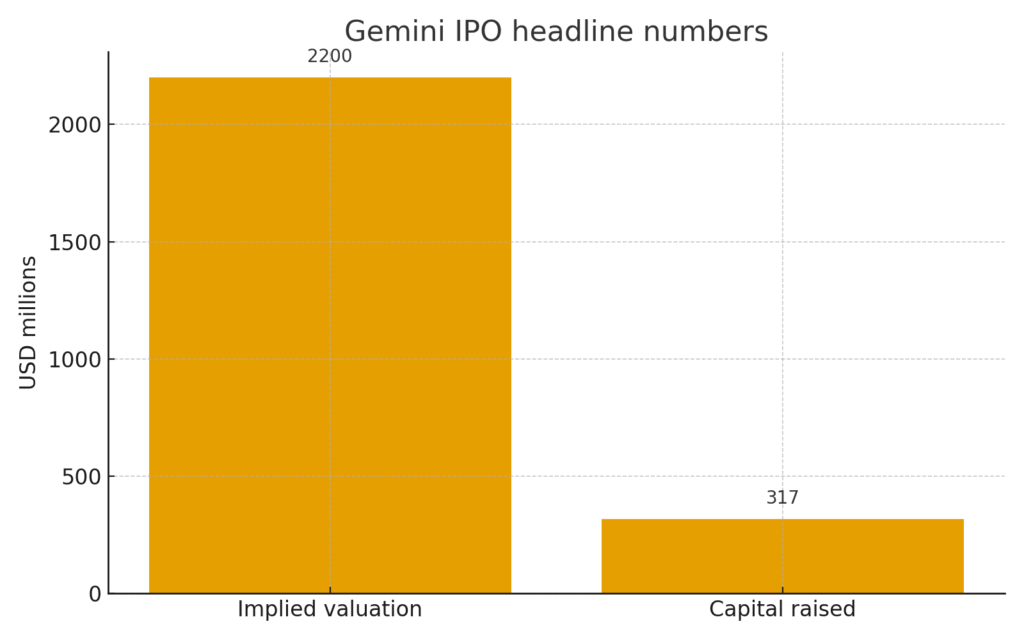

Gemini targets an implied valuation near two point two billion while seeking to raise about three hundred seventeen million at the top of a price range from seventeen to nineteen per share. The deal would float about sixteen point six seven million shares on Nasdaq with major banks as bookrunners.

Issuer dossier

What Gemini is a crypto exchange founded in twenty fourteen by Cameron and Tyler Winklevoss with a focus on regulated custody and consumer access in the United States.

Revenue profile a mix of trading, custody and staking services with sensitivity to spot volumes and fee compression.

Peers Coinbase and Bullish in public markets plus large private venues.

Use of proceeds general corporate purposes with flexibility to invest in product and compliance according to filing language.

Governance and market structure blueprint

Listing venue Nasdaq with the ticker GEMI.

Underwriters global banks as joint bookrunners.

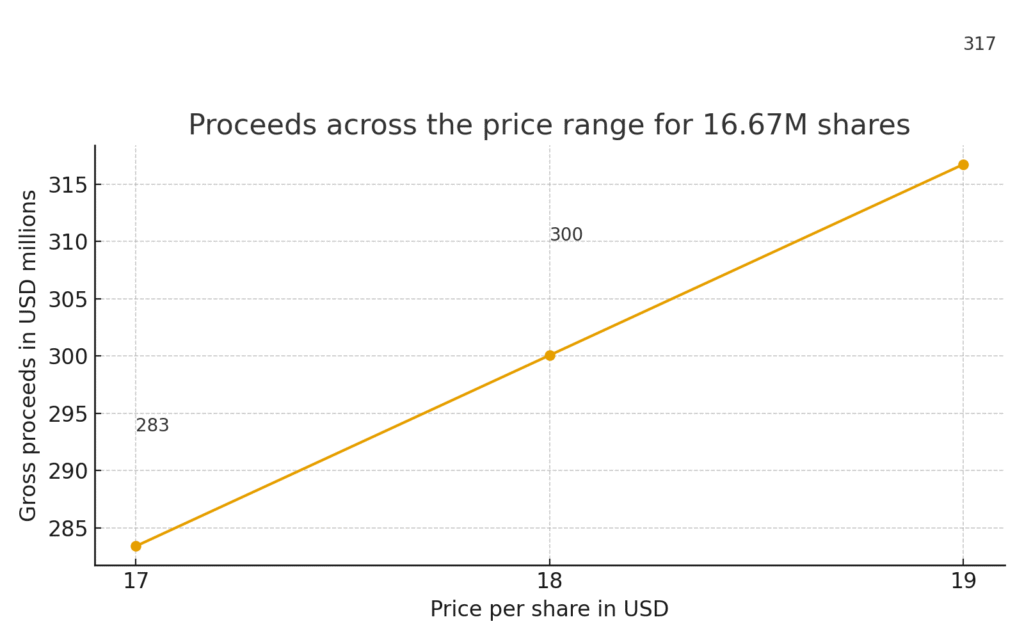

Float math range from seventeen to nineteen with sixteen point six seven million shares implies gross proceeds from two hundred eighty four million to three hundred seventeen million before fees.

Ownership and control dual class or governance structure as disclosed in the prospectus should be reviewed for voting power concentration.

Claim vs evidence

| Claim | Evidence today | What to watch next |

|---|---|---|

| The deal is small so liquidity will be thin | Float is meaningful for a first print and can expand later through greenshoe and follow ons | Track daily turnover and depth in the first month |

| Crypto exchange listings do not work | Coinbase and Bullish now trade publicly and show investor demand when volumes rise | Watch correlation between spot volumes and revenue in coming quarters |

| Range looks tight | Banks often set narrow ranges near pricing for price discovery | Watch indications of interest and any range update in the roadshow |

Numbers that matter

Figura 1. Gemini IPO valuation vs raise

Figure 2. Gemini IPO pricing sensitivity

Allocation playbook

Set an allocation cap based on free float not on headline valuation.

Use a staged entry across pricing day and first week of trading.

Compare revenue sensitivity to spot volumes with peers.

Monitor custody insurance limits and compliance spend as leading indicators of resilience.

Track stable value products and payments as optionality levers.

Risks

Fee compression during slow tapes.

Regulatory shifts that alter custody economics.

Secondary market liquidity during off hours for your mandate.

Concentration of voting power.