Opening

France is pushing back on automatic passporting for crypto service firms under MiCA. Meanwhile, the market watchdog AMF asks for tighter oversight and a larger role for ESMA. As a result, approvals from one member state may not travel across the bloc without extra checks. The move aims to protect consumers and keep markets clean. In turn, exchanges, custodians and stablecoin issuers face near term pressure. Key points • France questions automatic passporting without uniform supervision. • ESMA guidance and cross border audits are now on the table. • Firms may need stronger capital and clearer disclosures. • Launch timelines and marketing plans could slow.MiCA and passporting in brief

MiCA creates a single rulebook for the European Union. In principle, a firm licensed as a crypto asset service provider in one country can access the rest of the bloc. However, uneven supervision creates gaps. Therefore France flags the need for consistent controls before the passport works at scale.What France is signaling

First, the AMF wants stronger tests for governance and internal controls. Next, it asks for clear supervision when a firm serves clients across borders. In addition, Paris pushes for strict handling of client assets and faster incident reporting. Finally, it wants rapid intervention when a firm repeats violations.Why this matters

Large platforms plan to use a single European hub. A tougher stance in France can change that plan. Consequently, companies may add compliance staff, raise capital and update custody models. Marketing calendars may also slip. On the upside, investors gain rules that are easier to understand and enforce.Threat model snapshot

• Regulatory fragmentation. Different interpretations across countries. Impact high. Likelihood medium. • Passport delays. Extra reviews slow market entries. Impact medium. Likelihood high. • Capital strain. Higher buffers and audits raise costs. Impact medium. Likelihood medium. • Product stops. Tighter rules for staking and stablecoin yield. Impact medium. Likelihood medium. • Reputation risk. Negative findings during audits. Impact high. Likelihood low.Defense playbook for CASPs

• Map each host country requirement in advance and align controls. • Build an ESMA ready file with governance proofs and runbooks. • Separate client assets at the legal and technical level and document flows end to end. • Run incident drills and publish a plain language policy for users. • Plan capital and liquidity buffers for stress periods. • Stagger market launches and review outcomes before scaling.Comparative view of passporting signals

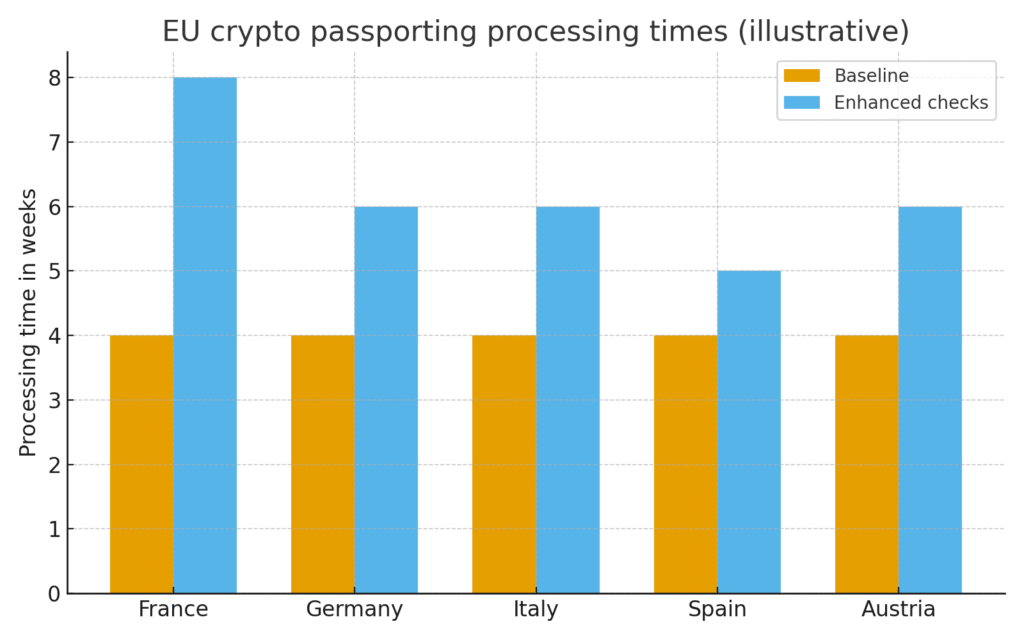

This table gives an indicative read based on public guidance. It helps teams plan compliance and entry.| Country and regulator | Current license regime | Extra checks now signaled | Potential impact for CASPs | Expected timing |

|---|---|---|---|---|

| France AMF | Full MiCA path with national onboarding | Stronger governance tests and cross border supervision with ESMA input | Longer approvals and higher disclosure needs | Near term in the current quarter |

| Germany BaFin | MiCA with existing national controls | Emphasis on risk management and client asset handling | Extra audit work and stricter processes | During the next two quarters |

| Italy Consob | MiCA alignment via national law | Focus on custody segregation and incident reporting | Updated custody models and runbooks | Through the next quarter |

| Spain CNMV | MiCA framework with consumer focus | Clear marketing rules and suitability checks | Tighter campaign reviews and disclosures | Rolling updates this quarter |

| Austria FMA | MiCA adoption with prudential tone | Capital buffers and periodic stress reviews | Higher capital planning and liquidity buffers | Over the next two quarters |

Figure 1. Baseline MiCA comparison passporting processing times against enhanced checks for France Germany Italy Spain and Austria measured in weeks

Conclusion

In short, France signals a tougher path for crypto passporting under MiCA. Stronger ESMA involvement and stricter checks would change expansion plans across the bloc. Therefore firms that prepare early can keep timelines on track while users gain clearer protections.

2 Comments

Pingback: Solana leads the market as traders brace for a Fed rate cut - The Crypto Tides

Pingback: Polymarket adds earnings prediction markets after US clearance - The Crypto Tides