People and policy meet market structure. A deep read that separates claims from verified facts, then maps the adoption drivers that could carry BTC to a seven digit handle.

What happened

At a main stage session in Hong Kong, Eric Trump predicted that Bitcoin could reach one million per coin within several years and praised China as a major power in digital assets. The remarks come during a cycle where institutional access, government data on chain, and Asia venue competition are reshaping liquidity and custody.

What he said vs what is verified

| Claim | Verifiable facts today | What to watch next |

|---|---|---|

| Bitcoin can reach one million within several years | Spot ETF demand, new treasury strategies and broader custody access have expanded the buyer base across the U S and Asia. Government macro data is beginning to be distributed on public chains through major oracle networks, improving data integrity for markets. | Depth across U S spot ETFs and Asia venues, treasury announcements from listed companies, progress on government data distribution cadence and coverage, and durability of miner economics after upgrades. |

| China is a major power in crypto | Asia hubs have competed to attract liquidity and projects. Talent, mining logistics and venture capital from the region remain influential even when domestic retail trading is limited. | Policy signals across Hong Kong, Middle East and Southeast Asia, cross border capital channels, and enterprise pilots that consume on chain data feeds. |

Context that matters now

Institutional flow and market microstructure Spot ETFs and professional custody have unlocked mandates that previously could not hold BTC. That flow is episodic and tends to cluster around macro prints and quarter ends.

Government data on chain The movement to publish macroeconomic series on public chains through oracle providers is early but important. It makes high value datasets queryable in a tamper evident way, which can anchor derivatives and structured products.

Asia venue competition Hong Kong, Singapore and Middle East centers are racing to host listings, funds and primary issuance. That competition influences where depth and price discovery live during Asia hours.

Governance and custody blueprint

Regulatory perimeter The U S has expanded crypto policy workstreams around stable value instruments, market structure and token custody. Asia jurisdictions emphasize licensing and risk segregation at the exchange level. The path to one million depends on how these two models converge.

Custody stack Segregated accounts, proof of reserves with attestation, and qualified custodians with insurance remain non negotiable for institutions. The rise of enterprise wallets with policy engines allows finer control of key rotation and withdrawal approvals.

Data and oracles With government series available through oracle networks, the integrity of those feeds becomes part of core market plumbing. Diversity of publishers, versioning and replay protections are essential.

Mining and energy Hashpower is consolidating into industrial scale sites that monetize both compute and grid services. Their capital costs and power contracts set the floor for sustainable issuance.

Scenario map for the next two years

Bull case Spot ETF depth keeps climbing, government data on chain scales to additional series, and Asia venues capture larger share of new issuance. Treasury adoption by global brands creates recurring buy pressure.

Base case Progress is uneven but positive. ETF net creations fluctuate with macro, while custody and oracle standards keep improving. Price grinds higher with sharp pullbacks tied to policy headlines.

Bear case A policy shock hits stable value instruments or a major venue. ETF outflows and liquidity fragmentation force deleveraging. The narrative resets to security first before growth resumes.

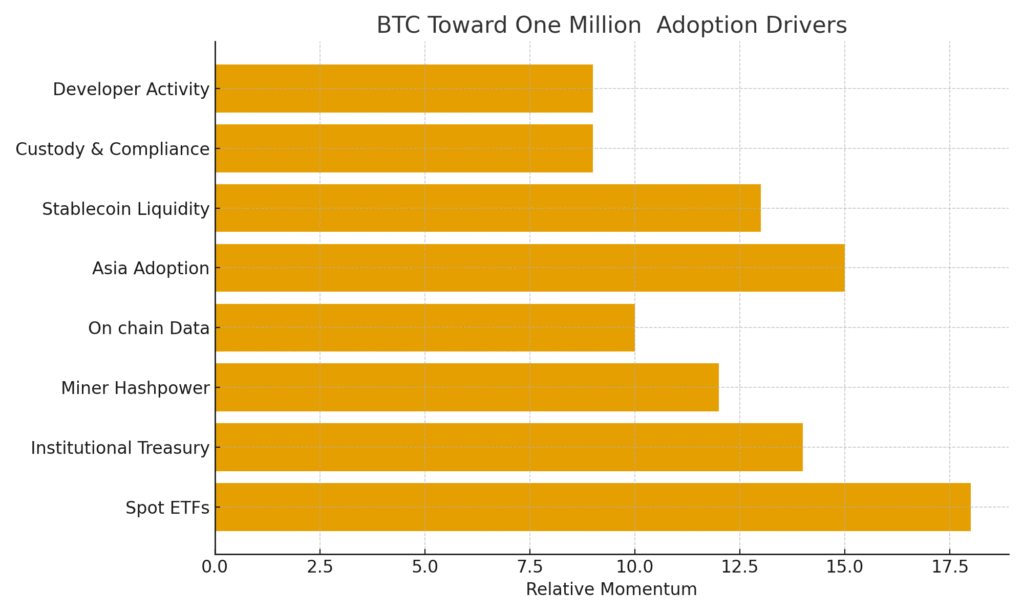

Figure 1. BTC to one Million driver relative scenario

Checklist for decision makers

Match custody policy to mandate size and withdrawal frequency.

Monitor oracle change logs when models consume government series.

Stress test liquidity using both U S and Asia hours.

Track miner breakevens and forward power hedges.

Separate conviction time horizons from trading time frames.

The adoption flywheel in one picture

Use the cover chart to frame the discussion with your stakeholders. It shows the eight drivers that most influence progress toward the one million narrative ETFs, corporate treasuries, miner security budget, on chain data availability, Asia adoption, stable value liquidity, custody and compliance readiness, and developer activity.

Related Posts

Thailand is pushing a regional crypto hub policy dossier and architecture blueprint

Why Ethereum is becoming Wall Street token a market structure read

ARK Invest adds to Bitmine what the Ether treasury bet signals now