Policy meets security practice. A national holder explains how it will split reserves to reduce single address risk and improve transparency.

What happened

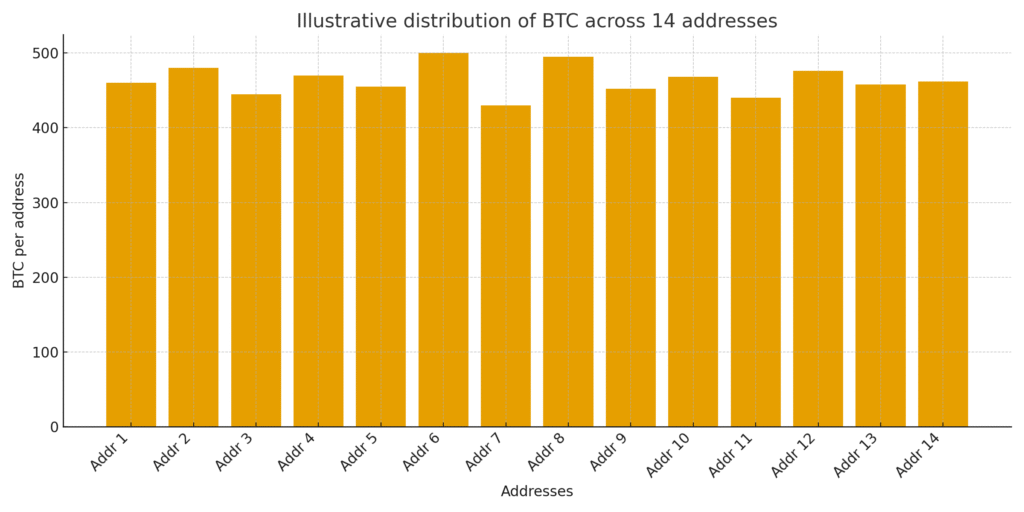

El Salvador announced that it will move its sovereign Bitcoin reserves from a single address into multiple new addresses. The National Bitcoin Office said each address will hold up to a defined cap and that a public dashboard will disclose aggregate balances.

Why this matters now

Concentration risk A single address concentrates operational and adversarial risk. Attack paths range from key compromise to supply chain exposure at signing devices.

Transparency and monitoring Multiple addresses with a disclosed cap and a public dashboard make it easier to audit holdings and to detect anomalous flows in real time.

Market signal The move frames a template for public treasuries and corporate treasuries that hold native assets directly rather than via wrapped instruments.

Threat model snapshot

Key compromise private key exposure through phishing, malware or insider threats.

Signer device failure firmware bugs or tampered hardware that alter signing behavior.

Custody process drift untracked policy changes that weaken controls.

Concentration of UTXO large UTXO sets create predictable targets and more costly recovery.

On chain privacy erosion linkable flows that reveal operational patterns.

Defense playbook in practice

Address caps limit per address balances to reduce blast radius.

Multi step migration stage transfers over time and confirm balances on independent nodes.

Multi sign policy enforce M of N signatures with hardware isolation and access rotation.

Address hygiene refresh derivation paths and avoid address reuse.

Public dashboard publish aggregate holdings with independent replication instructions so third parties can verify.

Figure 1. El Salvador BTC address distribution

Timeline and governance checklist

Map legacy address and define caps for each new address.

Approve a multi sign policy that separates duties and removes shared devices.

Run a dry run with test funds and capture a signed runbook.

Begin staged transfers and monitor mempool for anomalies.

Publish the dashboard and a changelog for key policy parameters.

What to watch next

Verification of the new addresses and consistency with the announced caps.

UTXO structure after the migration and how it impacts future treasury moves.

Community replication of the dashboard with open instructions.

Related Posts

Thailand is pushing a regional crypto hub policy dossier and architecture blueprint

Neo and ChainGPT in 2025 What ships next and where builders should look

Eric Trump at Bitcoin Asia the road to one million BTC and why China matters