Gemini’s S 1 filing reveals a 75M USD credit facility from Ripple. This is a liquidity and governance signal that will be closely read by investors before the roadshow.

Term sheet decoder

Facility size: 75M USD

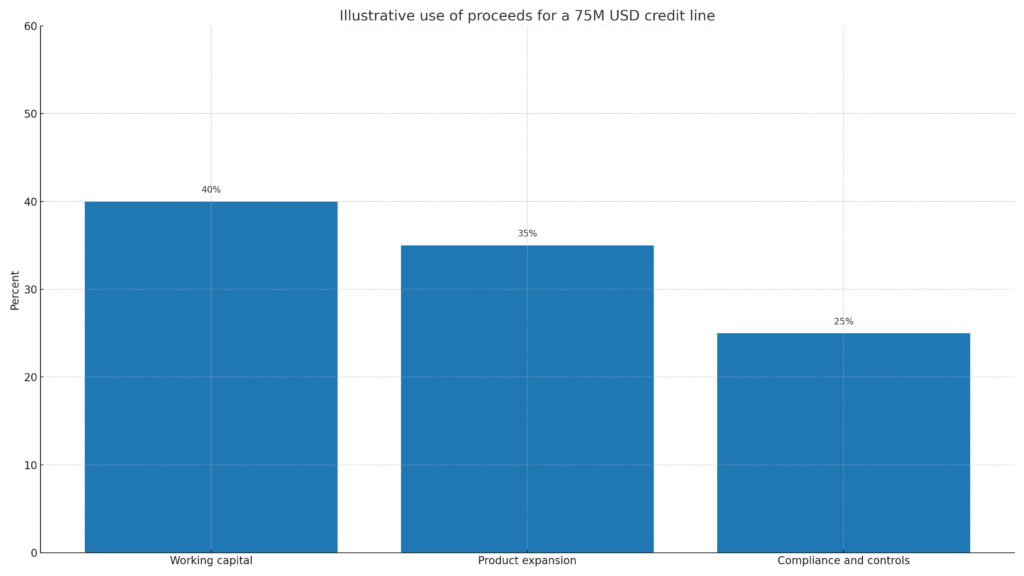

Probable use of proceeds: working capital, product expansion, compliance and controls

Why it matters: the facility shapes the liquidity stack and tests disclosure rigor while Gemini prepares public market scrutiny

Pro forma liquidity stack for stress days

| Layer | Component | Behavior in stress | What to verify |

|---|---|---|---|

| Tier 1 | Cash and cash equivalents | Immediate buffer for withdrawals | Daily and intraday visibility |

| Tier 2 | 75M USD credit line | Drawn if spreads widen or volumes spike | Covenants and draw conditions |

| Tier 3 | Treasury lines and insurance | Event driven access | Coverage limits and exclusions |

| Tier 4 | Equity raised at IPO | Strategic capital | Timing windows and valuation risk |

Illustration only. Not actual balances.

IPO readiness scorecard

| Dimension | Key questions | What investors want to see |

|---|---|---|

| Reserves clarity | Segregation and attestations | Independent and frequent proofs |

| Revenue mix | Fees vs services vs interest | Less cyclicality and more stable margins |

| Counterparty risk | Facility covenants and backstops | Transparent terms and redundancy |

| Governance | Board and audit committee strength | Real independence and veto power |

| Unit economics | CAC, ARPU, cohort retention | Path to durable margins |

Caption: This split is illustrative. The filing summary does not assign exact line items.

Five questions a buy side PM will ask

What triggers a draw and how often do drills occur

How do reserves backstop intraday outflows without forced selling

What share of growth comes from non trading revenue with stable margins

Which covenants could tighten flexibility in a drawdown

How will disclosures evolve between the S 1 and the first 10 Q

Strategy trees

Base case: the facility remains undrawn, confidence improves, the window to list opens, and the mix tilts toward institutional services

Stress case: volatility rises, partial draws occur, transparency becomes the main valuation lever, and governance gets a spotlight

Red flags vs green flags

| Red flags | Green flags |

|---|---|

| Ambiguous reserve disclosures | Independent attestations on a fixed cadence |

| Funding concentration | Multiple facilities with staggered maturities |

| Heavy reliance on retail trading | Growth in custody, prime, and fiat ramps |

Implementation checklist for Gemini

Publish a plain language FAQ for the facility

Add a change log for disclosures with time stamps

Run and publish periodic liquidity stress tests

Clarify custody, insurance posture, and incident response