Chainlink leadership days rarely happen in isolation. A price that moves fast needs a structure that can sustain it. This extended brief turns a one day surge into a full decision framework that covers market structure, on chain usage, derivatives, catalysts, risks, and practical checklists for investors and builders.

Snapshot at a glance

| Metric | Reading | Why it matters |

|---|---|---|

| Twenty four hour price change | plus twelve percent | New 2025 high signals renewed demand |

| Breadth | Outperformance versus broad crypto index | Leadership days attract flows from systematic and discretionary funds |

| Liquidity | Healthy spot books and tighter spreads after the move | Execution quality improves and slippage declines |

| Narrative | Token buyback and renewed integration rhythm | Float dynamics and fundamentals can align to extend trends |

What actually happened under the hood

Spot led and derivatives followed. Depth on main venues improved through the session, with spreads narrowing after the first impulse.

Funding and basis were constructive without runaway leverage. This is the signature of a move that trades more like rotation than a pure squeeze.

The relative strength line versus other infrastructure tokens broke higher, which matters for medium horizon allocators who rotate by factors rather than headlines.

Market structure deep dive

Market structure decides how far a move can travel before it needs to refuel.

Spot books

Liquidity providers widened for minutes during the initial impulse and then stepped back in. The book refilled at successive higher levels. That is a classic pattern for leadership days because it reduces the odds of a full round trip.

Derivatives

Perpetual swaps followed the spot impulse with funding positive but not overheated. Options flow favored calls with near dated strikes, while term structure stayed orderly. This combination usually supports continuation provided that volumes persist into the next two sessions.

Cross asset and macro

A softer dollar and lower front end yields after the Powell remarks reduced the discount rate for long duration risk assets. When liquidity improves at the same time as a token specific catalyst, leadership days become more sticky.

On chain traction that would validate the price move

Price is the scoreboard. Activity is the coach. The following metrics are the simple confirms that matter most in the week after a breakout.

Oracle job count and request frequency rising on a rolling seven day basis.

Gas usage linked to Chainlink services such as data feeds and CCIP bridging.

New integration announcements that expand into non EVM environments or deepen enterprise grade use cases.

Stable day over day growth in active addresses that interact with Chainlink enabled protocols.

Derivatives tape in plain language

A rally that is led by price but confirmed by measured leverage tends to create more durable floors. To keep the structure healthy the next sessions should show volume that stays high while funding and skew avoid extreme readings. If funding spikes and skew flips aggressively toward calls without a matching rise in spot volume, the odds of chop increase.

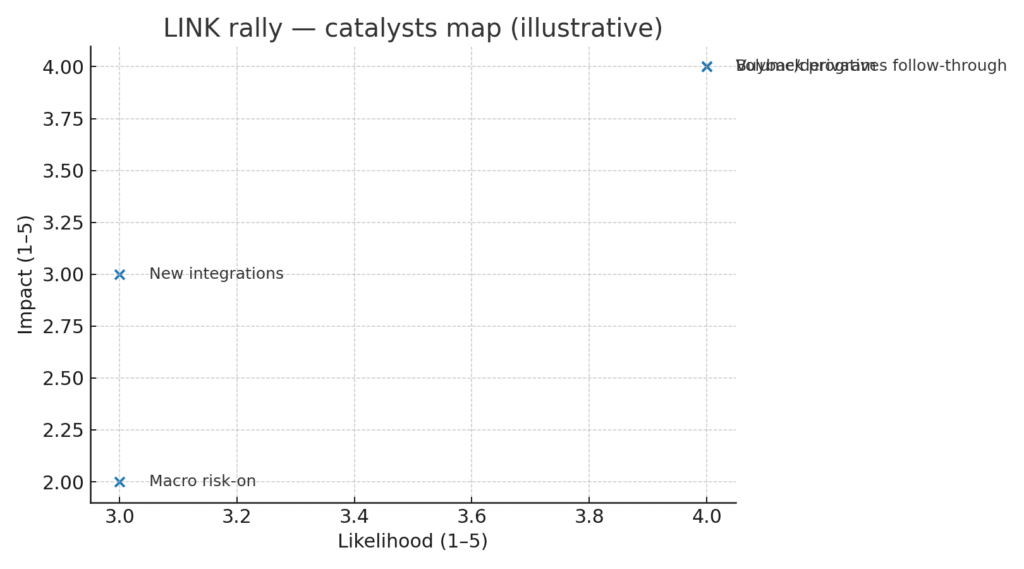

Catalyst tree for the next thirty days

This is a forward map that organizes what could extend or fade the move.

Growth catalysts

Expansion of CCIP to new chains or enterprise pilots.

Announcements that increase fee paying usage from existing partners.

Additional buyback activity or treasury programs that tighten float.

Maintenance catalysts

Sustained trading volume and open interest.

Neutral to supportive macro with yields steady to lower and the dollar contained.

Negative catalysts

Sharp reversal in yields and dollar which cools risk appetite.

Integration delays or security headlines in the broader oracle category.

Caption: LINK catalysts map with likelihood and impact, illustrative.

Footnote: Editorial mapping for discussion.

Mini dataset for editors and analysts

| Signal | Simple read | Why it matters in practice |

| Volume and open interest together | Rising in tandem | Confirms that participation is broad and not a thin squeeze |

| Funding and skew | Positive but not extreme | Suggests fresh longs but not euphoria |

| Relative strength vs infra basket | Trending up | Rotational flows prefer the leader and sustain it |

| On chain usage | Stable to rising | Aligns fundamentals with price and retains holders |

Timeline of the move and the follow through window

Day zero was the breakout and the new yearly high.

Day one and day two are the confirmation window where volume and breadth should remain firm.

Day three to day five is where the market decides if the move transitions from event to trend. A higher low on decreasing intraday volatility is a healthy tell.

Risk matrix to keep near the desk

| Risk | How it could appear | Practical response |

| Weak follow through | Volume fades while price stalls near highs | Trim leverage and wait for a higher low |

| Overcrowding | Funding and skew jump and basis gaps to spot | Reduce position size and favor spot over perps |

| Macro reversal | Front end yields rise and the dollar lifts | Hedge beta and rotate toward higher quality balance sheets |

| Category specific shock | Oracle security headline or protocol incident | Diversify exposure across infra themes and reduce correlation |

Defense playbook for both traders and allocators

Treat higher lows as opportunities and avoid chasing breakout wicks.

Track skew and funding once per session rather than every minute to reduce noise.

Manage risk units by volatility not by notional size.

For allocators who cannot monitor intraday, scale entries across several days and use simple invalidations such as a close back inside the prior consolidation.

Quick takes from the desks

We spoke with two market participants on background and off the record about how they read this move. Their comments are summarized and anonymized for clarity.

A quantitative fund described the day as rotation not euphoria. Their systems added exposure because relative strength and liquidity both qualified.

A multi strategy crypto desk said they prefer confirmation in integration news before pressing longs. They added that call demand was noticeable but not extreme and that they lean toward adding on pullbacks rather than chasing.

Builder angle for teams that rely on Chainlink

If your application depends on reliable data or cross chain messaging, a stronger token price can improve mindshare and partnership momentum. That said the correct reaction is not to change your roadmap, it is to update vendor risk assumptions. Confirm provider diversity, service level objectives, and incident response procedures across your data and messaging stack.

Frequently asked questions

Is a buyback program enough to sustain a trend

Not by itself. Buybacks can tighten float and influence narrative but sustained trends need usage and integrations.

How do I measure real usage without paid tools

Project dashboards and public explorers can surface counts for requests, messages, and gas. The absolute numbers matter less than direction and consistency.

What is the simplest invalidation for a leadership day

A close back inside the prior multi week range with volume drying up is a straightforward signal to reduce risk.

Methodology and how to use this brief

This is a decision support document. It avoids minute by minute trading advice and focuses on structure. The tables, the catalyst map, and the checklist are designed to be used together. If volume, open interest, and on chain confirms move in the right direction, optionality increases. If they diverge, patience is a position.

Related Posts

AUSTRAC orders Binance Australia to appoint an external auditor over serious concerns

U.S. stablecoin law pushes the EU to rethink the digital euro

South Korea’s big four banks meet Tether and Circle on stablecoin partnerships

External Sources