Price action remains headline sensitive. The dip under 115,000 USDT for BTC and the repeated tests near 880 USDT for BNB occur with neutral funding, firm BTC dominance and a gentle pickup in 30 day volatility. Use the pulse below for actionable levels and risk for the next 24 to 48 hours.

Daily Market Pulse

Operational metrics at time of writing. Approximations intended for decision framing.

| Metric | Reading | Signal | Quick take |

|---|---|---|---|

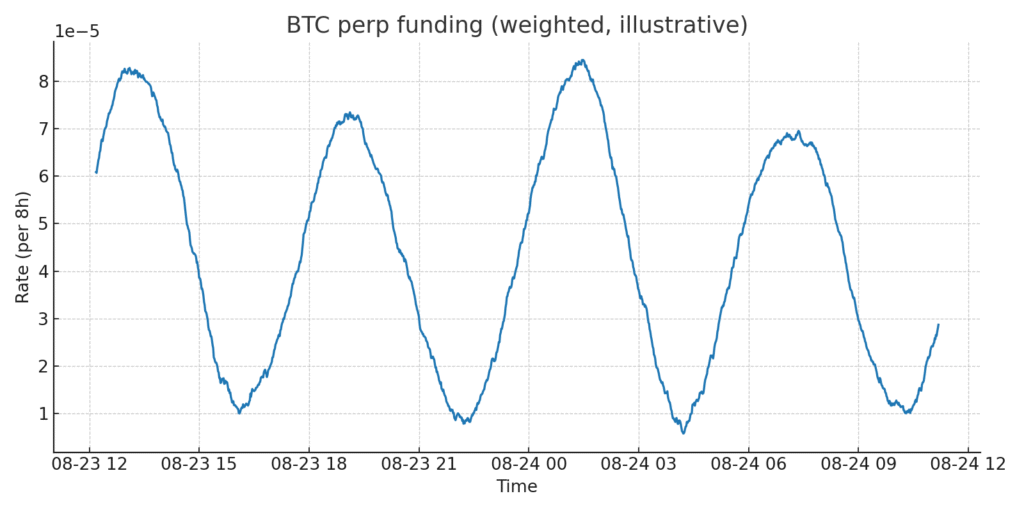

| BTC perp funding (avg) | 0.01% to 0.02% | ↔︎ | Neutral. No one‑sided leverage. |

| ETH open interest (total) | ~34.8 B USD | ↑ | Light uptick in 24 h. Persistent derivatives interest. |

| BTC dominance | ~58.5% to 58.7% | ↔︎ | Preference for megacaps. |

| BTC 30‑day realized vol | low 30s | ↗︎ slight | Waking up from multi‑month lows. |

Sources appear at the end. No links inside the body by editorial policy.

What is moving the tape today

Price prints: BTC under 115,000 with quick wicks at intraday support. BNB near 880 with frequent lower shadows. Prints visible across verified feeds.

Tame derivatives: Funding stays neutral to slightly positive. No immediate squeeze setup.

Selective liquidity: ETH OI grows at the margin, aligned with hedging and rotations into near‑term expiries.

Vol regime shift: Realized and implied move off the floor yet remain contained.

Levels to watch

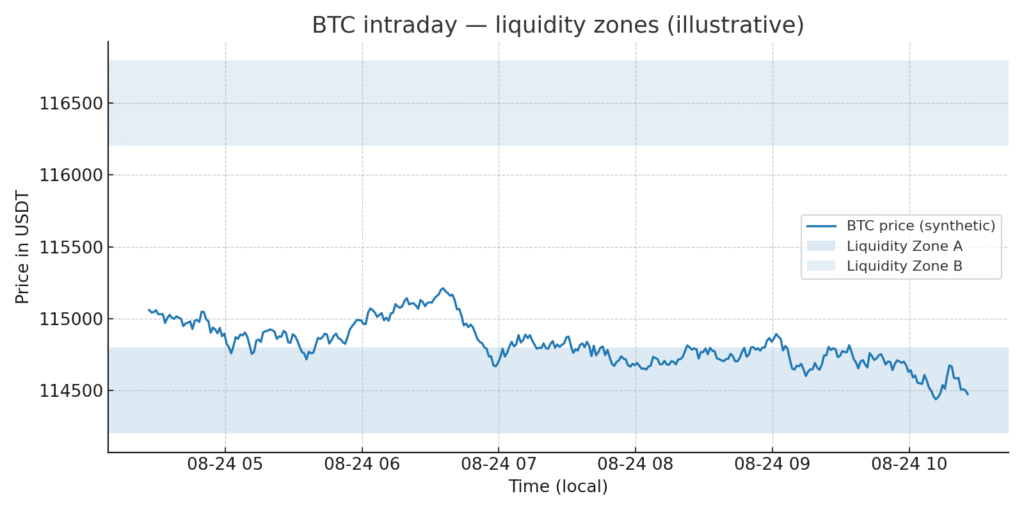

BTC: tactical support 114,200 to 114,800. Control zone 116,200 to 116,800. Resistance 118,500. Intraday invalidation on hourly close below 113,800.

BNB: support 860 to 875. Resistance 900 to 915. Strength confirmed on closes above 905 with rising volume.

Figure 1. BTC intraday 1m with liquidity zones

Positioning and flows

Funding and basis: Neutral funding and capped basis reduce the incentive for aggressive directional arbitrage.

Open interest: ETH shows a steady OI climb. BTC flat.

Dominance: Near 58 percent favours BTC and top caps over mid caps.

Figure 2. Weighted average BTC funding

Game plan for 24–48 hours

Measured directional entries: Scale into supports with tight invalidations. Avoid chasing late breaks.

Options overlays: Low vol supports cost‑efficient call spreads or light downside hedges.

Risk control: Step down size if BTC loses 113,800 with momentum.

Risk flags

Macro surprise: Out‑of‑consensus guidance can amplify a one‑direction move.

Weekend depth: Shallow books increase wick risk.

Funding tilt: Watch for a sudden skew in funding that could trigger a squeeze.

Conclusion

Patience at supports and clear invalidations work best in this regime. Keep exposure moderate and let the market come to your levels.