A focused market wrap for decision makers. Sentiment is risk off and levels matter again. This read gives a clean pulse and a plan.

Daily Market Pulse

| Metric | Status today | Read |

|---|---|---|

| BTC perp funding | Slightly positive | positioning is light and not stretched |

| ETH open interest | Stable vs yesterday | no sign of crowded leverage |

| BTC dominance | Mixed intraday | rotation pauses while majors digest |

| 30 day realized volatility | Elevated vs last month | larger daily ranges return |

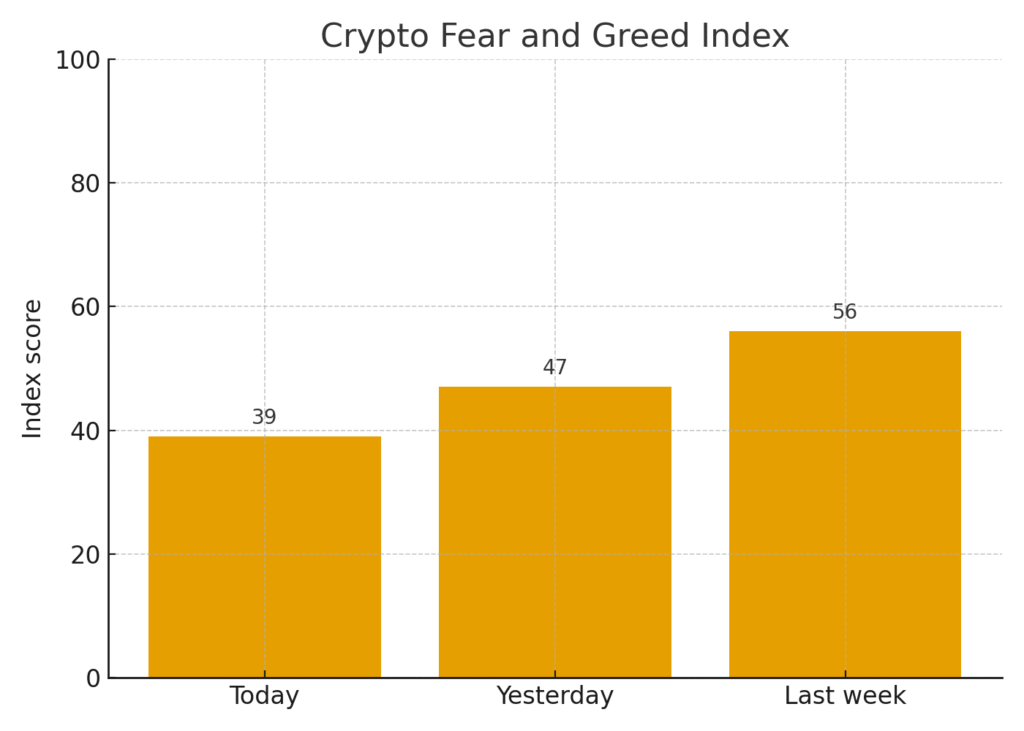

Note use the figure below to track the sentiment pivot using a simple compare across today, yesterday and last week.

Figure 1. Fear and greed analysis

Quick map of levels

Near term support watch the area where Asia and U S sessions recently defended. If broken on volume, expect a deeper probe into prior acceptance.

Resistance prior week highs and the first failed breakdown level. A clean reclaim with volume can reset the narrative.

Invalidation if price trades below the second support without fast response from buyers, reduce risk and wait for new structure.

How to navigate a fear tape

Set position sizes for higher intraday variance.

Avoid chasing breaks during low liquidity hours.

Place alerts at session pivots so entries are planned not reactive.

Track ETF net creations when U S opens.

Rebalance only after daily closes if your mandate is not intraday.

What could flip the mood

Large net creations in spot ETFs or a treasury allocation from a visible brand.

A macro print that reduces rate uncertainty.

Clear policy progress on market structure or stable value instruments.