Bitcoin retraced roughly ten percent from recent highs and is now probing a cluster of supports that traders often watch during uptrends. The tape shows cooling leverage, weaker breadth among large cap altcoins, and firmer BTC dominance. The move looks like de-risking rather than capitulation.

Daily Market Pulse

| Metric | Today’s signal | Quick read |

|---|---|---|

| BTC perpetual funding | Flat to slightly positive | Leverage cooled after the spike |

| ETH open interest | Down on the margin | Systemic leverage trimmed |

| BTC dominance | Drifting higher | Classic pattern when alts underperform |

| 30-day realized volatility | Elevated and rising | Risk teams stay cautious |

Tape forensics

The first leg of selling was liquidity driven. Slippage was largest in long tail pairs while majors kept tighter spreads.

Breadth deteriorated across L1 and meme baskets. That confirmed broad de-risking rather than a single headline hit.

Liquidations were concentrated in the last two sessions, then slowed as funding normalized around flat.

Levels traders are watching

| Lens | Why it matters | What confirms strength |

|---|---|---|

| Short-term holder realized price zone | A commonly tracked “soft floor” in bull phases | Strong reclaim with healthy spot participation |

| Prior breakout area | Former resistance often acts as support on first retest | Absorption on retest and higher lows on intraday charts |

| Liquidity nodes on spot books | Shows where resting demand sits | Thickening bids that survive multiple taps |

Microstructure notes

Basis narrowed across perps and dated futures. That reduces carry attractiveness and cools leverage.

Funding dispersion remains wide across alts, signaling residual stress pockets.

Options desks reported a modest rise in short-dated implied volatility with put skew firming.

Scenario map for the next 72 hours

Stabilization

Spot demand absorbs retests near support. Funding holds near flat and breadth stops falling. Range builds for a potential attempt higher.

Drift lower

Dominance keeps rising while breadth stays weak. Pullbacks extend slowly as bids step down and options sellers demand more skew.

Sharp extension

A macro or security shock pushes forced deleveraging. Look for liquidation clusters, one-way books and temporary dislocations in long tail pairs.

Risk radar

Macro liquidity headlines can extend volatility even without crypto-specific catalysts.

Exchange and stablecoin settlement frictions tend to appear when volumes spike.

Weekend order books are thinner and can exaggerate moves.

What to watch next

Breadth turning up across large caps, not only BTC.

Funding staying near or below flat while price stabilizes.

Evidence that spot buyers, not only derivatives, are leading rebounds.

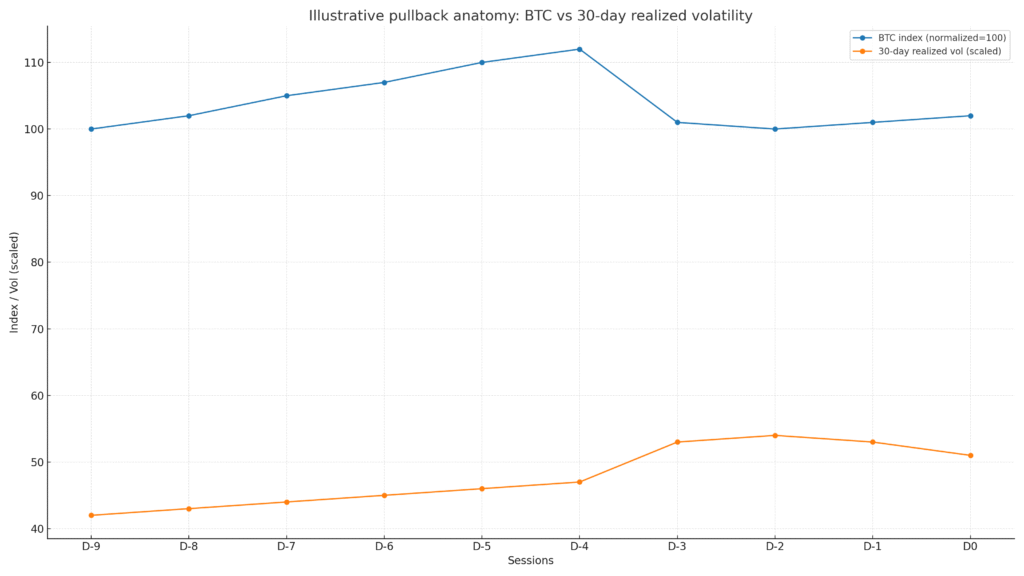

Pullback anatomy: BTC vs 30-day realized volatility

Caption: Illustrative series to visualize the typical relationship between a price pullback and realized volatility. Not actual market data.

Related Posts

- Interview Explainer: Kenneth Rogoff revisits his 2018 Bitcoin call

- Market Forensics: Cardano and Dogecoin led losses as breadth cracked

- Adviser Briefing: UK bitcoin ETNs are opening the gate for professional and retail investors