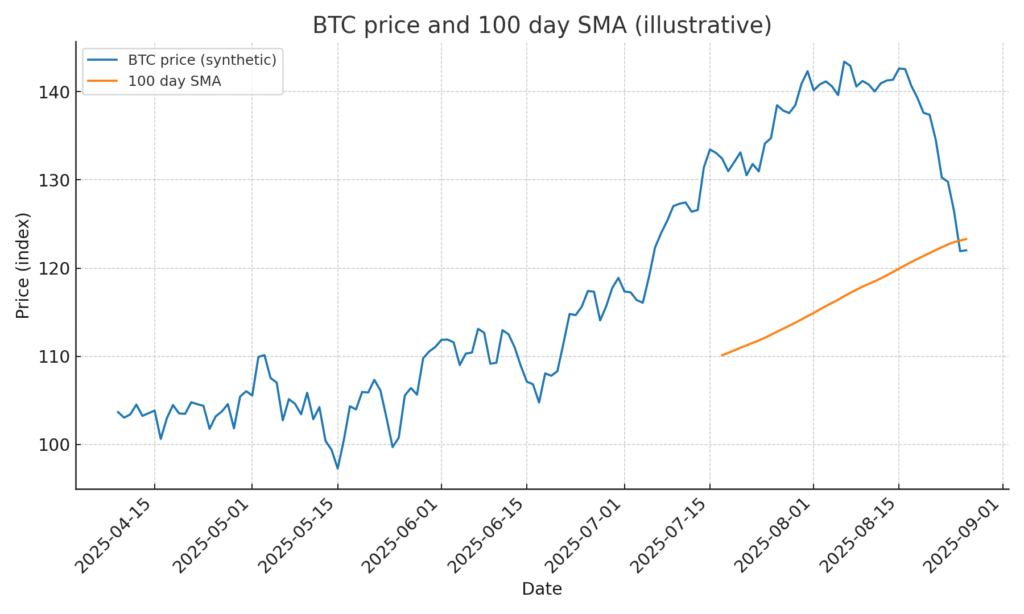

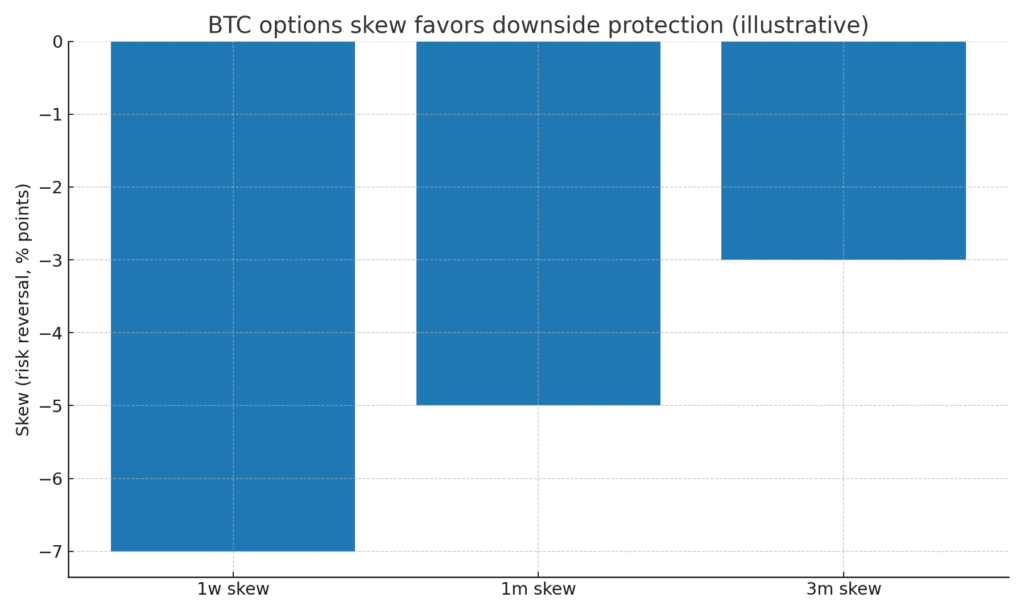

Fast read: Bitcoin slipped below its 100 day simple moving average while the options market ahead of Friday’s large BTC and ETH expiries shows a preference for downside protection. Ether, Solana and XRP display comparatively firmer structures, although liquidity remains uneven. This note connects the signals and sets a clean risk plan. No links appear in the body. External sources and internal links are listed at the end.

Daily Market Pulse

| Metric | Time CEST | Direction | Takeaway |

|---|---|---|---|

| BTC vs 100 day SMA | 10:15 | Below | Trend tone weakens and the burden of proof shifts to buyers. |

| BTC options skew | 10:15 | Put biased | Demand for protection into Friday’s expiry dominates. |

| Breadth ETH SOL XRP | 10:15 | Mixed to firmer | Relative strength on several time frames vs BTC. |

| 30 day realized vol BTC | 10:15 | Higher | Expect wider daily ranges and longer wicks. |

Figure 1. BTC price and 100 day average, illustrative reconstruction

What changed and why it matters

Technical break. A close below the 100 day average increases the risk that rebounds fail at that reference unless confirmed by volume and depth. The average is not a prediction tool. It is a widely watched anchor that affects behaviour and stop placement.

Skew speaks defence. Risk reversals lean negative which indicates higher demand for puts than calls. That is consistent with hedging into headlines and thin liquidity windows. After large expiries, a reset in open interest can compress ranges if hedges roll off.

Relative strength outside BTC. ETH and SOL hold mid range structures on many charts. XRP remains softer today yet still fares better than BTC on some relative metrics. Leadership can rotate if liquidity stabilises.

How to read skew into expiry

Level vs change. A negative skew is defence. A skew that becomes less negative while price stabilises can mark a turn in risk appetite.

Term structure. One week skew reacts first. One month and three month skews change slower and tell you if hedging is tactical or structural.

Dealer flows. Put heavy positioning can pin the tape near large strikes into expiry. Watch whether post expiry price escapes those magnets.

Figure 2. BTC options skew shows preference for puts over calls, illustrative

Levels and validation

Reclaim the average: A sustained reclaim of the 100 day average with rising spot volume improves the tactical tone.

Support bands: Watch prior congestion areas rather than round numbers for stop placement.

ETH SOL XRP: Confirm relative strength with higher lows and better order book depth on dips.

Original mini dataset

| Window | Funding signal | Open interest signal | Depth signal |

| Early Europe | Neutral | Down | Low |

| US open | Neutral to positive | Flat | Medium |

| Late US | Neutral | Down | Low |