What flipped this week

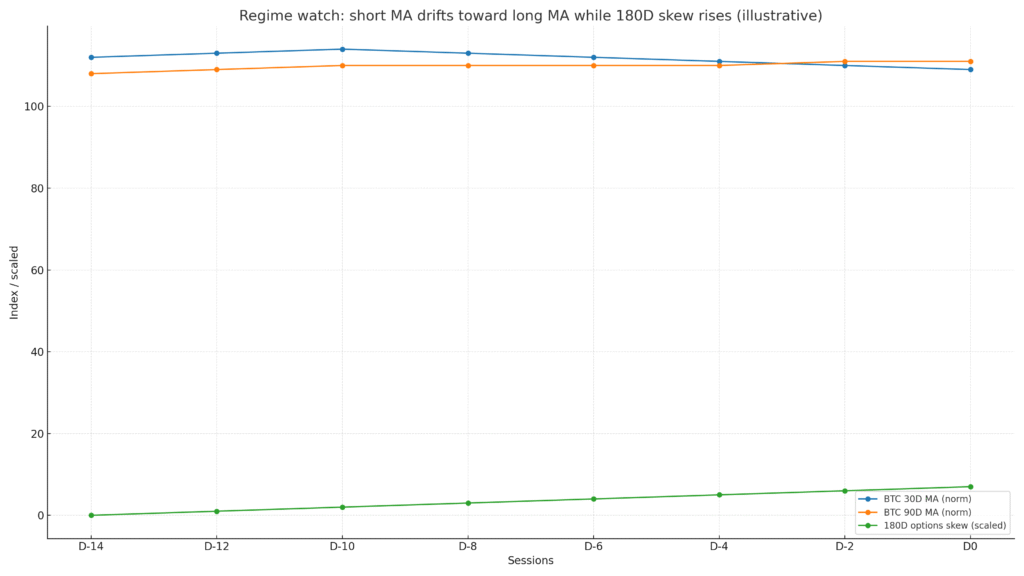

Options markets show long tenor put skew rising and holding firm. A short moving average drifts toward a longer one. Breadth across large caps remains weak while funding sits near flat. Taken together, these signals lean cautious into the policy calendar.

Regime dashboard

| Indicator | Current tilt | Why it matters |

|---|---|---|

| One hundred eighty day options skew | Higher and persistent | There is steady demand for protection into events |

| Short versus long moving average | Short drifts lower toward long | Momentum is fading on bounces |

| Breadth among large caps | Narrow and soft | Risk appetite has not recovered yet |

| Funding across majors | Near flat | Less leverage from longs after the pullback |

Definitions in plain English

Options skew describes the relative pricing of puts versus calls. Rising skew means puts trade richer, which often happens when participants want protection. Moving average drift shows whether short-term price action is catching up to a slower trend. Breadth measures how many significant assets advance together. Funding near flat means leveraged longs are not forcing the bid.

Confirmation and invalidation triggers

Confirmation of a bearish regime

Skew stays bid while spot fails to hold at support. The short moving average closes below the long one. Breadth fails to improve for several sessions and BTC dominance stays firm.

Invalidation of a bearish regime

Breadth turns up with strong spot leadership. Skew softens as options writers add supply and implied volatility normalizes. The short moving average curls higher and prints higher lows.

Risk map and practical caveats

Macro liquidity headlines can stretch volatility even without crypto specific catalysts. Weekend books are thinner and can exaggerate moves. Settlement frictions may appear when volumes spike. Treat any single indicator as a piece of context rather than a standalone signal.

What to watch next

Breadth stabilizing across large caps, funding near or below flat while price holds, and evidence that spot flows rather than derivatives drive rebounds. If those conditions line up, caution fades. If not, the cautious tilt remains the base case into the event calendar.

Related Posts

- Interview Explainer: Kenneth Rogoff revisits his 2018 Bitcoin call

- Market Forensics: Cardano and Dogecoin led losses as breadth cracked

- Adviser Briefing: UK bitcoin ETNs are opening the gate for professional and retail investors

External Sources

CoinDesk: Key Bitcoin indicators hint at a bearish regime shift as Jackson Hole nears

Deribit Insights week 34: Crypto derivatives analytics and risk reversal readings

Deribit Insights week 33: Options skew, term structure and smile analysis

Kaiko Research: Skew and flow context around market selloffs

Glassnode chart: Short-Term Holder Realized Price and MVRV

Glassnode docs: Guide to long and short term holder supply metrics

The Block data: BTC options 25 delta skew daily dashboard