What the new survey shows

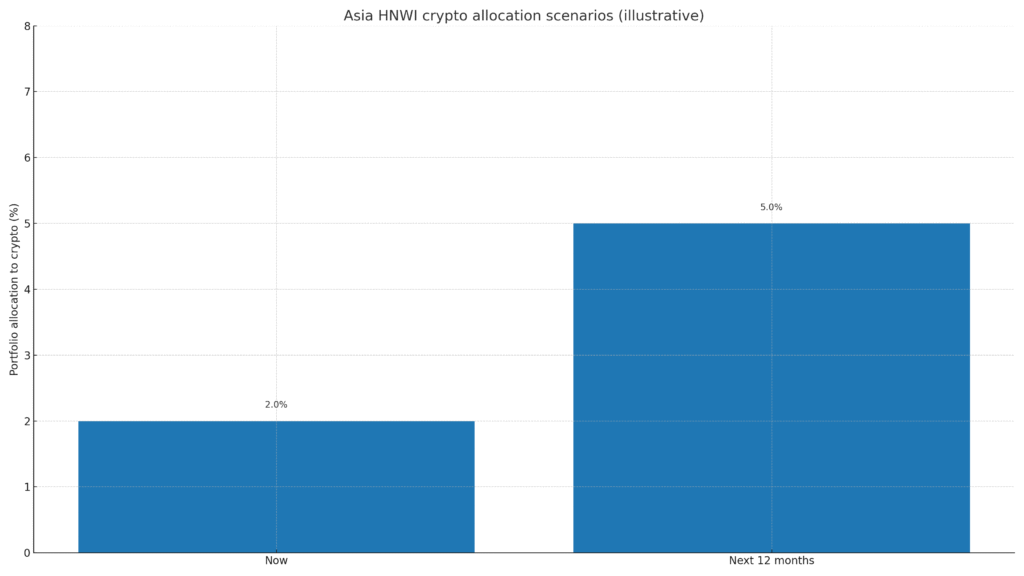

Family offices and high net worth investors across Asia are raising target allocations to crypto from low single digits toward mid single digits over the next twelve months. The stated drivers are diversification, liquidity across time zones, and the availability of regulated wrappers that fit compliance workflows.

The allocator’s lens

| Driver | Policy translation | Example control |

|---|---|---|

| Diversification with convex payoff | Start small and cap by volatility | Risk budget per sleeve and a max drawdown trigger |

| Liquidity and always-on venues | Rebalance outside local hours | Weekly windows with guardrails on flows |

| Regulated access vehicles | Prefer listed wrappers with clear custody | Quarterly attestations from issuers and custodians |

Sizing scenarios for an IPS, illustrative

| Sleeve | Now | Next 12 months | Notes |

|---|---|---|---|

| Core listed exposure | 2.0 percent | 5.0 percent | Range depends on jurisdiction and mandate |

| Opportunistic and venture | 0.5 percent | 1.0 percent | Only for sophisticated profiles |

| Infrastructure or mining | 0.0 percent | 0.5 percent | Energy and policy constraints apply |

Case study

A multi family office in Singapore adds a small listed sleeve with position limits by issuer rating. The firm documents issuer credit risk for notes and custody mechanics for funds. It also introduces a quarterly evidence pack that contains holdings, attestations, and a reconciliation of any corporate action cash flows.

Interview simulation with a private banker

What unblocks clients now

Wrapper clarity and straight-through reporting. When exposure papers like any other listed instrument, execution becomes routine.

What still slows adoption

Suitability checks, internal approvals, and client education. The message that resonates is plain language about risks, custody, and rebalance rules.

What could reverse the trend

A custody incident or a regulatory change that narrows approved wrappers.

Adviser implementation checklist

Label issuer credit risk for notes and map custody mechanics for funds.

Maintain a quarterly evidence pack with issuer and custodian attestations.

Set small position limits and a simple rebalance policy tied to risk budgets.

Explain liquidity in plain language, including weekend and holiday caveats.

Related Posts

- Interview Explainer: Kenneth Rogoff revisits his 2018 Bitcoin call

- Market Forensics: Cardano and Dogecoin led losses as breadth cracked

- Adviser Briefing: UK bitcoin ETNs are opening the gate for professional and retail investors

External Sources

Reuters: Asia’s wealthy investors seek more crypto in portfolios

Capgemini World Wealth Report 2024: Global HNWI trends and digital adoption

Capgemini World Wealth Report portal: Latest updates and datasets

Goldman Sachs Family Office Investment Insights: Eyes on the Horizon report for global family offices

Citi Private Bank Family Office Survey 2024: Regional allocation trends and preferences

KPMG with Aspen Digital: Investing in digital assets guide for HNWIs and family offices

CoinDesk: Asian private wealth managers embrace crypto and plan higher allocations