ARK Invest has increased its exposure to Bitmine Immersion Technologies (BMNR), a public company positioned as an “Ether treasury/infra” play. The move lands amid rising institutional engagement with ETH (ETF inflows, CME OI records) and an accelerating debate over corporate balance‑sheet exposure to crypto beyond Bitcoin. This piece dissects what ARK’s bet likely expresses, how Ether‑treasury models differ from the classic “Bitcoin as treasury” playbook, and where the execution risks live.

Context: why this incremental buy matters

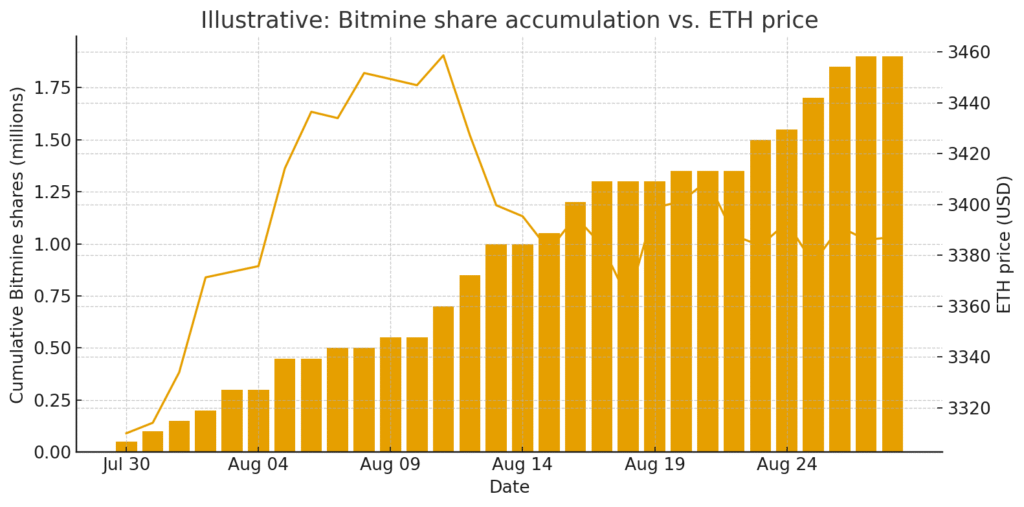

ARK Invest’s additional purchase of Bitmine shares is not simply a punt on a single equity; it’s a statement on a broader thesis: Ether as financial plumbing. Over the last weeks, market structure signals have skewed toward Ethereum: futures open interest on major venues has set fresh highs; spot ETF flows are gradually deepening; and the “settlement layer” narrative is being amplified by traditional finance voices. Against that backdrop, a listed company levered to the ETH stack becomes a proxy exposure for equity investors who cannot or prefer not to hold the asset directly.

Three immediate implications follow:

Proxy demand loop. If institutions are more comfortable adding ETH exposure via equities/ETFs than via self‑custody, names like Bitmine can see flows disproportionate to fundamentals during regime shifts.

Balance‑sheet optionality. An Ether‑treasury strategy can act as a capital allocation lever (treasury assets, staking yield, tokenized T‑bills in the periphery) that ordinary growth companies lack.

Narrative bridge. “ETH rails for stablecoins and tokenized assets” is an easier story for boards and LPs than DeFi jargon. ARK’s buy strengthens that bridge for public market PMs.

Figure 1. A bar/line graphic showing illustrative Bitmine share accumulation vs. ETH price (synthetic)

Issuer dossier: Bitmine at a glance

Business model. Bitmine positions itself at the intersection of ETH infrastructure and treasury management. The company’s disclosures emphasize Ether‑linked treasury exposure and infrastructure/operations aligned with the Ethereum ecosystem. Depending on quarter, revenue mix can tilt between infra services, staking/validation economics, and treasury mark to market.

Exposure pathways.

Treasury ETH (potentially staked or paired with short duration tokenized T‑bills for liquidity management).

Infra services supporting Ethereum or EVM‑compatible networks (validation, data center capacity, ancillary services).

Financial operations that monetize ETH balance sheet posture (basis trades, conservative cash & carry around ETF roll dates, if permitted by policy).

Why it fits ARK’s book.

High beta to ETH macro. As ETH’s role in settlement/stablecoins expands, Bitmine’s multiple can compress/expand with the narrative cycle.

Public‑equity wrapper. It provides compliance‑friendly ETH thematic exposure for ETFs.

Optionality on yield. Staking yield, even post‑withdrawals, remains a structural differentiator vs. non yielding BTC balance sheets.

Key sensitivities.

ETH price and implied vol; validator participation and rewards; ETF flow cadence; regulatory treatment of staking; counterparty/custody risk.

Governance & custody blueprint (for “Ether treasury” companies)

Below is a practical blueprint we use to evaluate corporate Ether treasury strategies. It highlights operational guardrails versus the now familiar Bitcoin treasury model.

1) Policy & governance

Board approved treasury charter specific to ETH (use of staking, LSTs, restaking exclusions, risk limits).

Separation of duties: acquisition, storage, staking decisions, and unwind authority.

Clear KPI linkage: treasury return on risk weighted capital, tracking error vs. policy benchmark (e.g., ETH beta 0.4–0.6 at portfolio level).

2) Custody stack

Segregated, auditable custody with SOC audited providers; cold warm hot key management with quorum.

Staking via institutional validators with slashing insurance and withdrawal credential controls under board policy.

Counterparty diversification (custody, validators, banking).

3) Liquidity & risk

Minimum liquidity buffer in fiat/T‑bills for two quarters of opex.

Drawdown rules: e.g., staged de‑risking if ETH falls >35% peak‑to‑trough while ETF outflows persist >3 consecutive weeks.

Stress testing: validator slashing, depegs on stablecoin rails used for operations, basis compression around ETF events.

4) Disclosure

Quarterly reconciliation of ETH holdings (staked vs. liquid), realized/unrealized P&L, and counterparty concentration.

Sensitivity tables: +/- 20% ETH price; +/- 100 bps staking yield.

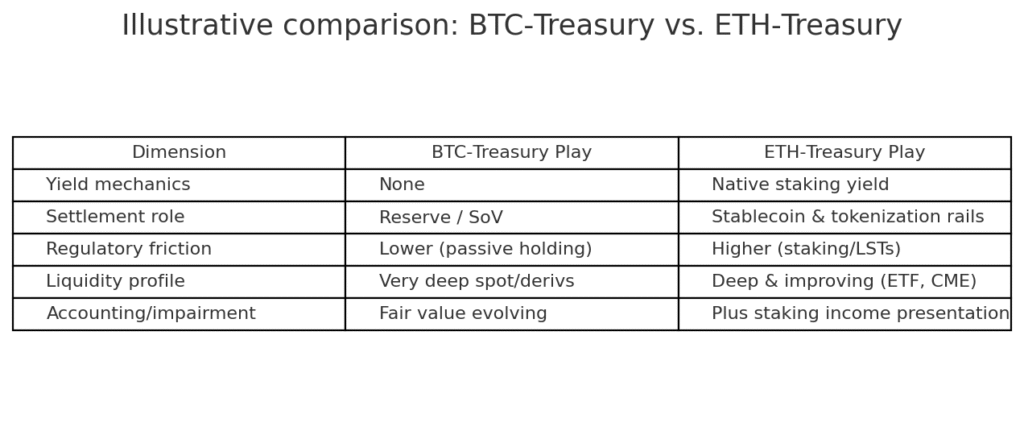

Value add: Comparative table ETH‑treasury vs. BTC treasury (illustrative)

| Dimension | BTC‑Treasury Play | ETH‑Treasury Play |

|---|---|---|

| Yield mechanics | None (unless derivatives) | Native staking yield (policy bounded) |

| Settlement role | Reserve narrative; store of value | Settlement layer for stablecoins/tokenization |

| Regulatory friction | Lower for passive holding | Higher if staking/LSTs involved |

| Liquidity profile | Very deep spot/derivatives | Deep and improving; ETF + CME OI rising |

| Accounting/impairment | Fair value under evolving rules | Similar, plus staking income presentation |

Table is illustrative/synthetic for analytical purposes.

Figure 2. A simple two column comparative visual derived from the table

What ARK may be underwriting

1) The “plumbing premium.” If large banks and fintechs route stablecoin flows over EVM rails, Ether‑centric treasuries could command a structural premium versus pure mining or trading businesses.

2) ETF‑linked reflexivity. As ETF AUM grows, authorized participants’ hedging/rolls create predictable windows of basis dynamics that a well governed Ether treasury can use to improve ROE within strict policy risk limits.

3) Cost of capital advantage. Companies that can demonstrate auditable staking policies and diversified custody may achieve a lower equity risk premium than commodity miners, supporting higher multiples for the same dollar of ETH beta.

Risks to the thesis

Policy shock: any prohibition/restriction on staking for public companies would compress the yield narrative.

ETF flow reversal: multi‑week outflows could impair the “plumbing premium,” especially if coupled with rising realized vol.

Smart‑contract/execution risk: validator misconfiguration, slashing, or counterparty failure at custody/validator level.

Narrative crowding: too many “Ether treasury” equities diluting the scarcity premium.

Bottom line

ARK’s incremental Bitmine buy is a signal that the institutional ETH thesis is broadening from price exposure to infrastructure and balance‑sheet strategy. For equity investors, the question is not whether Ether‑linked treasuries can work they already do in limited forms but which issuers will operationalize governance, custody, and disclosure to deserve a durable multiple.