Big idea

The UK is expanding access to bitcoin ETNs. Professionals already have a pathway on recognized exchanges. Retail access resumes in October under marketing and suitability rules. This can reduce reliance on proxies and normalize crypto exposure in UK portfolios.

ETN versus ETF versus ETP

| Feature | ETN | ETF | ETP |

|---|---|---|---|

| Legal form | Unsecured note that tracks an index | Fund vehicle | Umbrella label for listed structured exposure |

| Key risk | Issuer credit risk | Custody and tracking | Depends on structure |

| Why allocators use it | Fast listing and distribution fit in EU and UK | Familiar wrapper for many platforms | Flexible branding across products |

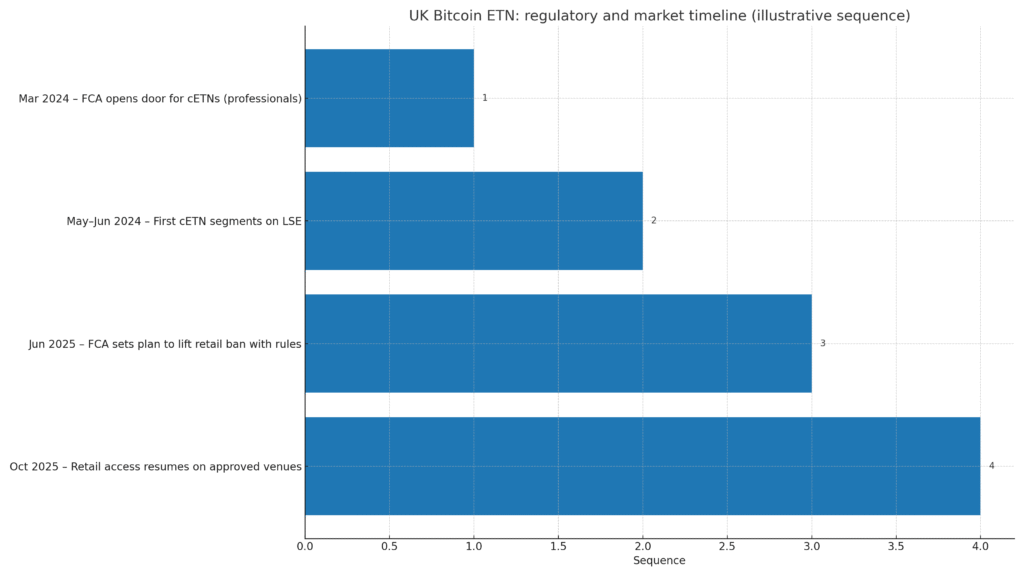

Verified timeline

| Date | Event | Implication |

|---|---|---|

| Mar 2024 | FCA opened the door for crypto ETNs to professionals on recognized exchanges | Institutional pathway established |

| Q2 2024 | ETN segments launched on the London Stock Exchange | Liquidity and listing infrastructure live |

| Jun 2025 | FCA set the plan to lift the retail ban with rules | Marketing and suitability regime defined |

| 8 Oct 2025 | Retail access resumes on approved venues | Broader participation under FCA oversight |

Use case scenarios

| Audience | Why ETN helps | Guardrails to implement |

|---|---|---|

| UK wealth platforms | Fits model portfolios with established documentation flows | Credit risk labeling and position limits by issuer rating |

| Active traders | Exchange venue access and settlement convenience | Product KID, suitability flags, issuer exposure caps |

| Financial advisers | Familiar paperwork and supervision | Client suitability and quarterly issuer attestations |

Adviser toolkit checklist

Client explainer that covers issuer credit risk and product custody.

Quarterly issuer attestation and internal stoplight sizing by rating.

Position limits for retail sleeves and a documented escalation path.

UK bitcoin ETN timeline. See file in the assets section below.

Related Posts

- Amdax Plans A Bitcoin Treasury Company For An Amsterdam Euronext Listing

Solana ‘Alpenglow’ Enters Governance: What 150ms Finality Could Mean for Validators and Apps

- Market Forensics: Cardano and Dogecoin led losses as breadth cracked