A public company with a balance sheet that favors BTC plans to list in Amsterdam through a reverse listing. This read explains the structure, the incentives, and the signals for the region.

The news in plain words

Reuters reports that a bitcoin treasury supported by the Winklevoss brothers will enter the Amsterdam market using a reverse listing with MKB Nedsense. The firm has raised one hundred twenty six million euros and holds more than one thousand bitcoin. After approval the combined company is expected to rebrand and trade as a pure treasury vehicle.

What reverse listing means

A reverse listing places a new business inside an already listed shell that survives the process. Shareholders of the private business receive stock in the public shell and control it after the transaction. The route can be faster than a traditional listing but it still requires approvals and detailed filings.

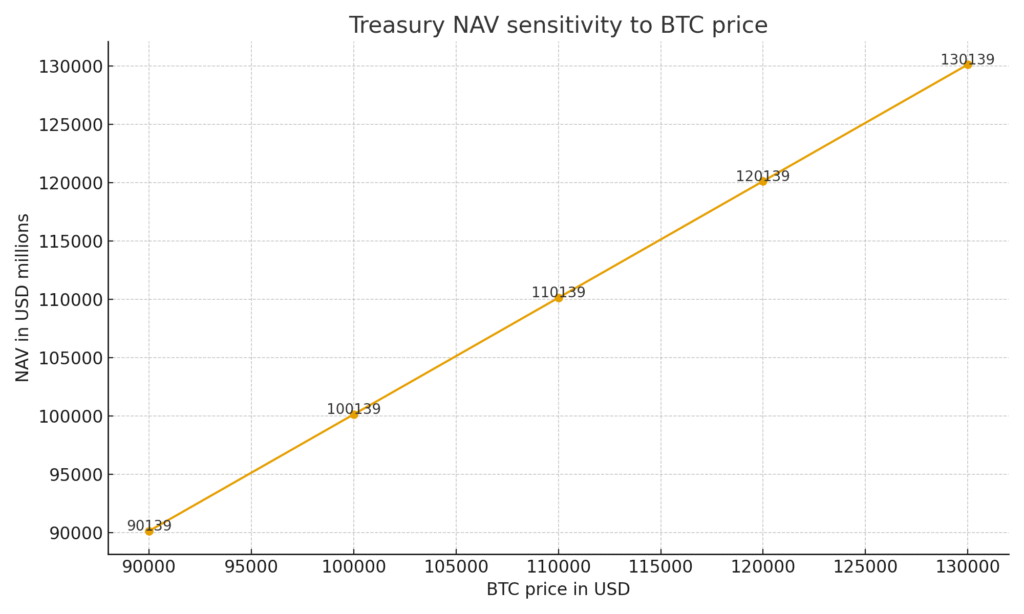

Figure 1. Line chart of treasury NAV in USD millions across BTC prices from 90k to 130k assuming one thousand BTC p

Why Europe and why now

Spot bitcoin funds in the region have grown slower than in the United States. A listed treasury with a simple story can tap demand that prefers direct exposure and less complex products. Amsterdam offers a visible venue with investor protections and with growing digital asset expertise.

Signals for corporate treasurers

Public acceptance of balance sheets that anchor value in bitcoin.

A path to funding that does not require complex trading businesses.

Clearer separation between a treasury vehicle and an exchange or broker.

Risk map for investors

Scenarios for the next quarter

Strong demand lifts volume and attracts more treasury style listings.

Thin liquidity leaves the vehicle trading at a wide discount.

A macro drawdown tests the patience of long only funds and sets a better entry for others.

Final take

A simple listed balance sheet full of bitcoin is a clear signal. If volume shows up the model can spread across Europe. If liquidity is thin the story still matters because it teaches the market how to separate bitcoin holding vehicles from trading firms.

Related Posts

Venus Protocol incident Phishing loss pause and a defense playbook for DeFi teams

Solv and Chainlink enable real time collateral verification for SolvBTC Dossier and blueprint

September market setup Eric Trump in Tokyo Metaplanet capital plan and BTC seasonality risk map

- Gemini IPO Valuation math and what a 17 to 19 range implies for proceeds