What is the Aethir ATH token unlock

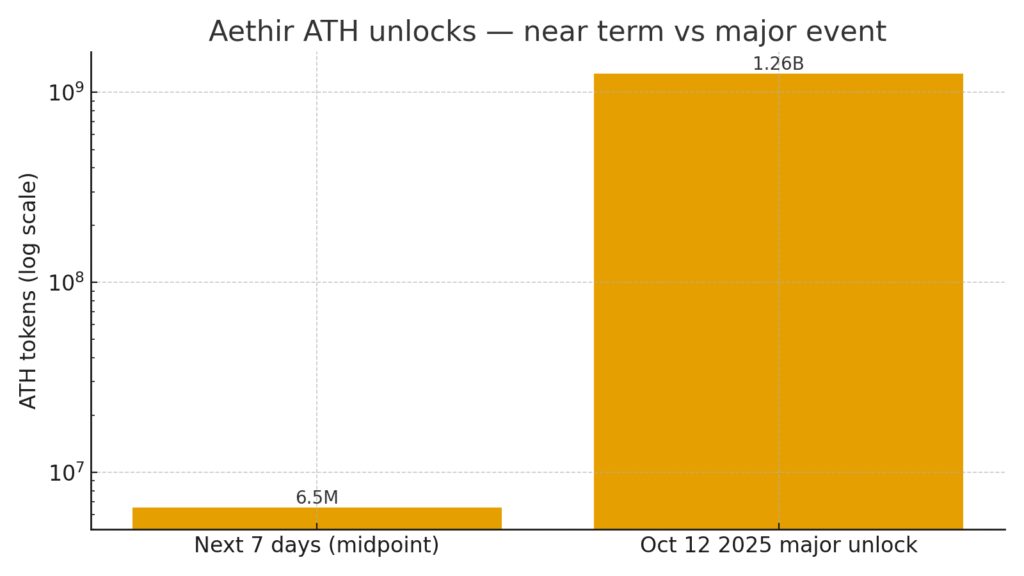

A token unlock is the release of previously locked tokens from a vesting schedule into circulation. For Aethir the next significant date is October 12 2025 with a planned unlock size of approximately 1.26 billion ATH. The source note comes from market data that references TradingView for the calendar entry.How Aethir ATH vesting works

According to the official tokenomics sheet the team allocation is subject to an eighteen month cliff. After that cliff the team tokens vest in a linear schedule over thirty six months. This design delays early selling by insiders and spreads emissions across three years once the cliff ends. Other categories such as ecosystem growth partners and community grants may follow their own schedules set at genesis.Schedule overview and near term context

Below is a simplified view to orient readers. Values are indicative and focus on the dates you care about. Numbers come from the details provided in the brief and public dashboards. Percentages are omitted here because circulating supply can change over time.Timeline snapshot

- Now to the next week small unlocks in the low millions of ATH flagged by DropsTab. The percentage impact appears minimal at current float.

- October 12 2025 large unlock about 1.26 billion ATH. Tracked across market calendars including TradingView items and other unlock dashboards.

- Post cliff for team eighteen months after token generation the team schedule begins linear vesting for thirty six months. Monthly releases follow the allocation rules in the tokenomics sheet.

Unlock schedule table visual

| Date | Category | Amount ATHATHATH | Share of current circulation | Source note |

|---|---|---|---|---|

| Next 7 days | Ecosystem and incentives | ~3,000,000 to 10,000,000 | < 1% indicative | DropsTab dashboard labels |

| 12 Oct 2025 | Major unlock window | 1,260,000,000 | TBD at date | TradingView calendar trackers |

| From team cliff end | Team linear vesting monthly | Over 36 months | n/a | Official tokenomics sheet |

Figure 1. Aethir ATH token unlock October 12 2025 bar chart showing 1.26B ATH on Oct 12 versus ~6.5M in the next 7 days on a log scale.

Benefits and risks around the October unlock

Potential benefits

Clarity for the market a well signposted unlock can reduce uncertainty.

Distribution to long term stakeholders emissions often move tokens from locked insiders to circulating holders and ecosystem users.

Liquidity support larger float may improve market depth if market makers prepare inventory.

Main risks

Supply overhang a large unlock can pressure price if demand is not ready.

Calendar crowding if other categories overlap the emission window volatility can rise.

Behavioral flow early recipients might rebalance into stablecoins or other assets.

Risk matrix for Aethir ATH unlock

| Risk | Likelihood short term | Impact | Mitigation ideas |

| Supply sells into thin books | Medium | High | Communicate schedules early, arrange market maker depth, align emissions with milestones |

| Information gaps about recipients | Medium | Medium | Publish category breakdowns and label addresses where possible |

| Confusion about team cliff and vesting math | Medium | Medium | Visual timeline plus monthly emission table from tokenomics sheet |

People Also Ask oriented answers

Is the Aethir ATH unlock on October 12 2025 confirmed

The date appears on market calendars that track unlocks and is referenced via TradingView items. Always verify against the official tokenomics sheet and the project announcements.

How big is the Aethir ATH unlock

The figure cited in market trackers is about 1.26 billion ATH for the October event. Additional small unlocks in the millions of ATH may happen around adjacent windows according to DropsTab labels.

Does the team have a lockup and vesting

Yes. The team allocation carries an eighteen month cliff followed by thirty six months of linear vesting as stated in the official tokenomics documentation.

Will the Aethir ATH price drop after the unlock

No one can predict price. Unlocks add supply which can weigh on price if demand is weak. On the other hand if the market expects the unlock and builders align releases the effect can be muted.

What to watch next

Final confirmation from official channels on the October window and any tranche breakdown.

Updated dashboards from DropsTab and other trackers as the date approaches.

Exchange notices about wallet maintenance or new listings that could change liquidity at the margin.

Any alignment between emissions and product shipping that could offset sell pressure.

1 Comment

Pingback: Vitalik Buterin on EU Chat Control privacy security and crypto implications - The Crypto Tides