Issuer dossier for Euro stablecoin

Who is behind the euro stablecoin A group of major European banks has created a dedicated company to launch a euro stablecoin that meets banking‑grade risk, compliance and governance standards. The initiative aligns with EU policy that encourages tokenized money under MiCA while preserving consumer protection and financial stability. What the product aims to be A fully‑reserved digital representation of euros with transparent backing in cash and short‑dated safe assets held with supervised entities. The design targets instant settlement on public blockchains and private rails, with strict redemption at par. Why now Payments are fragmenting across cards, account‑to‑account schemes, instant rails and crypto. A bank‑issued euro stablecoin can unify experiences for ecommerce, B2B invoicing, brokerage funding and on‑chain settlement while giving supervisors clearer oversight relative to offshore tokens. Where it would launch Rollout would prioritize European Economic Area jurisdictions and venues with robust KYC/AML controls. The company structure allows the banks to ring‑fence operational risk, pursue partnerships and scale across chains.Governance and custody for Euro stablecoin

Reserves and attestation Reserves consist of cash and high‑quality liquid assets segregated from bank balance sheets. Independent attestation and monthly reporting document composition, maturity, counterparties and concentration limits. Smart‑contract controls Contracts include mint/burn, upgrade timelocks, circuit breakers and allow‑lists where required. Issuer keys follow multi‑party policies, HSM protection and auditable workflows with role separation. Compliance Wallet screening, travel rule data exchange and sanctions controls integrate with banking systems. Primary mints and redemptions occur through KYC’d channels, with secondary‑market monitoring for anomalies. Custody paths End users can self‑custody or use bank/regulated custodians. For enterprises, treasury sub‑accounts, whitelists and policy engines enforce spending rules, limits and approval chains.How the euro stablecoin would work for users

- A verified customer deposits euros with a participating bank.

- The issuing company mints euro stablecoin tokens one‑for‑one and credits the user’s address.

- Users pay merchants, fund exchanges, settle invoices or interact with DeFi, subject to jurisdictional controls.

- At redemption, tokens are burned and euros are sent back to the customer’s bank account at par.

Benefits and risks of a euro stablecoin by European banks

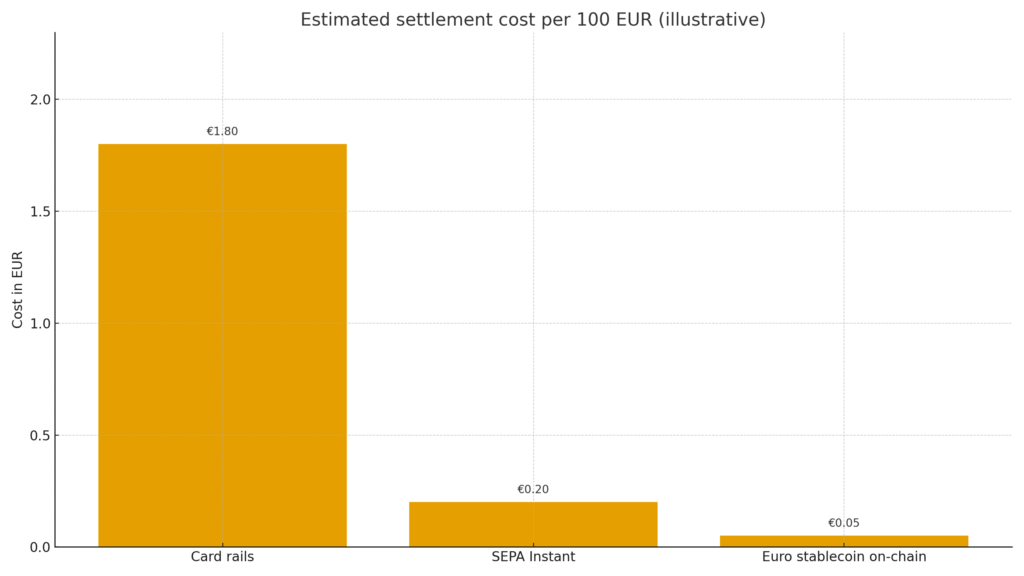

Benefits- Faster settlement windows for ecommerce and B2B compared with card rails.

- Reduced FX friction inside the eurozone and simpler reconciliation.

- On‑chain composability for payments, brokerage funding and tokenized assets.

- Stronger consumer protection via audited reserves and supervised issuers.

- Smart‑contract or key‑management failures if controls are weak.

- Fragmentation if multiple euro stablecoin models are not interoperable.

- Regulatory changes or caps on wallet types and cross‑border use.

- Bank‑level de‑risking could limit access for some fintechs and merchants.

Market context and comparison for Euro stablecoin

Below is a quick comparison of euro stablecoin options and initiatives. It highlights issuer type, compliance posture and likely use cases.| Product or initiative | Issuer type | Reserve model | Likely chains | Primary use cases |

|---|---|---|---|---|

| Bank consortium euro stablecoin | Multiple EU banks via new company | Cash and HQLA at supervised entities with attestations | EVM chains and permissioned rails | Retail and enterprise payments, brokerage, settlements |

| EURC (Circle) | Fintech e‑money issuer | Cash and short‑dated securities, regular attestations | EVM and non‑EVM | Commerce, exchange funding, remittances |

| EUROe (various) | Licensed e‑money issuer | Cash reserves at EU institutions | EVM and L2s | Merchant payments, treasury |

| Private bank tokens | Single bank | On‑ledger deposits or tokenized claims | Private/permissioned | B2B settlement, cash management |

Figure 1. Estimated settlement cost per 100 EUR

PAA for euro stablecoin

Is there any euro stablecoin Yes. Several euro stablecoin products exist from licensed e‑money issuers and fintechs, and a bank consortium is now advancing a fully‑reserved, supervised option aimed at retail and enterprise payments.

Is there an euro stablecoin on Binance Listings vary over time. Major exchanges typically support one or more euro stablecoin tickers, subject to liquidity and compliance. Availability depends on jurisdiction and the issuer’s listing agreements.

What is the top 5 stablecoin By market cap, dollar‑pegged tokens dominate. Among euro units, market caps are smaller but growing. A bank‑backed euro stablecoin could increase adoption by adding credibility, payment acceptance and integration with banking rails.

Is there an euro Tether coin There have been euro‑denominated tokens from well‑known issuers. For payments in Europe, a supervised bank‑issued euro stablecoin with clear redemption and attestations may be preferred by merchants and corporates.

What to watch next for euro stablecoin adoption

Regulatory filings and approvals under MiCA for e‑money tokens and significant asset‑referenced tokens.

Reserve transparency standards, including auditors and disclosure cadence.

Chain selection, bridges and interoperability standards to avoid fragmentation.

Merchant acceptance, fee schedules and settlement terms relative to cards and account‑to‑account instant rails.

Sources and methodology for Euro stablecoin

This analysis relies on public announcements, regulatory frameworks and market comparisons. External sources are listed at the end of the post as clean hyperlinks.

Conclusion on Euro stablecoin adoption

A euro stablecoin issued by European banks could shift on‑chain payments from speculative to practical by combining audited reserves, banking compliance and open networks. If the consortium executes on reserves, contracts and merchant acceptance, 2025 could mark a decisive phase for euro‑denominated digital cash in commerce and DeFi.

3 Comments

Pingback: What is SharpLink tokenization on Ethereum and why it matters for public equity in 2025 - The Crypto Tides

Pingback: Vitalik Buterin on EU Chat Control privacy security and crypto implications - The Crypto Tides

Pingback: SWIFT builds on Linea what it means for payments and Ethereum L2 in 2025 - The Crypto Tides