Executive summary

IG Group will acquire Australian exchange Independent Reserve to expand its digital asset footprint in Asia Pacific. The transaction values the business at approximately one hundred seventy eight million Australian dollars. IG will purchase an initial seventy percent stake with an option to acquire the remaining thirty percent subject to performance triggers and approvals. Management guides to cash earnings per share accretion in the first full financial year after completion. Closing is expected after regulatory clearances in Australia and Singapore.Why IG Group acquires Independent Reserve

- Strategic rationale. Scale presence in regulated crypto markets across Australia Singapore and New Zealand where Independent Reserve already holds local approvals. Leverage IG distribution to cross sell crypto to active traders and wealth clients while importing IG risk controls.

- Deal perimeter. Acquisition of a controlling interest in Independent Reserve equity. Enterprise value implies a revenue multiple consistent with fast growth regional exchanges with strong compliance posture.

- Integration plan. Keep the Independent Reserve brand and leadership for local trust. Align custody standards market surveillance and treasury operations with IG policies. Build shared liquidity where possible while preserving domestic order books.

- Funding and metrics. Considerable balance sheet capacity and strong cash generation support the purchase. The company targets accretive cash earnings per share in the first full year post close.

Governance and custody under IG Group acquires Independent Reserve

Custody. Harmonize key management and wallet segregation with IG security standards. Cold storage with multi party controls insurance coverage with explicit limits and daily reconciliation between on chain balances and general ledger. Market surveillance. Expand abuse detection on spoofing layering wash trading and cross venue manipulation. Share alerts between exchange operations and IG central risk. Client protections. Strengthen segregation of client assets and margin procedures. Maintain transparent incident response with plain language disclosures. Compliance. Align travel rule screening sanctions checks and fiat on ramp monitoring across both organizations. Document change management for any product launches.

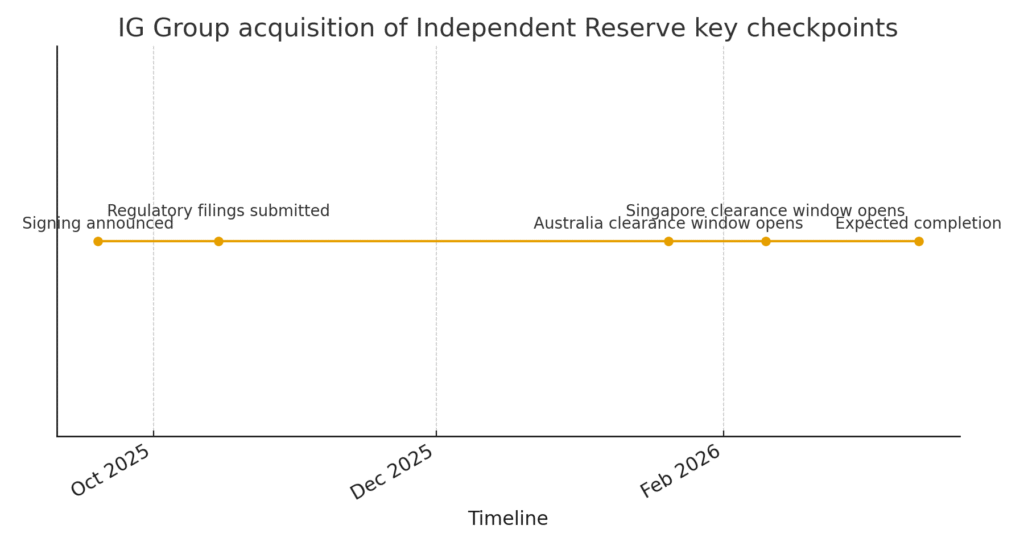

Figure 1. Chart of IG Group acquires Independent Reserve integration plan

Deal terms checklist

Initial stake. Seventy percent acquisition with future option on the remaining thirty percent.

Valuation headline. Enterprise value around one hundred seventy eight million Australian dollars.

Earn out. Additional consideration contingent on fiscal twenty twenty six performance.

Approvals. Australia and Singapore regulators. Expected completion in early twenty twenty six.

Financial impact. Targeted accretion to cash earnings per share in the first full year after close.

Integration priorities after IG Group acquires Independent Reserve

Wallet and treasury harmonization. Align cold storage addresses policy limits withdrawal queues and signatory rules.

Risk and compliance bridge. Unify surveillance tooling and alert workflows. Calibrate thresholds to local market microstructure.

Product roadmap. Expand fiat rails and market access while maintaining conservative listings. Introduce safer retail education modules.

Communications. Proactive messaging to clients partners and regulators stressing continuity of service and stronger protections.

Impact of IG Group acquires Independent Reserve on Asia Pacific markets

Creation of a joint risk committee. Disclosure of named custody partners. Timeline from signing to regulatory clearance. Net promoter score changes among Australian and Singapore client cohorts. Monthly changes in verified users and fiat flows. Realized spread and depth on top trading pairs.

Conclusion

The IG Group acquires Independent Reserve deal positions the firm as a stronger player in regulated digital assets across Asia Pacific. With integration plans underway and regulatory approvals pending, the acquisition could reshape competition and client access in 2025 and beyond

3 Comments

Pingback: mXRP turns dormant XRP into productive capital - The Crypto Tides

Pingback: Morgan Stanley crypto trading via E*Trade what it means for Bitcoin Ethereum and Solana 2025 - The Crypto Tides

Pingback: MEXC Cecilia Hsueh at TOKEN2049! new Chief Strategy Officer sets strategy for 2025 - The Crypto Tides