Executive summary

The first United States spot exchange traded fund that holds XRP directly begins trading today on Cboe BZX under the ticker XRPR. The issuer group known as REX Osprey offers regulated exposure through a physically backed structure. This launch arrives after a shift in exchange listing standards that simplifies the path for spot crypto ETFs beyond bitcoin and ether. The venue listing and the rules change open a new access lane for advisors and traditional allocators who prefer an exchange traded wrapper. Early sessions will focus on spreads, primary market activity and assets under management growth which together set the tone for tracking quality and long term adoption.Issuer dossier

- Product identity. Name REX Osprey XRP ETF. Ticker XRPR. Listing venue Cboe BZX. Structure physically backed with direct XRP holdings. Target users advisors wealth platforms hedge funds and retail brokerage accounts.

- Commercial thesis. Distribution first since many platforms cannot hold tokens directly. Liquidity bridge as authorized participants arbitrage ETF units versus XRP on multiple venues. Brand leverage by combining ETF engineering with crypto native expertise.

- Differentiators to watch. Creation basket policy and the size and cadence of in kind flows. Fee path including any launch waivers. Clear marketing compliance and benchmark choices that support platform onboarding.

Governance and custody blueprint

Custody is the central operational risk. Best practice uses segregated cold storage with multi party controls audited access logs insurance coverage with explicit limits and daily reconciliation between on chain balances and fund accounting. Valuation relies on a transparent pricing methodology that aggregates high quality venues into a repeatable net asset value. A broad network of authorized participants and market makers improves primary market efficiency and helps keep spreads tight. Oversight includes sanctions screening provenance checks surveillance for abnormal flows and documented incident response pathways.Market structure implications

A United States listed spot vehicle tends to attract incremental demand from passive allocators and cross over funds. Over time that demand can move order flow from offshore venues into regulated pipes. If XRPR scales the arbitrage of creations and redemptions can stabilize intraday pricing. As listed derivatives expand the ETF can serve as a reference that aligns spot futures and options which supports tighter spreads and deeper books. Meeting data quality and liquidity thresholds can also open the door to index inclusion and model portfolio adoption.What to watch in the first thirty days

- Primary market activity measured by the count of creation and redemption events and the median size per event.

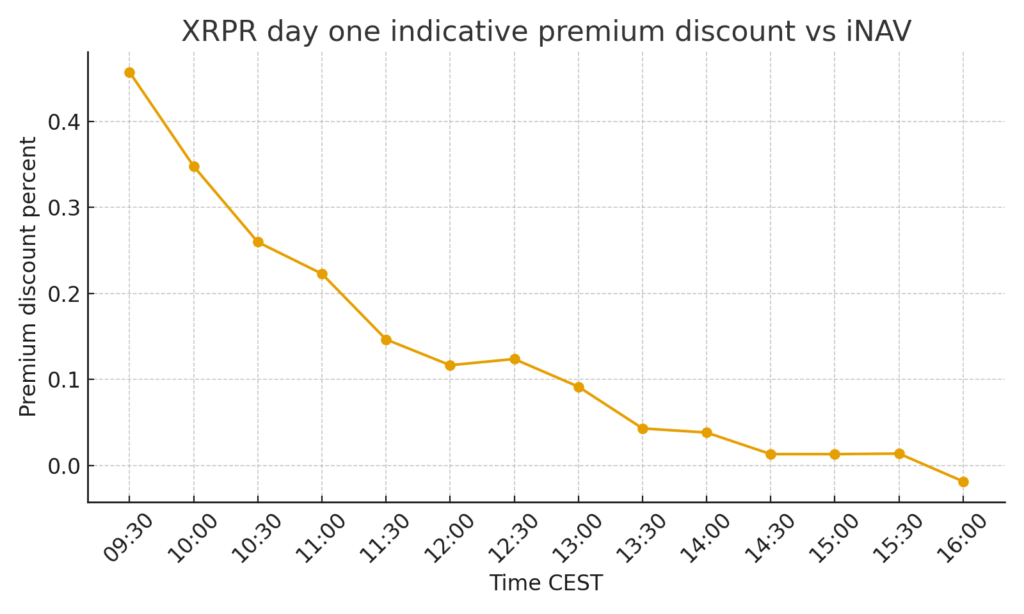

- Premium discount behavior versus indicative net asset value during volatile intervals.

- Tracking difference versus a clear spot reference over the first month.

- Assets under management breakpoints at one hundred million and five hundred million which often unlock distribution on large platforms.

- Temporary fee waivers that can accelerate early adoption.

Risk factors

Operational interruptions at custodians or price feed providers can force fair value pricing and widen spreads. Regulatory interpretation may evolve and introduce new disclosure or wallet movement restrictions. Concentration in a small set of authorized participants can create bottlenecks during stress. Early two way quotes can look tight while true depth remains shallow so on screen depth across multiple levels matters.Scenario analysis

Base case. Gradual asset growth led by advisors and retail brokerage platforms with spreads held within a narrow band as the authorized participant network broadens. Upside case. Fast inclusion by model portfolio strategists and thematic funds which pushes assets past the first hundred million and leads to tighter spreads. Downside case. Operational hiccups or a macro risk off impulse that slows creations and leaves persistent discounts until confidence returns or fees reset.Checklist for allocators

- Custody coverage with clear policy limits.

- Named and diversified authorized participants and prime brokers.

- Public and verifiable pricing methodology.

- Predictable creation basket windows with reasonable cut off times.

- Competitive fee path after any launch waivers expire.

Launch day premium discount

Figure 1. XRPR day one indicative premium discount versus indicative NAV during launch day trading hours

Access and trading

XRPR is listed on the Cboe BZX Exchange and is accessible through brokers that route orders to US equity exchanges. Investors should search for the ticker XRPR inside their brokerage platform and consider using limit orders during the first sessions to avoid slippage. Availability can vary by jurisdiction and account type. In the European Economic Area some brokers restrict access to US domiciled ETFs if a KID is not provided under PRIIPs rules which may require using a locally compliant wrapper instead. Standard equity market hours apply with potential price discovery extensions in pre market and after hours where supported by the broker.

Conclusion

The listing of XRPR turns XRP access into a portfolio native instrument for mainstream investors. The next thirty days will define spreads tracking and institutional trust. A clean execution can set a repeatable template for additional spot digital asset products in the United States.

4 Comments

Pingback: mXRP turns dormant XRP into productive capital - The Crypto Tides

Pingback: Ethereum Fusaka upgrade slated for December with higher blob capacity - The Crypto Tides

Pingback: IG Group acquires Independent Reserve to expand digital assets in Asia Pacific - The Crypto Tides

Pingback: Ripple expands custody network in Africa with Absa Bank after RLUSD rollout - The Crypto Tides