Opening

Polymarket moves quickly after securing a compliant route back into the United States. Meanwhile, the platform adds earnings prediction for listed companies. Traders price outcomes such as beat, meet, or miss, and they follow resolution rules tied to official filings. In turn, election momentum meets quarterly results and pushes activity beyond politics and sports. As a result, liquidity has more places to go each week.Issuer Dossier

| Item | Detail |

|---|---|

| Operator | Polymarket with US access routed through QCEX exchange and clearing |

| Product scope | Earnings outcome markets plus selected corporate events |

| Resolution sources | Company press releases, Form 8 K or 10 Q, and recognised price references at close |

| Primary integration | Stocktwits interface for discovery and discussion |

| Geography | Global access where permitted with a compliant US on ramp |

| Objective | Bring real time crowd forecasts to earnings season with transparent rules and audit trails |

Governance and Custody Blueprint

Regulatory footing QCEX provides a supervised exchange and clearing stack for fully collateralised event contracts. In addition, policies cover onboarding, eligibility, market surveillance, and incident handling. The aim is orderly risk and consistent rule application. Market design Each question states the event window and the exact resolver. Contracts are cash settled. Moreover, position limits and order size caps apply where required. A public rules page documents dispute paths and final sources. Funds and custody Client balances remain segregated at the clearing layer. Separation of duties protects signers and operational keys. Reconciliations run intraday and at end of day. When rare events occur, playbooks define pause and unwind steps. Data and audit Rule changes receive version numbers. Executions and fills carry immutable identifiers. In addition, resolution pages reference external sources so reviewers can reproduce outcomes after the event.Coverage map for earnings markets

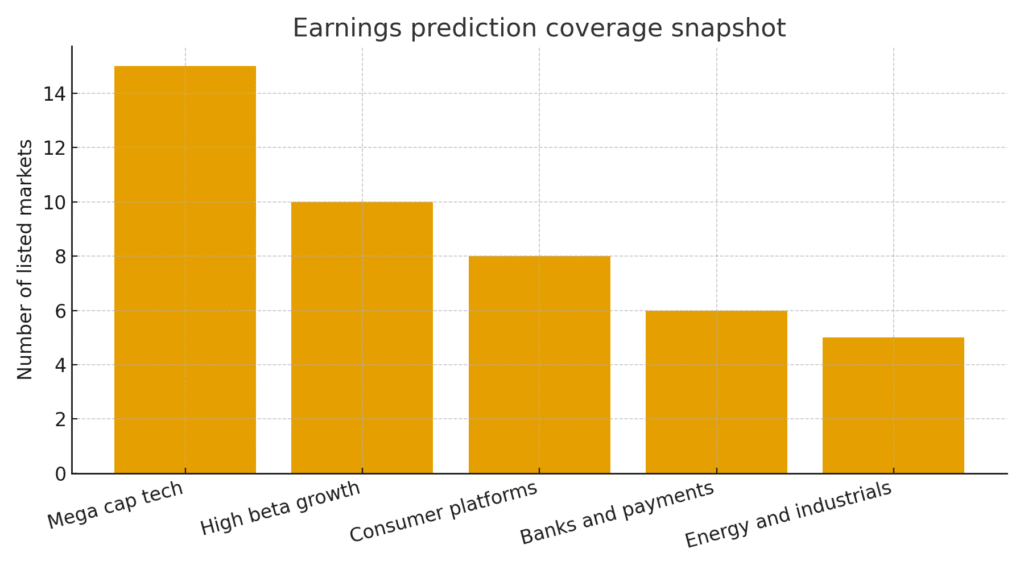

| Company type | Example tickers | Typical question | Resolution reference | Notes |

| Mega cap tech | NVDA, AAPL, AMZN | Will revenue exceed the published consensus this quarter | Company release and a named consensus snapshot at announcement | High interest and deep liquidity |

| High beta growth | COIN, RIOT, MARA | Will EPS beat the median estimate | Form 8 K or 10 Q plus the consensus snapshot | Useful for miners and exchanges |

| Consumer platforms | ABNB, UBER, SHOP | Will guidance come in above the current midpoint | Company press release and transcript | Guidance language can drive volatility |

| Banks and payments | JPM, V, MA | Will net income beat the consensus range | Company materials and consensus at announcement | Clean references and stable calendars |

| Energy and industrials | XOM, CVX, CAT | Will buybacks or capex change above a set threshold | Press release and filing notes | Non earnings actions give extra angles |

- Name the resolver and the resolution window in plain language.

- Then state the consensus source and snapshot timing.

- Block trading from ineligible geographies and categories.

- Enforce position limits and run surveillance alerts.

- Finally, publish post mortems for any disputed outcome.

Figure 1. Number of earnings prediction markets by category including mega cap tech high beta growth consumer platforms banks and payments and energy and industrials with mega cap tech leading

Conclusion

In short, Polymarket broadens beyond politics with earnings questions. The US path through QCEX gives a compliant route. Therefore, clear rules for resolution and custody protect users while keeping markets transparent. As coverage expands, daily activity should rise into each earnings window.