Executive overview

London Stock Exchange Group launches a blockchain platform for private funds. First, the system covers the full lifecycle. It manages issuance, subscriptions, register maintenance, secondary transfers and post trade servicing. As a result, workflows shrink and errors drop. In short, allocators see positions faster and with fewer reconciliations.Issuer Dossier

| Item | Detail |

|---|---|

| Platform name | Digital Markets Infrastructure |

| Segment | Private funds with expansion to other asset classes |

| Core workflow | Issuance, subscriptions, register, secondary transfers, settlement, servicing |

| First clients | MembersCap as manager and Archax as venue and custody partner |

| Technology | Microsoft Azure with a permissioned ledger for tokenisation |

| Objective | Faster settlement, better visibility, lower admin effort |

Why this matters now

Private markets keep growing. Even so, many tasks still depend on email and spreadsheets. Consequently, records fragment across teams. A single venue that unifies issuance, positions, cash flows and servicing removes duplication. Therefore managers launch faster. Meanwhile, allocators track exposure in near real time.Market context

Across capital markets, exchanges and banks move from pilots to live tokenised workflows. In practice, attention shifts from coin prices to regulated market plumbing. Because of this, London now joins the race to standardise tokenised fund operations across Europe. Notably, the focus sits on control, audit trails and time to settlement.

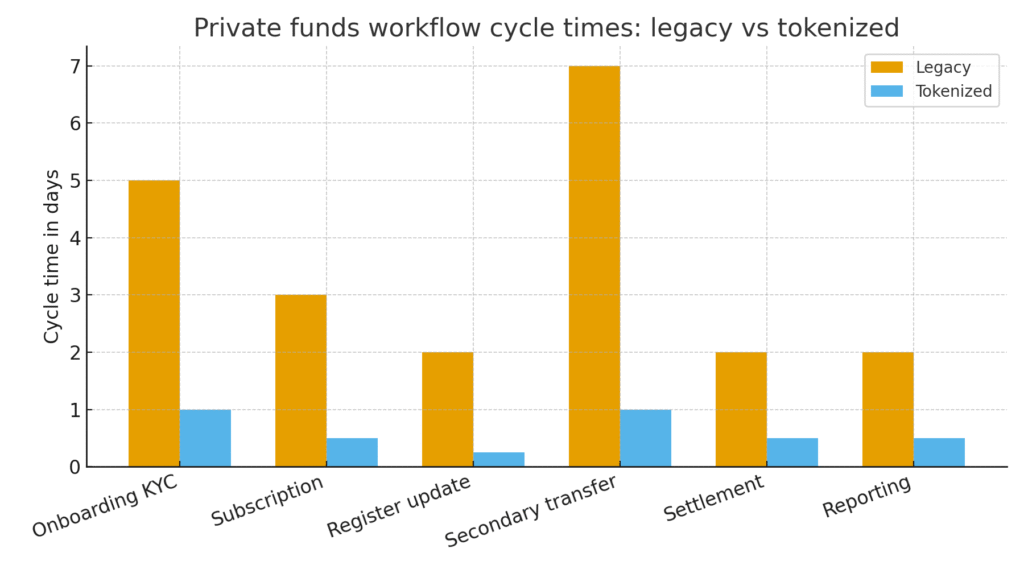

Figure 1. Cycle times in days for legacy versus tokenised workflows across onboarding KYC subscription register maintenance secondary transfer settlement and reporting

Governance and Custody Blueprint

Actors and roles MembersCap issues a private reinsurance fund through LSEG Digital Markets Infrastructure. In addition, Archax acts as market venue, custody partner and nominee for qualified investors. LSEG operates the permissioned ledger and workflow. Meanwhile, Microsoft Azure provides the cloud stack and security controls.

Asset model Units in the fund appear as tokens on a permissioned ledger. The investor register stays in sync with the token registry. Transfers occur only between whitelisted wallets after eligibility checks. As a safeguard, policy rules block any non compliant movement.

Recordkeeping and controls This platform keeps a canonical record for issuance, subscriptions, register updates and servicing. KYC and AML checks sit inside onboarding. In addition, role based approvals and four eyes checks govern issues and transfers. Every event is logged for audit. Therefore teams can trace decisions without extra email trails.

Investor lifecycle First, onboard and verify eligibility. Next, subscribe and reconcile cash. After that, update the register and whitelist the wallet. When offering documents allow it, transfer units. Finally, receive income and reports inside the same workflow.

Interoperability Data and events appear in LSEG Workspace for portfolio views. At the same time, the platform connects to traditional rails and selected distributed ledgers. This mix lets firms adopt tokenisation without replacing core systems on day one.

Risk controls and resilience Custody uses legal segregation. Keys sit in HSMs with separation of duties. In addition, business continuity and disaster recovery exist at cloud and app layers. As a result, operations continue during incidents.

Operational blueprint at a glance

| Workflow step | System owner | Control | Ledger record | Intended settlement window |

| Onboarding and eligibility | LSEG with KYC providers | Document checks and sanctions screening | Investor identity and wallet whitelist | Same day once complete |

| Subscription and cash match | Asset manager and banking partners | Source of funds and reconciliation | New units minted against subscription | T plus zero to T plus one |

| Register maintenance | LSEG registrar | Four eyes approval | Holder balance and restrictions | Continuous |

| Secondary transfer | Archax venue and LSEG | Allow list and offer constraints | Transfer with full audit trail | Near real time when permitted |

| Corporate actions and income | Asset manager and admin | Entitlement calculation and distribution approval | Payment instructions and confirmations | T plus one to T plus two |

Checklist for adoption

Define investor eligibility and wallet policies.

Map cash settlement rails and currency options.

Configure reporting templates for allocators and auditors.

Assign operational roles for approvals and cutoffs.

Run a parallel reconciliation for the first two cycles.

Conclusion

In short, LSEG moves tokenisation from pilot to production for private funds. One workflow joins issuance, register, transfers and servicing. As a result, cycles shorten and reconciliations fall. Finally, the first live use with MembersCap and Archax gives other managers a clear path to adopt regulated rails without bespoke stacks.

2 Comments

Pingback: Solana leads the market as traders brace for a Fed rate cut - The Crypto Tides

Pingback: Polymarket adds earnings prediction markets after US clearance - The Crypto Tides