Market Overview

Bitcoin’s network hashrate has surged to an unprecedented record, underscoring the immense computational power securing the blockchain. At the same time, BTC price action has successfully reclaimed the 115K level, renewing bullish momentum as traders cast their eyes on the symbolic 120K threshold. The convergence of record hashrate strength and positive market sentiment suggests strong fundamentals, yet potential risks loom that could disrupt this upward trajectory.Daily Market Pulse

A snapshot of the current short-term dynamics shaping Bitcoin:| Metric | Value | Trend |

|---|---|---|

| BTC Perpetual Funding Rate | +0.018% | Slightly elevated, showing long bias |

| ETH Open Interest | $9.8B | Rising, reflects growing risk appetite |

| BTC Dominance | 54.2% | Stable, consolidating |

| 30-Day Realized Volatility | 41% | Increasing, indicates sharper swings |

Miners Face Margin Squeeze, Explore AI Pivot

Behind the record-breaking hashrate lies a challenging reality for miners. Rising energy costs and tougher competition are compressing profit margins across the industry. As a result, some operators are exploring diversification into artificial intelligence workloads, repurposing high performance hardware and infrastructure to meet growing AI demand.

This strategic pivot highlights a broader industry transformation. Mining farms are increasingly being repositioned as advanced data centers, where Bitcoin mining is only one of multiple business lines. The ability of miners to balance blockchain security with AI services could determine hashrate sustainability and long-term network resilience.

Price Momentum: The 115K Recovery

Bitcoin’s rebound above the 115K mark has energized bulls, reinforcing the case that institutional inflows and ETF demand are providing strong market support. On chain data confirms sustained accumulation by long term holders, while U.S. spot ETFs have posted four consecutive days of positive inflows.

Technical analysis suggests immediate resistance around 118.5K and a crucial breakout zone at 120K. A decisive move beyond this barrier could trigger momentum driven buying and widespread short covering, adding fuel to the rally.

Three Key Risks That Could Derail the Rally

Despite the bullish setup, analysts warn that several risks could disrupt Bitcoin’s push toward 120K:

Macroeconomic headwinds: Rising deficits in the United States and shifting interest rate expectations could spark risk-off sentiment, dragging crypto lower.

Miner capitulation: As margins shrink, smaller miners may be forced to liquidate holdings, adding selling pressure to the market.

Regulatory shocks: Unresolved SEC rulings and new global frameworks could curb institutional flows and sentiment.

Comparative Analysis

| Bullish Drivers | Bearish Drivers |

|---|---|

| Record hashrate indicates robust security | Miner profitability at risk |

| Spot ETF inflows sustain momentum | Macroeconomic uncertainty persists |

| Long term holders show strong accumulation | Regulatory decisions still pending |

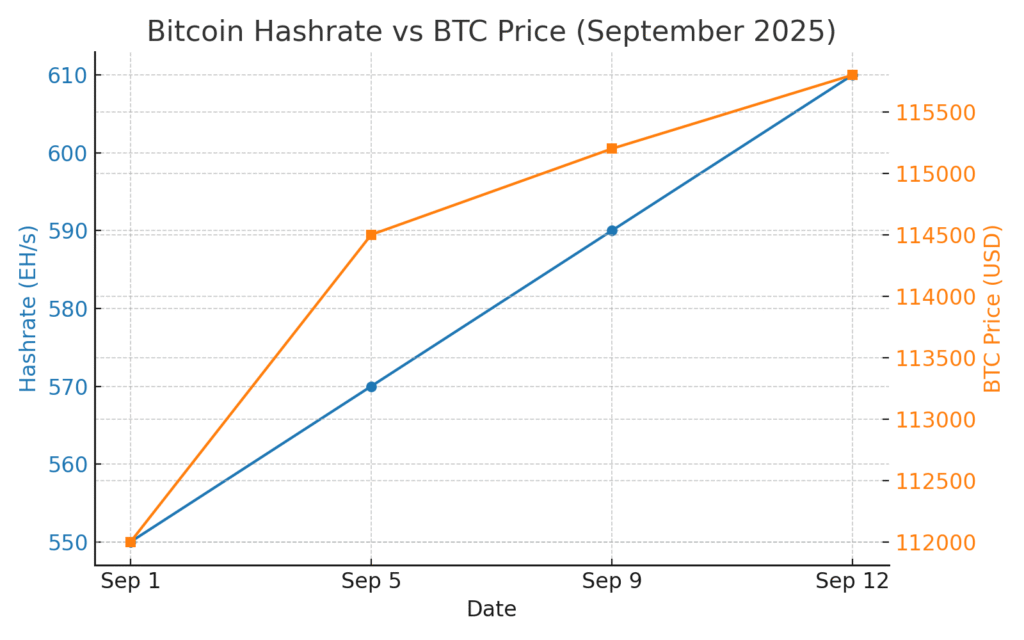

Figure 1. Line chart comparing Bitcoin hashrate growth in exahashes per second and BTC price in USD during September 2025, showing both metrics rising together.

Conclusion

Bitcoin stands at a crossroads. The record-breaking hashrate reinforces the network’s long-term resilience, while the price reclaim of 115K highlights renewed institutional and retail demand. Yet the road to 120K is not guaranteed. Macroeconomic uncertainty, miner stress, and regulatory unknowns remain potential obstacles. Traders and investors must weigh these bullish and bearish forces carefully, as the next breakout could define the trajectory of the broader crypto market into year-end.

4 Comments

Pingback: London Stock Exchange launches blockchain platform for private funds - The Crypto Tides

Pingback: France challenges EU crypto passporting under MiCA - The Crypto Tides

Pingback: Solana leads the market as traders brace for a Fed rate cut - The Crypto Tides

Pingback: Polymarket adds earnings prediction markets after US clearance - The Crypto Tides