Summary

BBVA will use Ripple Custody to deliver regulated safekeeping for digital assets in Spain. The first phase covers bitcoin and ether. As a result, customers get approvals, segregation and clear reports that feel like banking. Meanwhile, MiCA provides a rulebook that lowers launch risk and clarifies roles. Looking ahead, the same platform can secure tokenized assets once demand and policy mature.

Alliance dossier

Scope

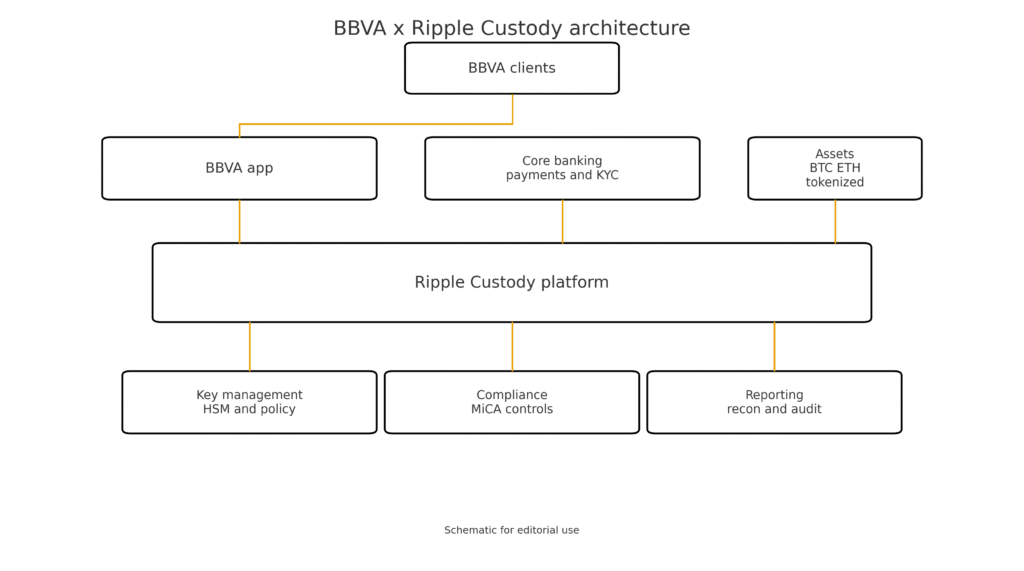

BBVA connects its mobile app and core banking to Ripple Custody. The integration supports buy flows, deposits, withdrawals and vault grade storage. In practice, positions sit in segregated accounts and move only under policy based approvals.

Objectives

Reduce operational risk for retail and wealth clients. Keep identity, limits and reporting inside the bank perimeter. In addition, give risk and treasury teams reliable data in the dashboards they already use.

Why now

MiCA is active across the European Union. Therefore banks finally have clarity on custody, disclosure and incident response. Customers want safer rails than exchange wallets, so BBVA can meet that demand with a compliant stack.

What Ripple brings

Ripple Custody is the institutional platform built on technology from the Metaco acquisition. It provides hardware backed key management, policy engines for approvals, lifecycle tools for tokens and full reconciliation hooks. Moreover, the design sits beside bank identity and audit systems rather than replacing them.

Custody infrastructure blueprint

Customer entry

The BBVA app presents purchase and deposit flows that feel familiar. Identity checks, risk scoring and payments remain in the bank core. Orders settle to Ripple Custody under bank policy so the journey stays simple.

Safekeeping core

Keys live in hardware security modules. Policies define who can sign, on which device, during which time window and under which limit. As a safeguard, emergency controls and allow lists limit risky pushes.

Compliance layer

MiCA requires proof of control for private keys, daily reconciliation, clear disclosures and tested incident playbooks. Ripple Custody exposes the signals compliance teams need for reviews, attestations and reports. Consequently, auditors can reuse methods already applied to other bank products.

Reporting and finance

Positions and movements post to the bank ledger. Daily proofs feed internal audit and customer statements. Therefore finance reconciles balances with the same discipline used for deposits and cards.

Figure 1. BBVA clients and app feeding Core banking into Ripple Custody

What customers and the bank gain

For customers

People keep crypto within a brand they already trust. Support and dispute resolution follow the same paths used for cards and savings. Storage relies on bank policies rather than a retail wallet. As a result, the chance of losing keys is lower.

For the bank

Operational risk drops because approvals and segregation follow standard practice. Teams measure exposure and liquidity in familiar dashboards. In addition, the same rails later handle tokenized assets without a rebuild. That saves time and reduces change risk.

Market impact scenarios

Base case

Adoption grows as users move balances from exchanges into bank custody. Asset coverage starts with bitcoin and ether. After the first reporting cycle, tokenized funds become the next logical product. Issuers gain a clear route to distribution because the control plane already lives inside the bank.

Upside case

User trust lifts take up faster than expected. BBVA extends the service to businesses and to more European markets. Tokenized deposits and structured products follow. Ripple gains a flagship reference and signs more banks that prefer a proven platform to a green field build.

Risk guardrails

A market shock could slow new accounts. In that scenario the service continues with a short asset list. The bank tightens change windows and watches inventory and liquidity limits. Meanwhile, Ripple supports steady operations and prepares for the next scale phase.

Ecosystem effects

Exchanges

Balances move from exchange custody to segregated bank vaults. Venues then compete on price, routing and liquidity rather than storage. In turn, customers get a split model. They trade on approved venues while long term holdings rest in a bank account.

Tokenization

With custody and controls live inside a large retail bank, issuers can list tokenized funds and debt more quickly. Lifecycle tooling for mint and burn already exists inside Ripple Custody. Therefore corporate actions and reconciliations become part of routine operations.

Policy loop

A household name offering crypto custody gives supervisors real data on how MiCA works for retail distribution. Feedback can refine technical standards and incident templates. As a result, banks gain clearer guidance for future rollouts.

Bank readiness checklist

Ownership and policy for private keys with named approvers in a central register.

Hardware security module capacity sized for current volumes and next year growth.

Segregated accounts with daily reconciliation tied to the ledger of record.

Incident runbooks tested, including snapshot recovery and integrity checks.

Audit trails linked to identity systems so entitlement reviews are simple.

Limits by product by channel and by customer tier enforced by the policy engine.

Vendor risk reviews completed for venues, data providers and middleware.

MiCA disclosures prepared and kept current in the product library.

Roadmap signals to watch

First regulator disclosures and the cadence of inventory attestations.

Expansion of the asset list beyond bitcoin and ether into tokenized instruments.

Activation of token lifecycle features for pilot issuers.

Rollout to more markets across the BBVA footprint.

Additional tier one banks adopting the same custody stack.

Related posts

Kraken opens xStocks to European investors as tokenized equities gain traction

Nasdaq’s bid to trade tokenized securities signals a turning point in US market structure

External links

Ripple press release announcing the agreement with BBVA in Spain

Ripple insight on custody use cases and stablecoin lifecycle tools

CoinDesk coverage and MiCA context for banks entering custody

BNY press release on safeguarding Ripple USD reserves which shows bank grade integration

Financial Times on BBVA expanding crypto custody roles in Europe

3 Comments

Pingback: Bitcoin Hashrate Surges as Bitcoin Reclaims 115K: Can Bulls Overcome Risks Toward 120K? - The Crypto Tides

Pingback: London Stock Exchange launches blockchain platform for private funds - The Crypto Tides

Pingback: France challenges EU crypto passporting under MiCA - The Crypto Tides