Executive brief

Nasdaq proposes a path for tokenized representations of listed securities to settle on blockchain rails while trading continues on the single trusted order book. The aim is pragmatic. Price discovery stays unified. Post trade plumbing becomes faster and simpler. As a result, investors keep familiar protections and market participants gain mobility of assets, clearer entitlements and lower operational friction.

Context and why it matters

For years, tokenization lived in isolated pilots. Liquidity stayed thin and the benefits rarely reached mainstream investors. This proposal takes a different route. It brings token settlement into the core equity stack. Consequently, brokers keep the trading workflow they already use, and investors keep the same rights. Meanwhile, settlement gains a programmable option that can compress timelines and reduce errors.

What Nasdaq is proposing

Orders for listed stocks would enter, match and print as they do today. Market data would continue to aggregate across a single book. Surveillance would apply uniformly. After the trade completes, a participant could choose token settlement with an eligible custodian. In practice, execution remains where spreads and depth already exist, while settlement gains a new rail. Therefore, the change targets cost and latency without disturbing price formation.

What remains unchanged for investors

Investors keep voting rights, dividends and the duty of best execution. Portfolios continue to experience the same economic exposure. Disclosures and audit trails remain familiar. In short, a tokenized share is the same security with a different settlement path. Because of that continuity, clients do not need a new interface or a new rulebook to hold the position.

What changes for brokers and custodians

Brokers route orders exactly as they do today. After a fill, they may instruct token settlement for eligible accounts. The heavier work moves to custody and reconciliation. Firms must record the precise location of control, document how entitlements are credited and resolve exceptions quickly. Over time, as tooling matures, firms can expand access from pilot clients to broader segments. In addition, primes and trust banks will need clear policies for token collateral and margin.

Benefits by stakeholder

Investors

They keep the experience they know. Nevertheless, they benefit when corporate actions arrive faster and transfers require fewer steps.

Brokers and market makers

They preserve established gateways, risk controls and matching logic. Meanwhile, they obtain a flexible settlement instruction that reduces back office friction.

Issuers and fund sponsors

They retain listing standards and disclosure, yet reach more digital native holders. Creation and redemption cycles can tighten, and collateral can move with less manual work.

Governance and control blueprint

Success depends on three guardrails. First, strict equivalence of rights between traditional and tokenized forms. Second, a single source of truth for positions to prevent drift in corporate actions. Third, uniform surveillance across both representations so abuse monitoring never opens a gap. With these guardrails, tokenization behaves as a settlement choice rather than a parallel market.

Risks and mitigations

Fragmentation of standards

Firms could select incompatible token formats. To mitigate, members should use shared flags, well defined conversion workflows and testing calendars that force alignment.

Drift in entitlements

Dividends or splits may process at different times. The remedy is a unified position record and strict reconciliation across both forms, especially around record and payable dates.

Split in financing markets

Token collateral may not be accepted widely at first. Conservative haircuts, transparent control locations and documented custody procedures can build lender confidence.

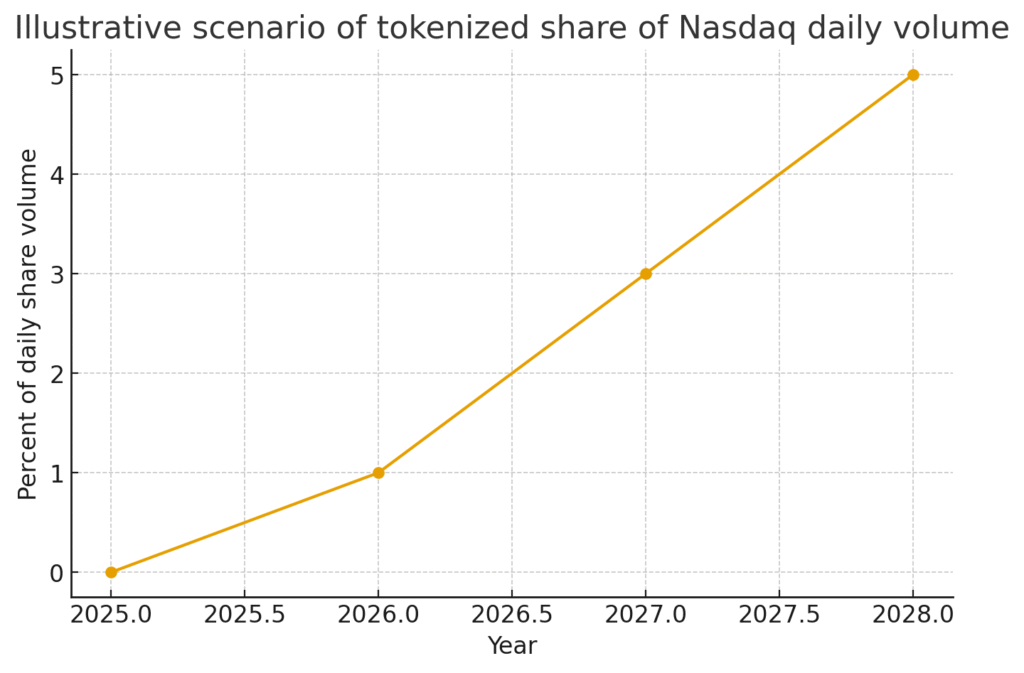

Figure 1. Illustrative scenario where tokenized share of Nasdaq daily volume rises from zero in 2025 to five percent by 2028.

Market structure implications

Liquidity depends on concentration. A single order book protects the signal of best bid and best offer. Because execution remains unified, spreads should hold and depth should remain stable. If the design works, improvements will appear in settlement metrics rather than in quote quality. If it fails, the names that lean hardest into token settlement will show thinner books. Therefore, desks should watch quoted size, effective spreads and time to finality.

Early use cases

Creation and redemption for funds

Large block transfers occur every day. Faster and more predictable settlement reduces financing drag and tracking error.

Corporate actions

Near real time crediting of entitlements lowers exception rates and improves client experience.

Collateral mobility

Desks that run equity swaps and delta one strategies can move assets across venues with fewer manual handoffs. Consequently, balance sheets work harder with less friction.

Pilot plan blueprint

An effective pilot is narrow and measurable. Choose a small set of names and a short list of custodians. Define one inventory view that merges both representations. Track four metrics from day one. Instruction rejects. Exception rates during corporate actions. Fails to deliver. Time from trade date to finality. Publish results to members so lessons compound, then expand the scope gradually.

Compliance and audit essentials

Books and records must show exactly where control sits for token positions. Client consent should be explicit and written in plain language. Surveillance cannot diverge between token and traditional forms. The simplest approach is to treat both representations as one position with two settlement paths. That approach keeps monitoring simple and closes gaps that bad actors could exploit.

Retail impact

Many retail clients may never request token settlement. They will still benefit if back office costs fall and service tickets decline. Faster entitlements and cleaner transfers reduce frustration. Simpler systems help everyone, even when the client never touches a token.

Expert perspective

Question What single design choice matters most

Answer A single order book. It preserves the signal that every strategy depends on.

Question What would you test first

Answer Corporate actions. Any drift in entitlements breaks trust.

Question What could scale faster than expected

Answer Token collateral for financing once haircuts and controls are standardized at primes and trust banks.

Question What hidden risk deserves attention

Answer Divergence among middle office vendors. If tools encode different assumptions, exception rates climb.

Readiness checklist for the next month

Trading teams document when to flag token settlement in post trade instructions.

Middle office builds a combined inventory view that merges both representations.

Corporate actions run mock dividends and splits and log each exception and fix.

Risk sets conservative haircuts for token collateral and tests margin impact.

Client service prepares clear guides that explain what changes and what does not.

How to measure success

Success is quiet and measurable. Fewer exceptions. Fewer fails. Shorter time to credit entitlements. Stable spreads and steady depth. If these indicators improve without harming price discovery, the feature should expand to more names and more clients. Otherwise, the market will revise guardrails and try again with a tighter scope.

Closing view

The proposal is cautious and practical. It preserves the trading surface that already works. It modernizes the plumbing that creates cost and delay. Therefore, if custodians, brokers and the clearing utility execute together, token settlement can become a standard feature of public markets rather than a side experiment.

Related Posts

External Links

3 Comments

Pingback: Kraken opens xStocks to European investors as tokenized equities gain traction - The Crypto Tides

Pingback: Grayscale files with the SEC to convert Bitcoin Cash Hedera and Litecoin trusts into exchange traded funds - The Crypto Tides

Pingback: BBVA and Ripple push bank grade crypto custody in Spain as MiCA era begins - The Crypto Tides