HashKey introduces a digital treasury fund with a five hundred million target. The goal is simple. Provide liquid crypto exposure under a regulated Hong Kong framework while preserving capital during stress. As a result, corporates, family offices and institutions can add a small yet controlled slice of BTC and ETH to their treasury mix. Moreover, the fund promises audit trails, daily transparency and predictable operations.

Issuer dossier

The manager operates under Hong Kong rules with a licensed entity. Client assets stay segregated from firm capital at all times. In addition, approvals require multiple signers and every movement is reconciled each day. Reporting follows a clear cadence so boards can track custody locations, counterparty exposure and any exception handling. Consequently, investors get a structure that fits conservative treasury policies without giving up on market participation.

LP mandate matrix

| Cohort | Ticket size | Liquidity window | Risk ceiling | Reporting cadence |

|---|---|---|---|---|

| Institutions | Twenty to one hundred million | Weekly gates | Rolling drawdown control near ten percent | Daily summary and monthly full reports |

| Family offices | Five to twenty million | Two weekly windows | Fifteen percent drawdown guideline | Weekly snapshot and monthly letters |

| Corporates | One to five million | Monthly window | Twelve percent drawdown guideline | Monthly report with treasury commentary |

Fund mechanics term sheet

| Item | Setting | Notes |

|---|---|---|

| Structure | Professional investor vehicle | Licensed manager in Hong Kong |

| Base currency | US dollars | Local settlement available where supported |

| Instruments | BTC, ETH, selected large caps, cash and bills | Exposure via spot custody and listed products |

| Leverage | None at launch | Borrowing policy reviewed after the first audit |

| Fees | Management fee plus performance band | Breakpoints for larger tickets and seed partners |

| Redemption | Cash or in kind | In kind requires compatible custody arrangements |

Why launch now

Treasurers feel two pressures at once. On one side, cash needs safety and liquidity. On the other, boards want measured exposure to the largest digital assets. Meanwhile, spot exchange traded products improved price discovery and operational standards. Therefore, a conservative fund with strong controls can bridge policy and practice. It gives finance teams a way to participate in upside without reinventing their stack.

Portfolio objectives and risk posture

The portfolio seeks simple outcomes. First, it aims to survive stress with cash buffers and clear circuit levels. Second, it aims to capture a share of long advances in BTC and ETH. Furthermore, position sizes respect venue depth, custody location and audit dates. Rebalancing prefers small frequent moves over large swings. Consequently, tracking error stays tight while execution quality remains stable.

Liquidity and redemption design

Redemption windows align with venue depth and custody handoffs. Institutions receive weekly gates. Family offices get two windows per week. Corporates use a monthly window that matches treasury calendars. In ordinary conditions, cash is the default settlement method. However, in kind redemptions are possible for clients with compatible custody. This design reduces forced selling and protects remaining investors.

Governance and custody blueprint

Controls sit on three pillars. First, strict segregation between client assets and manager capital. Second, cold storage with warm workflows and named approvers. Third, exchange connectivity through allow lists and circuit breakers. Additionally, the manager commits to publish custody locations, approval activity and reconciliation results on a fixed schedule. Evidence, not promises, builds trust.

Scenario map for regimes

In calm regimes the allocation leans toward large assets while cash stays modest. During balanced periods the mix evens out and a cash buffer smooths drawdowns. Under stress, cash and bills take the lead so the fund can buy when spreads normalize. The regime view avoids top picking. Instead, it adapts with clear rules that boards can review.

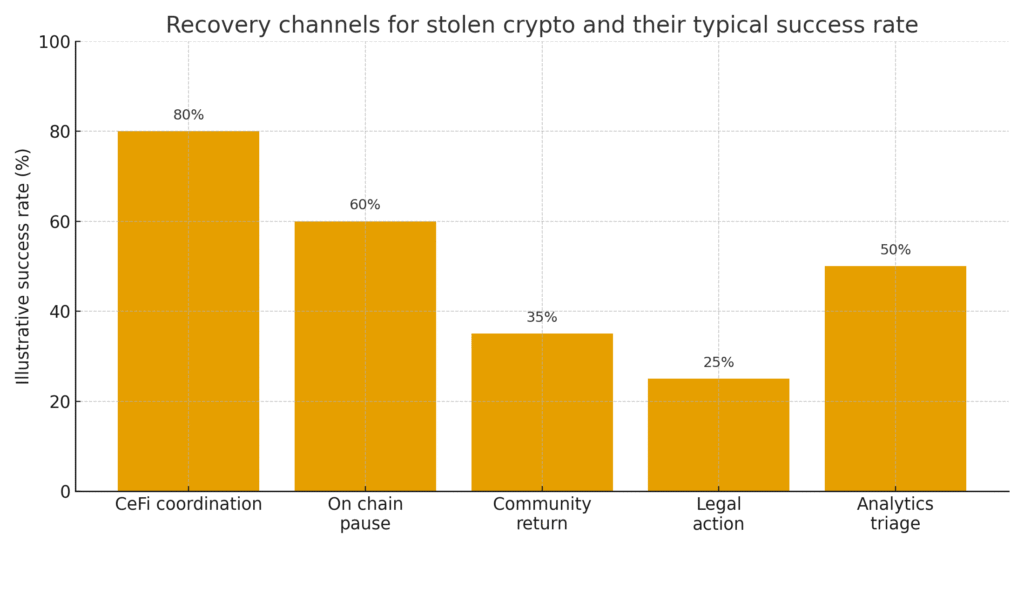

Figure 1. Five recovery channels comparison for stolen crypto

Control stack checklist

| Control area | Daily task | Weekly task | Quarterly task |

|---|---|---|---|

| Custody reconciliation | Match balances and sign off by desk leads | Independent ops variance check | External attestation with exceptions log |

| Counterparty limits | Verify exposure by venue and asset | Refresh allow lists and thresholds | Committee review and reset of hard limits |

| Execution quality | Compare quotes across two venues | Back test slippage and routing | Update tolerance bands and routing rules |

| Governance | Record approvals and role rotations | Test warm workflows with mock events | Full key ceremony and incident drill |

What to watch next

During the first months two signals matter most. Consistent inflows from corporates confirm board confidence. Clean execution during redemption windows confirms operational strength. If both signals hold, the fund can become a regional reference for cautious digital exposure. Otherwise, investors will wait for more evidence before increasing tickets.

1 Comment

Pingback: Kraken opens xStocks to European investors as tokenized equities gain traction - The Crypto Tides