Gemini is widening its footprint in the European Union with a focused expansion that combines staking for Ether and Solana with a new set of perpetual contracts that settle in USDC. The strategy aims to keep retail and professional users inside one product stack where spot markets, staking balances and derivative exposure live together under a single risk view. This alignment often improves capital efficiency and reduces operational friction for users who would otherwise move funds between venues.

For everyday users the headline is clear. Staking creates a simple on platform path to earn native rewards while keeping custody and reporting in one place. Reward rates vary by network conditions and by the validator policy that the venue applies. Therefore the right way to evaluate the offer is not a single headline number but a framework that looks at expected reward range, fee policy, reward distribution cadence and the way the platform handles rare events such as slashing.

Active traders see a different unlock. Perpetual contracts allow precise hedge overlays on top of spot and staking exposure without having to unwind core positions. In practice that means a user can hold Ether or Solana, collect protocol rewards where eligible, and still short or reduce delta through a USDC settled contract when volatility rises. Moreover the ability to move collateral within one account structure reduces idle balances and can lower the cost of maintaining protection.

Timing in Europe also matters. MiCA is moving from text to implementation and several national regulators are aligning licensing categories for custody, exchange and derivatives. Because of that trend, product depth has become a competitive axis in the region. A platform that can show audited operations for staking and transparent margin rules for derivatives will likely win trust from institutions that prefer regulated access.

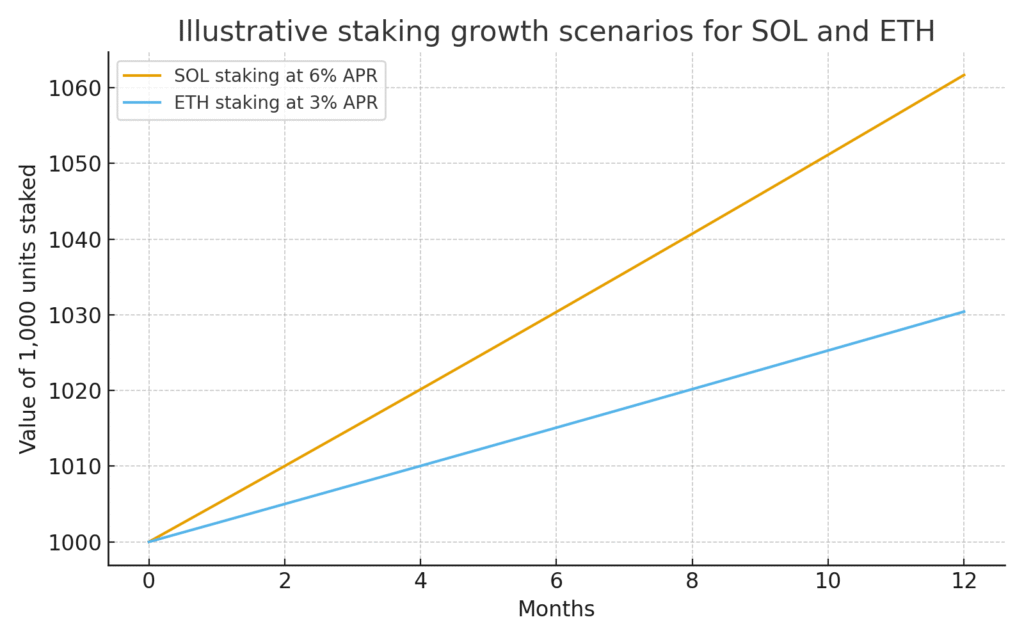

Below is an illustrative view that helps readers reason about how small differences in annual reward rates can compound over a year for a simple starting position. It is not a forecast and it is not investment advice. It is only a visualization to anchor expectations before fees and before any protocol change.

Figure 1. Line chart that compares a one thousand unit position in Solana at six percent annual rate and a one thousand unit position in Ether at three percent annual rate over twelve months with monthly compounding

Issuer dossier

• What is new

Gemini opens staking for Ether and Solana in the European Economic Area and introduces perpetual contracts that settle in USDC. The offer targets two groups at once. Everyday users who want native rewards and advanced users who need precise risk control.

• Why it matters

Users can keep spot balances, staking positions and derivative exposure in one account structure. That setup reduces transfers, trims idle balances and improves capital efficiency during volatile sessions.

• Who benefits first

Active traders that hedge around core holdings. Long only allocators that prefer rewards inside one venue with clear reporting. Institutions that require regulated access with a single service perimeter.

• How rewards work

Rates are variable and reflect network conditions. The correct lens is a range for expected returns after fees and a clear policy for distribution cadence and rare events such as slashing.

Governance and custody blueprint

A staking service stands on validator operations and asset segregation. Users should look for three elements. First, a clear statement on whether the venue runs its own validators or appoints a provider and how that choice affects fees and risk. Second, a custody model that keeps client assets separate and auditable. Third, a procedure for protocol upgrades and for adverse events with transparent communication timelines.

Derivative products bring another layer of governance. Collateral lives in a treasury system with strict controls. Margin models must be public and predictable. Liquidation engines should protect the market during stress and avoid unnecessary loss for users who manage risk with discipline. Since contracts settle in USDC, the venue needs strong controls for stablecoin handling and for fiat ramps that move funds in and out without friction.

Practical user scenarios

• Hedge and hold

A user holds Ether for the long run and stakes it for native rewards. When volatility rises the user opens a small short in a USDC settled perpetual to reduce directional risk without touching the core position.

• Basis capture

A user buys spot Solana and sells a perpetual on the same asset when the contract trades at a premium. The position seeks to capture funding and convergence while keeping gross exposure limited.

• Cash efficient rotation

A user wants to rotate from Ether to Solana over several sessions. With one account structure the user can stage the move while using collateral for both spot and derivatives. Idle balances shrink and the user keeps fewer transfers across venues.

Risk checklist for readers

• Reward mechanics

Do not anchor on a single number. Reward rates change with network and validator conditions. Back test the range you expect and include the effect of validator queues.

• Fees and slashing

Read the service terms for fee levels, for slashing coverage and for the path that the venue follows after an event. Confirm the timeline for reward distribution.

• Leverage discipline

Perpetuals can protect or amplify risk. Define position size, maintenance buffers and exit rules before pressing buy.

• Counterparty exposure

Concentration at one venue is convenient but it creates dependency. If your mandate allows, distribute custody across more than one provider for core holdings.

• Liquidity under stress

Check depth and spreads in quiet hours and also around economic data. Plan your worst case slippage and size positions with that in mind.

Interview mini Q and A

Q. What is the single control that institutions ask for first

A. Segregation of client assets with an audit trail. Without that, no other feature moves the needle.

Q. How should retail users evaluate staking offers

A. Focus on four items. Reward range after fees. Distribution cadence. Policies for protocol changes. Clear steps after a slashing event.

Q. What problem do perpetuals solve for long only users

A. They offer a way to reduce directional risk quickly without closing a core spot or staking position. That tool can smooth the ride when volatility spikes.

What to watch next

Product depth in Europe will track the speed of licensing and supervision across member states. Expect a gradual broadening of instruments and a steady rise in automation for collateral routing between spot, staking and derivatives. The venues that publish clear metrics on custody, validator performance and margin events will stand out. Users can follow three signals. Growth in open interest for USDC settled contracts. Consistency of reward distribution for staking pools. Stability of spreads when the market is under stress.

Conclusion

The move places Gemini in a stronger position inside the region. It blends a simple path to protocol rewards with a professional hedge layer and it does so within one account structure. That mix serves users who want yield with comfort and it serves traders who want precision without constant transfers. The final test is not the launch itself but the day to day delivery across custody, validator operations and margin management. If those pillars hold, the expansion can shift share in a market that rewards clarity and reliability.