Executive summary

United States regulators released a coordinated staff statement. It explains how registered exchanges may approach certain spot crypto products. The move signals cooperation. It also gives a practical path for filings. The document does not change the law. Even so, it clarifies next steps for venues and issuers.

What actually happened

On September 2 the staff of the Securities and Exchange Commission and the staff of the Commodity Futures Trading Commission shared a joint message. In short, current law does not forbid SEC or CFTC registered venues from listing some spot crypto asset products. The focus sits on leveraged or margined or financed spot retail transactions. In addition, the agencies pledged to coordinate guidance. As a result, exchanges can plan filings with clearer expectations.

What does not change

No statute changed. There is no blanket green light for every asset. Exchanges still need to file proposals. They must also satisfy rules on surveillance, disclosure, custody, and market integrity. Furthermore, state obligations remain in place for money transmission and trust company activity. Broker dealer rules can also apply in some settings.

Why it matters

This message reduces uncertainty for traditional venues. Consequently, large operators may consider spot listings with greater confidence. Better clarity can draw order flow into supervised markets. That shift can improve transparency and investor protection. It may also narrow spreads through deeper books and better data sharing.

Regulatory pathway

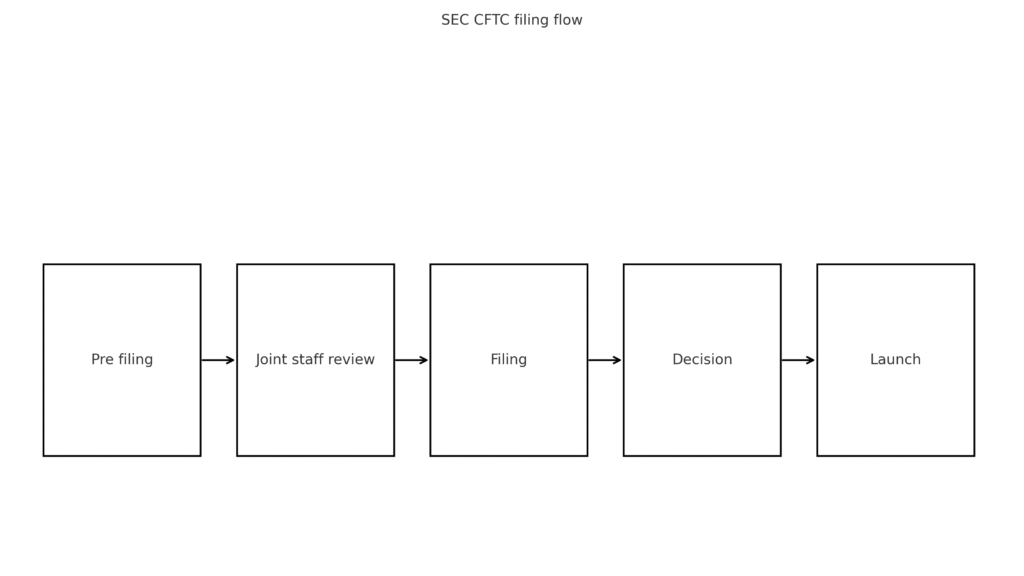

Step one. Scoping.

Define a narrow product set. Choose custody and clearing designs. Meet both staffs for a pre filing conversation.

Step two. Proposal.

Submit a rule change or a listing notice. Expect reviews and public comments. Provide a surveillance plan and a pathway to detect manipulation.

Step three. Custody.

Select qualified custodians. Describe segregation for cold and hot wallets. Add disaster recovery and incident response procedures.

Step four. Market protection.

Adopt protections for retail clients. Include margin rules, position limits, and plain language disclosures on volatility and forks.

Step five. Decision.

Receive approval or further comments. Prepare the launch plan and the public communication.

Figure 1. Simple boxes that show exchange pre filing, joint staff review, filing, decision, and launch

Benefits and risks

Potential benefits

More clarity for exchanges that operate across asset classes. Improved price discovery. Deeper order books. A path for tokenized products that fit commodity or non security definitions. In addition, the process can raise the bar on surveillance.

Key risks

Jurisdictional disputes around specific assets. Uneven application across venues. Legal challenges to staff interpretations. Operational mistakes if venues rush to market. Therefore strong internal controls remain essential.

Checklist for exchanges preparing to file

Map surveillance capacity and gaps.

Confirm data sharing with major crypto venues and analytics firms.

Choose a custody model with clear segregation and proof of control.

Draft simple disclosure packets that explain product design and risks.

Commission an external review of fair access and conflict management.

Plan a staged launch with circuit breakers and post trade reviews.

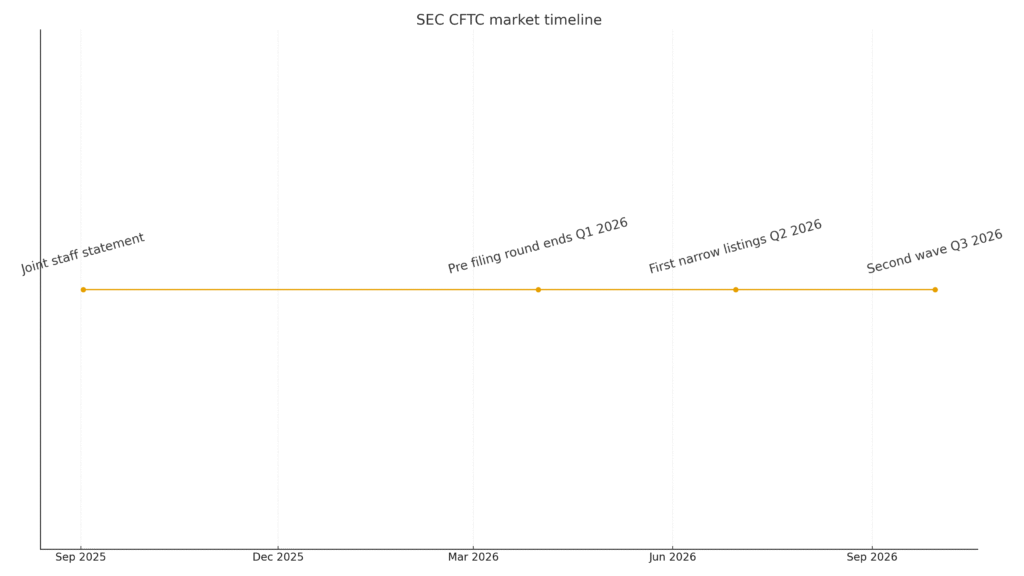

Possible market timeline

First, major exchanges hold pre filing meetings in the quarter after the statement. Next, a first wave of narrow listings may appear in the following quarter. After that, a second wave could explore tokenized products with simple structures. Each phase tests surveillance and custody in practice. If results hold, adoption expands. Otherwise, agencies may ask for adjustments.

Figure 2. Three quarters with milestones pre filing, first listings, second wave

Closing view

The joint action by the agencies does not end uncertainty. However, it shows real coordination and offers a usable path forward. The next signal will come from the first approvals and from the quality of the surveillance standards.