A security read for operators and treasuries that focuses on what happened, why it matters, and how to reduce blast radius next time.

What happened

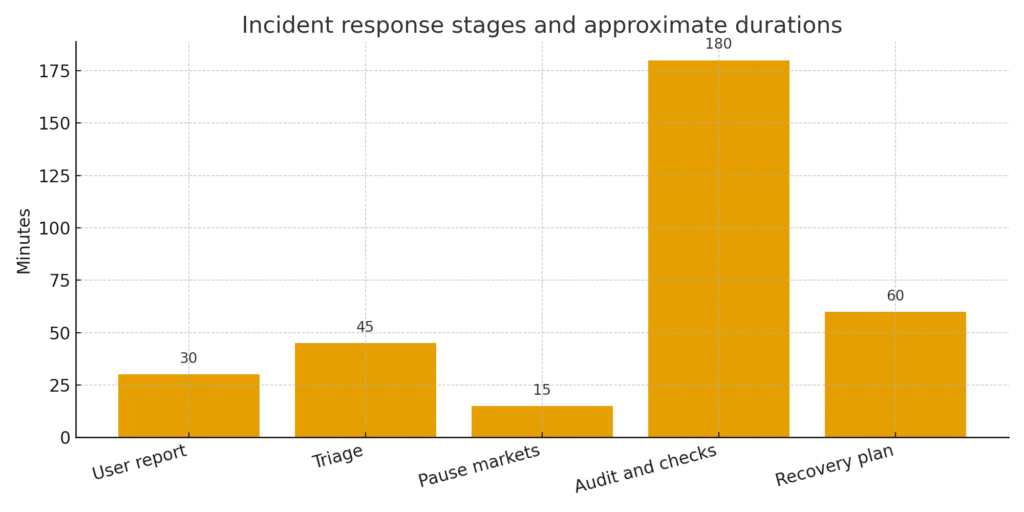

A large user of Venus Protocol suffered a wallet drain in a suspected phishing event. Estimated losses were reported in the tens of millions. Venus paused parts of the platform as checks began and stated that core contracts were not the source of the loss.

Why this matters

User side vulnerabilities travel a single compromised wallet can move risk into lending pools and collateral markets.

Operational discipline clear pause rules and circuit breakers can localize damage.

Comms and transparency fast and clear public updates reduce rumor and stabilize liquidity.

Threat model snapshot

Phishing and social engineering that capture keys or session tokens.

Malicious approvals that give attackers transfer rights.

Bridge pathways that widen the blast radius after a compromise.

Oracle and price feed anomalies during stress.

Defense playbook

Signer separation keep cold and hot roles separate with clear limits.

Withdrawal delay add a short delay for large withdrawals with a cancel path.

Treasury address caps set hard caps per address and rotate addresses.

Education and drills run regular phishing simulations with signed runbooks.

Figure 1. Venus incident timeline

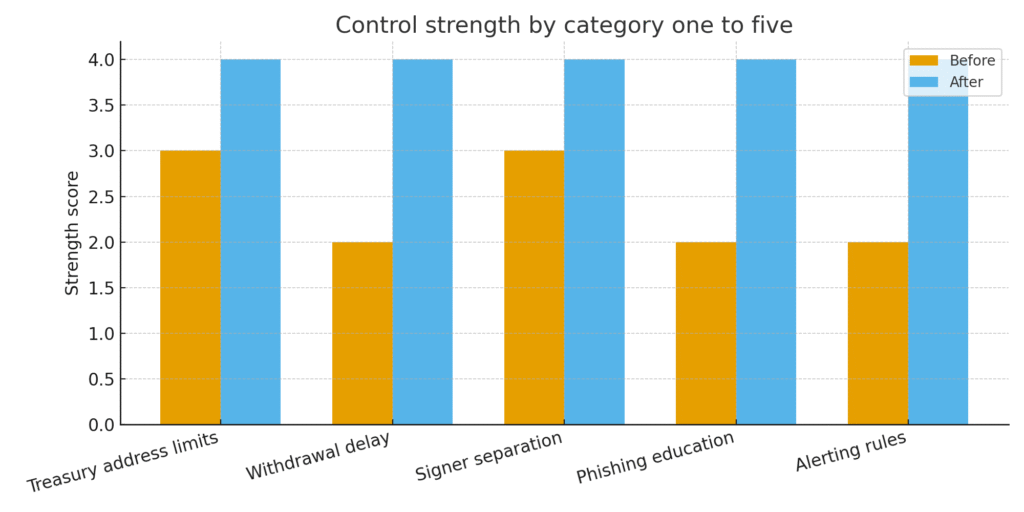

Control strength check

| Control | Before | After |

|---|---|---|

| Treasury address limits | Medium | Strong |

| Withdrawal delay | Low | Strong |

| Signer separation | Medium | Strong |

| Phishing education | Low | Strong |

| Alerting rules | Low | Strong |

Figure 2. Venus controls before after

What to watch next

Third party reports that confirm root cause and loss amounts.

The exact scope of the pause and the unpause criteria.

Any governance proposals that change limits and signer policies.

Related Posts

Solv and Chainlink enable real time collateral verification for SolvBTC Dossier and blueprint

September market setup Eric Trump in Tokyo Metaplanet capital plan and BTC seasonality risk map

- Gemini IPO Valuation math and what a 17 to 19 range implies for proceeds

External Sources

CoinDesk Solv and Chainlink bring real time collateral verification to SolvBTC pricing

- Chainlink Data SolvBTC Proof of Reserves data feed Ethereum mainnet

Quantstamp Audit certificate for Solv Protocol SolvBTC contracts

Crypto dot news Solv Protocol integrates Chainlink to secure SolvBTC rate feed on Ethereum