A focused explainer on how a liquid BTC product adds proof of reserves into its price feed and why that matters for lenders and treasuries.

Executive summary

Solv Protocol and Chainlink introduce real time verification of BTC reserves for the SolvBTC feed. The design mixes an exchange rate calculation with proof of reserves so that redemption reads include a live collateral view. This makes the asset more useful as collateral and lowers the chance of stale data.

Issuer dossier

What SolvBTC is a liquid representation of BTC designed for use across DeFi venues with bridges and wrappers for multiple networks.

Who runs what Solv manages issuance and redemption logic. Chainlink publishes proof of reserves and exchange feeds across networks.

Governance and architecture blueprint

Data sources proof of reserves reports total BTC held by custodians or smart contracts while the exchange component computes the secure exchange rate.

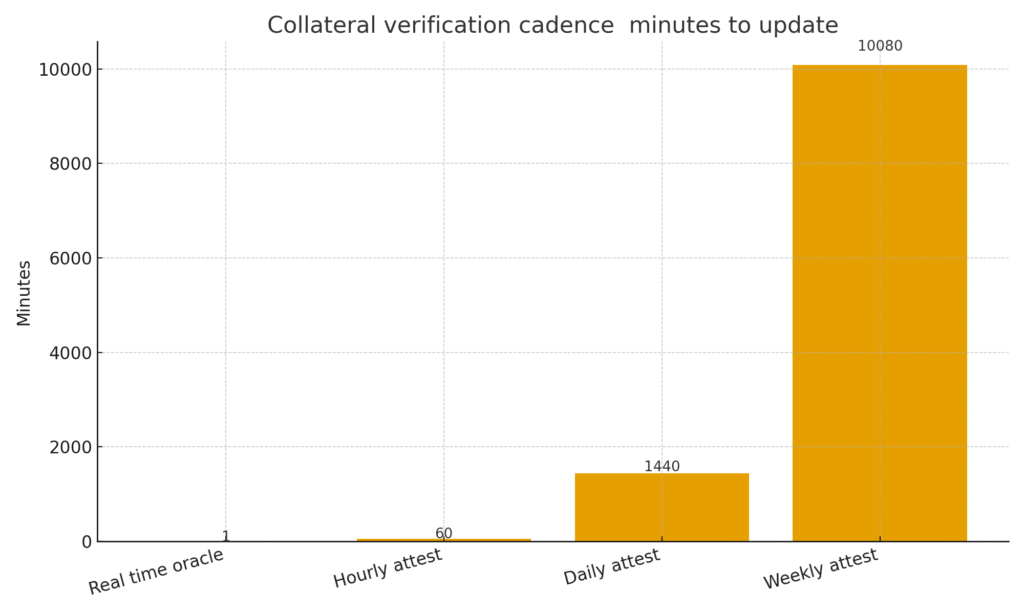

Update cadence the proof and the rate share a publisher network and update on deviation and on a time heartbeat.

Failure modes if a publisher stalls or a feed deviates beyond thresholds, consumers can freeze or reduce limits until confirmation arrives.

Lender policy lenders can set loan to value and haircuts based on feed health and attestation age.

Figure 1. Bar chart comparing collateral verification cadence across real time, hourly, daily, and weekly

Collateral transparency matrix

| Dimension | Before real time verification | With real time verification |

|---|---|---|

| Attestation age | Hours to days | Minutes to near real time |

| Collateral mismatch detection | Periodic checks | Continuous checks |

| Feed composition | Price only | Price and proof of reserves |

| Lender limits | Conservative haircuts | Tighter haircuts with clear rules |

| Incident response | Manual and slow | Automated with clear triggers |

Risk model and controls

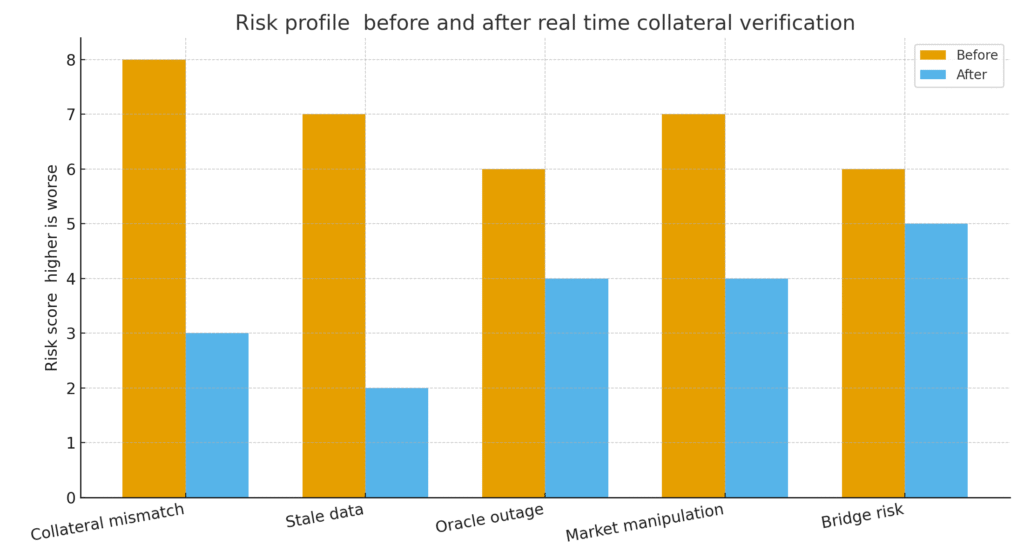

Key risks stale data, oracle outages, custody errors and bridge exposure.

Controls multi publisher design, deviation filters, time heartbeats, custody audits and staged mint burn paths.

Figure 2. Grouped bars showing risk scores before and after real time collateral verification across five risks.

What this enables for builders and treasuries

Safer use of SolvBTC in money markets where price plus collateral proof matters.

Faster incident response when a publisher or a custodian shows anomalies.

Clearer policies for loan to value settings and for temporary freezes after a trigger.

What to watch next

Coverage for more networks and custodial setups.

Public dashboards that allow independent replication of proofs.

Adoption by large money markets and by structured products with strict collateral rules.