A market structure read that focuses on setups, participation and discipline. The goal is clarity, not hype.

Daily Market Pulse

| Metric | Status today | Read |

|---|---|---|

| Funding across major venues | Neutral | positioning is not stretched |

| Open interest | Slight uptick | leverage is building slowly |

| Dominance vs majors | Stable | rotation is muted |

| Realized volatility 30 day | Rising | ranges widen and stop placement matters |

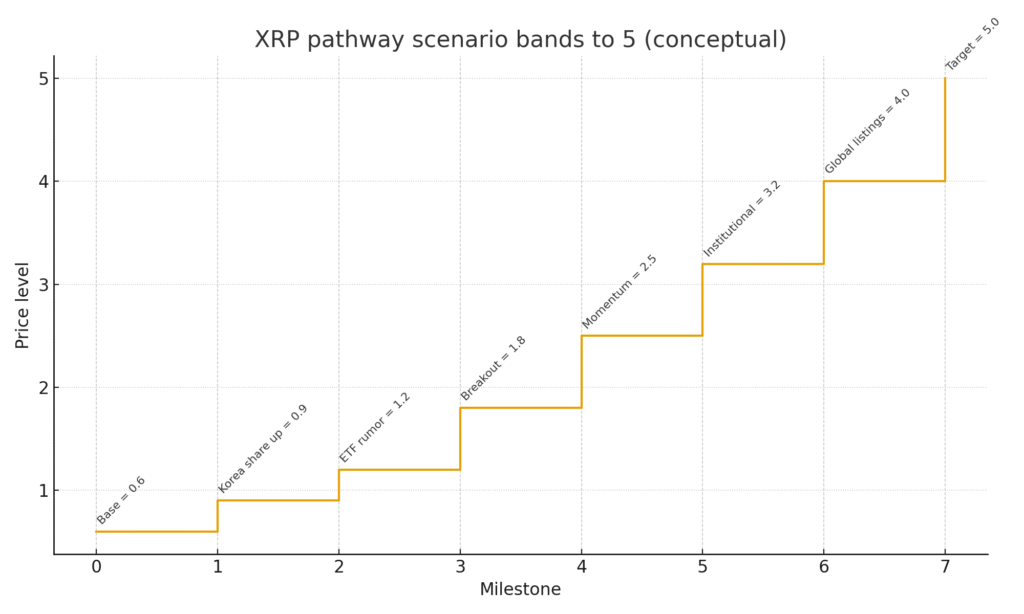

Why five appears on the map

Traders highlight a round number because round numbers group liquidity. A path to five needs a sequence. First, participation must expand beyond impulse spikes. Second, higher lows must print and hold across sessions. Third, depth must thicken on both sides so that breakouts do not fail at the first pullback. If those conditions align, the level becomes plausible rather than a headline.

Korean buyer footprint

Participation from Korean venues can change intraday dynamics. Asia hours then set the tone for Europe and the U S. When Korea share of volume rises, wicks can extend and liquidations can cluster near obvious levels. Plan entries with that clock in mind. Watch premium and discount between local venues and global venues as a quick proxy for urgency.

Pattern checklist

| Pattern | What to see | Why it matters |

| Ascending channel | Higher lows and clean midline respect | confirms control by buyers across sessions |

| Round trip rebid | Fast selloff that gets fully bid back within a day | shows demand under the market |

| Acceptance above prior week high | Multiple closes hold above that reference | signals new value and better trend quality |

| Failed breakdown | Wick below key support with immediate reclaim | traps shorts and fuels range expansion |

Level map for the next moves

Key supports areas where buyers defended during Asia and Europe yesterday.

First resistance the first breakdown level from last week plus prior week high.

Breakout trigger acceptance above the prior week high with volume and calm funding.

Invalidation a close below second support without quick response from buyers.

Figure 1. Conceptual pathway to five. Milestones show how participation and structure could align rather than predict a date or price

Risk management in a hype tape

Keep position size small relative to daily range.

Use alerts around session pivots instead of market chasing.

Avoid leverage spikes during thin hours.

Track Korea share of volume as a condition, not a trigger.

Final read

Five is a number, not a thesis. If participation broadens and structure improves, the market can earn each step. Until then, stick to the map and to your rules.

Related Posts

- El Salvador redistributes BTC reserves across new addresses for security

- BTC market today Fear dominates and a quick map of levels

Eric Trump at Bitcoin Asia the road to one million BTC and why China matters